Making Emiratisation a Success 2025 Guidebook

This guidebook provides insights and strategies for successfully implementing Emiratisation by the year 2025.

In Partnership with PEOPLE FOR TOMORROW Emiratisation Making www.tascoutsourcing.com A Success 2025

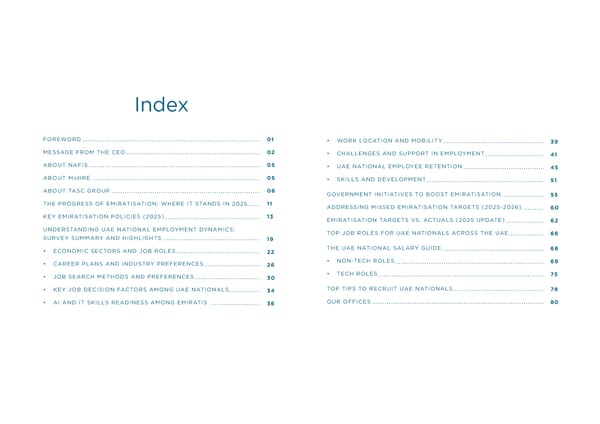

• WORK LOCATION AND MOBILITY • CHALLENGES AND SUPPORT IN EMPLOYMENT • UAE NATIONAL EMPLOYEE RETENTION • SKILLS AND DEVELOPMENT GOVERNMENT INITIATIVES TO BOOST EMIRATISATION ADDRESSING MISSED EMIRATISATION TARGETS (2025-2026) EMIRATISATION TARGETS VS. ACTUALS (2025 UPDATE) TOP JOB ROLES FOR UAE NATIONALS ACROSS THE UAE THE UAE NATIONAL SALARY GUIDE • NON-TECH ROLES • TECH ROLES TOP TIPS TO RECRUIT UAE NATIONALS OUR OFFICES 39 41 45 51 55 60 62 66 68 69 75 78 80 Index FOREWORD MESSAGE FROM THE CEO ABOUT NAFIS ABOUT MoHRE ABOUT TASC GROUP THE PROGRESS OF EMIRATISATION: WHERE IT STANDS IN 2025 KEY EMIRATISATION POLICIES (2025) UNDERSTANDING UAE NATIONAL EMPLOYMENT DYNAMICS: SURVEY SUMMARY AND HIGHLIGHTS • ECONOMIC SECTORS AND JOB ROLES • CAREER PLANS AND INDUSTRY PREFERENCES • JOB SEARCH METHODS AND PREFERENCES • KEY JOB DECISION FACTORS AMONG UAE NATIONALS • AI AND IT SKILLS READINESS AMONG EMIRATIS 01 02 05 05 06 11 13 19 22 26 30 34 36

The UAE labour market has once again demonstrated remarkable growth. As of January 2025, 131,883 UAE Nationals are employed in the private sector — a significant leap from 91,773 in 2023, reflecting a 43.7% increase in just two years. Since the launch of NAFIS in 2021, more than 94,900 Emiratis have joined the private sector. Similarly, the number of private-sector companies employing Emiratis rose from 19,000 in 2023 to 28,000 by the end of 2024 — an increase of 47.3%, underscoring the private sector’s growing commitment to Emiratisation. The labour market’s overall health is also evident in broader workforce metrics. Labour mobility reached 9% in 2024, pointing to a dynamic and evolving talent landscape. 99% of workers are now registered under the Wages Protection System (WPS), enhancing transparency and wage compliance. Moreover, over 95% of private-sector companies are now fully compliant with offering genuine employment opportunities to Emiratis, a milestone that reflects the strength of enforcement and the growing maturity of labour market systems. These achievements not only mark progress but reflect the nation’s strategic vision — one that places human capital at the centre of sustainable development. The Ministry of Human Resources and Emiratisation (MoHRE) remains committed to enabling meaningful Emirati participation across all economic sectors, promoting a diversified labour force, and building a resilient private sector. We extend our appreciation to our partners across the public and private sectors who continue to support these efforts. Let this guidebook serve not only as a resource, but as a catalyst for further dialogue, collaboration, and action. Together, we are shaping a workforce that is future-ready, competitive, and firmly rooted in national values. Foreword Warm regards, HE Dr. Farida Abdulla Al Ali Assistant Undersecretary of National Talents M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 1

Message from the CEO. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 2 The UAE continues to set a global example in economic resilience and workforce transformation. As the region embraces new opportunities and challenges, Emiratisation remains a key driver of national development — ensuring that UAE Nationals play a pivotal role in shaping the country’s economic and social future. The Central Bank of the UAE projects real GDP growth of 4.7% in 2025, reinforcing the nation’s robust economic outlook and long-term commitment to inclusive growth. The Emiratisation initiative has gained unprecedented momentum. As of January 2025, over 131,883 UAE Nationals are employed in the private sector — a testament to the success of MoHRE’s targeted policies and sustained corporate participation. This growth is supported by a 9% labour mobility rate, a 13.23% increase in skilled labour, and a 17.02% rise in active private sector companies, reflecting a job market that is dynamic, expanding, and increasingly aligned with the skills of the local workforce. Notably, women’s participation in the workforce also climbed by 20.95%, signaling the UAE’s unwavering commitment to gender equality and inclusion. This year’s Emiratisation survey reflects continued alignment between employer goals and Emirati aspirations. Operations, HR, and Tech emerged as the top three hiring areas for UAE Nationals, with 63% of employers preferring permanent roles — a clear indication of the private sector’s long-term investment in national talent. Encouragingly, Information Technology has become the most sought-after sector among Emirati jobseekers (23.98%), mirroring the country's rapid digital transformation. 85.41% of employers indicated a preference for hiring fresh talent with 0–2 years of experience — up from 81.27% last year — highlighting a strong push toward nurturing young Emiratis at the start of their careers. Purpose-driven employment remains a powerful motivator for UAE Nationals. Over 71.96% of employed Emiratis are seeking roles with greater meaning and alignment to their values. In terms of hiring forecasts, 70.57% of employers plan to recruit up to 10 UAE Nationals in 2025, while 21.29% intend to hire between 11–50 — a noticeable increase from last year’s 14.84%. These figures signal a maturing Emiratisation strategy that is shifting from numerical targets to deeper workforce integration. As TASC Group celebrates its 18th year, we remain committed to providing workforce solutions and contract staffing that address HR and compliance challenges. Our services help businesses meet Emiratisation goals while empowering UAE Nationals to build meaningful, future-ready careers. Guided by our core values of innovation, quality, collaboration, and reliability, we focus on delivering impactful partnerships and solutions. This third edition is more than just a guidebook. It is a strategic roadmap for public and private stakeholders to shape a thriving, inclusive future. Together, let us continue to unlock the full potential of UAE talent and ensure that Emiratisation remains a cornerstone of national success. Here’s to another year of making Emiratisation a resounding success. Warm regards, Mahesh Shahdadpuri Founder and CEO, TASC Group It is with great pride that I introduce the third edition of the Making Emiratisation A Success guide for 2025. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 3

M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 4 About MoHRE About MoHRE About NAFIS About NAFIS 'NAFIS' stands as a federal initiative designed to enhance the competitive edge of UAE National human capital and facilitate their integration into the private sector workforce. As a strategic component of the 'Projects of the 50', NAFIS reflects the UAE's broader commitment to its developmental trajectory and economic enrichment. The program is a testament to the nation's dedication to fostering a robust and diversified economy by equipping UAE National citizens with the skills and opportunities necessary to contribute significantly in various private sector roles. Through NAFIS, the UAE aims to harness the full potential of its UAE National workforce and secure a prosperous future for the country. The Ministry of Human Resources and Emiratisation (MoHRE) is at the forefront of the UAE’s efforts to develop a skilled, adaptable, and competitive workforce. Guided by the ‘We the UAE 2031’ vision, MoHRE's strategy focuses on catalysing the growth of a dynamic labour market that adheres to international standards in employment practices and labour organisation. With a commitment to fostering National talent, MoHRE has been instrumental in enabling UAE National professionals to excel within the private sector. MoHRE's strategic plan seeks to balance labour rights protection with employer interests, providing outstanding services that contribute to the UAE's status as a premier global destination for business and investment. The Ministry plays a critical role in ensuring economic stability and promoting the rich cultural diversity that characterises the UAE, thereby enhancing its appeal as a haven for international investments and a nurturing ground for diverse businesses. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 5

TASC Outsourcing is the MENA region’s leading people solutions provider headquartered in Dubai, United Arab Emirates. Since 2007, TASC has built teams for 650+ leading governmental, regional, and multinational organisations across the region by staying true to our promise of being ‘the best in the world at finding and managing the right talent with certainty faster’. We have aided the career aspirations of thousands of professionals from across the globe. As a leader in staffing and outsourcing solutions, we offer a comprehensive suite of HR recruitment and business services – everything from contract staffing and permanent recruitment to HR management, payroll outsourcing, global mobility and business set-up services, designed to increase your business efficiency while lowering costs. Our dedicated team of recruitment experts and HR specialists have an in-depth understanding of local and regional labour laws and regulations, including Emiratisation and Saudi Nationalisation across various industries and markets. We can help you source, attract, and recruit the world’s finest candidates locally and globally while maintaining 100% compliance at every step. About TASC Group Our Brands Corporate Services For future-ready tech specialists For reliable last-mile delivery solutions in the UAE An innovative platform that simplifies company formation, employee mobility-immigration, and government compliance management. A centralised platform to train, engage, and motivate in-store merchandisers driving better sales, brand visibility, and market feedback. For easy business set-up, managed PRO services and HR transformation M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 6 The UAE’s first-ever job search app exclusively for UAE Nationals M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 7

To build an inspiring, innovative, and global company that provides high-quality people solutions, delivered with unbeatable service to its customers. To do this by providing an environment for learning, growth, and advancement for its employees. Our Vision M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 8 Statistics Pharma & Healthcare E-commerce & Digital Logistics & Supply Chain Technology & Engineering Banking & Finance Retail & Consumer Energy & Oil Aviation & Automotive Telecom & Network Public Sector Software Engineering BI (Business Intelligence), Data & Analytics IT Infrastructure & Cybersecurity ERP & CRM Financial Crime & Compliance Specialisation Areas Our Services Corporate Services including managed PRO and GRO services Contract Staffing Permanent Recruitment and Executive Search Remote Hiring Talent Mobility and Immigration Emiratisation and Saudisation Payroll Services HR Consultancy and HR Transformation Services Business and RHQ Incorporation RPO and MSP PEO/ EOR Services 650+ Clients 7500+ Associates 24+ Industry Awards 18+ Years of Industry Experience Top 1% in the global staffing industry, as rated by NPS. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 0 9

The third edition of the ‘Making Emiratisation A Success Guidebook’ for 2025 provides comprehensive insight into the labour laws, regulations, government initiatives, and the current hiring trends in the job market for UAE National professionals. This guide also focuses on salaries for the Accounting and Finance, Operations and General Management, Procurement and Supply Chain, Logistics, Engineering and Manufacturing, Human Resources and Administration, Sales, Marketing and Communications, BI, Big Data and Analytics, Software Engineering, Digital, IT Infrastructure and Cybersecurity, ERP and CRM, and Financial Crime and Compliance specialisations. The recent survey results give a vivid insight into the job market in 2025, bringing to light both opportunities and challenges faced by UAE National professionals as well as private-sector organisations. Methodology The guide has been compiled using data gathered from 2,450 survey responses. MoHRE and TASC Group conducted two surveys in February and March 2025 with UAE National candidates and employees who are representative of the population across all seven Emirates and private-sector employers across a diverse set of industries to gain insight into the impact of Emiratisation on businesses in the region. The insights derived give a comprehensive overview of the UAE labour market landscape in 2025 – offering an accurate picture that considers various perspectives. Conclusion This guide serves as a practical and strategic resource for employers and UAE National job seekers alike. It brings together the most recent updates, policies, and success stories to offer a comprehensive understanding of the Emiratisation landscape as it stands in 2025. With clear steps, eligibility criteria, and insights into national workforce programmes, the guide aims to empower businesses to meet their targets efficiently while enabling Emiratis to explore meaningful career opportunities in the private sector. We hope it continues to support national efforts to enhance Emirati participation across key industries, and contributes toward the UAE’s long-term vision for a balanced, inclusive, and future-ready workforce. Acknowledgements We extend our sincere thanks to all the respondents, contributors, and stakeholders who supported the development of this guidebook. Your insights and experiences have played an invaluable role in shaping this edition. We are especially grateful to the Ministry of Human Resources and Emiratisation (MoHRE) for their guidance and continued partnership. Together, we strive to make Emiratisation not just a target, but a sustainable and impactful movement for the nation. About This Report M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 0 Emiratisation: The Progress of Where It Stands in 2025 M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 1

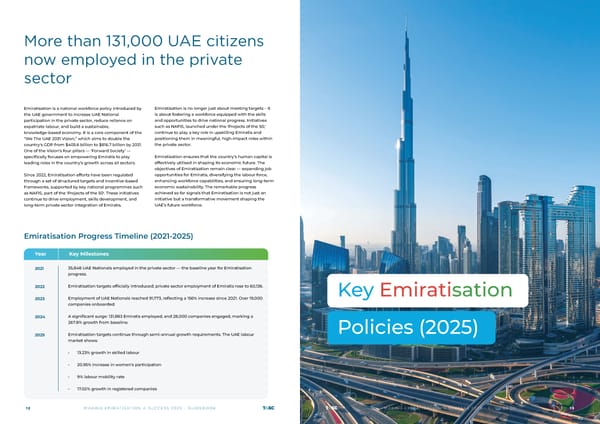

Emiratisation is a national workforce policy introduced by the UAE government to increase UAE National participation in the private sector, reduce reliance on expatriate labour, and build a sustainable, knowledge-based economy. It is a core component of the “We The UAE 2031 Vision,” which aims to double the country's GDP from $405.6 billion to $816.7 billion by 2031. One of the Vision’s four pillars — ‘Forward Society’ — specifically focuses on empowering Emiratis to play leading roles in the country’s growth across all sectors. Since 2022, Emiratisation efforts have been regulated through a set of structured targets and incentive-based frameworks, supported by key national programmes such as NAFIS, part of the 'Projects of the 50'. These initiatives continue to drive employment, skills development, and long-term private sector integration of Emiratis. Emiratisation is no longer just about meeting targets – it is about fostering a workforce equipped with the skills and opportunities to drive national progress. Initiatives such as NAFIS, launched under the 'Projects of the 50,' continue to play a key role in upskilling Emiratis and positioning them in meaningful, high-impact roles within the private sector. Emiratisation ensures that the country’s human capital is effectively utilised in shaping its economic future. The objectives of Emiratisation remain clear — expanding job opportunities for Emiratis, diversifying the labour force, enhancing workforce capabilities, and ensuring long-term economic sustainability. The remarkable progress achieved so far signals that Emiratisation is not just an initiative but a transformative movement shaping the UAE’s future workforce. More than 131,000 UAE citizens now employed in the private sector Emiratisation Progress Timeline (2021-2025) 35,848 UAE Nationals employed in the private sector — the baseline year for Emiratisation progress. Emiratisation targets officially introduced; private sector employment of Emiratis rose to 60,136. Employment of UAE Nationals reached 91,773, reflecting a 156% increase since 2021. Over 19,000 companies onboarded. A significant surge: 131,883 Emiratis employed, and 28,000 companies engaged, marking a 267.8% growth from baseline. Emiratisation targets continue through semi-annual growth requirements. The UAE labour market shows: • 13.23% growth in skilled labour • 20.95% increase in women’s participation • 9% labour mobility rate • 17.02% growth in registered companies 2021 2022 2023 2024 2025 Year Key Milestones M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 2 Key Emiratisation Policies (2025) M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 3

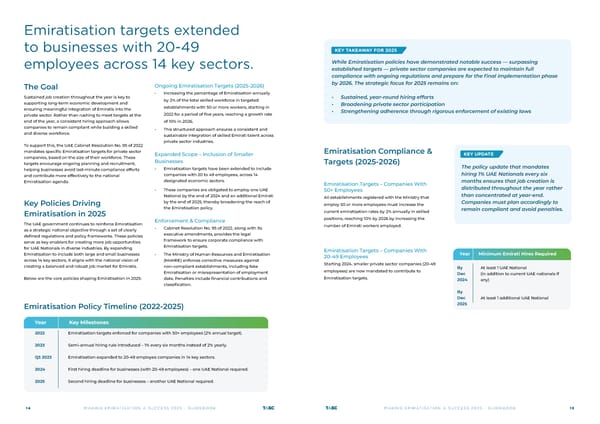

The Goal Sustained job creation throughout the year is key to supporting long-term economic development and ensuring meaningful integration of Emiratis into the private sector. Rather than rushing to meet targets at the end of the year, a consistent hiring approach allows companies to remain compliant while building a skilled and diverse workforce. To support this, the UAE Cabinet Resolution No. 95 of 2022 mandates specific Emiratisation targets for private sector companies, based on the size of their workforce. These targets encourage ongoing planning and recruitment, helping businesses avoid last-minute compliance efforts and contribute more effectively to the national Emiratisation agenda. Key Policies Driving Emiratisation in 2025 The UAE government continues to reinforce Emiratisation as a strategic national objective through a set of clearly defined regulations and policy frameworks. These policies serve as key enablers for creating more job opportunities for UAE Nationals in diverse industries. By expanding Emiratisation to include both large and small businesses across 14 key sectors, it aligns with the national vision of creating a balanced and robust job market for Emiratis. Below are the core policies shaping Emiratisation in 2025: Ongoing Emiratisation Targets (2025-2026) • Increasing the percentage of Emiratisation annually by 2% of the total skilled workforce in targeted establishments with 50 or more workers, starting in 2022 for a period of five years, reaching a growth rate of 10% in 2026. • This structured approach ensures a consistent and sustainable integration of skilled Emirati talent across private sector industries. Expanded Scope – Inclusion of Smaller Businesses • Emiratisation targets have been extended to include companies with 20 to 49 employees, across 14 designated economic sectors. • These companies are obligated to employ one UAE National by the end of 2024 and an additional Emirati by the end of 2025, thereby broadening the reach of the Emiratisation policy. Enforcement & Compliance • Cabinet Resolution No. 95 of 2022, along with its executive amendments, provides the legal framework to ensure corporate compliance with Emiratisation targets. • The Ministry of Human Resources and Emiratisation (MoHRE) enforces corrective measures against non-compliant establishments, including fake Emiratisation or misrepresentation of employment data. Penalties include financial contributions and classification. Emiratisation targets extended to businesses with 20-49 employees across 14 key sectors. Emiratisation Policy Timeline (2022-2025) Emiratisation targets enforced for companies with 50+ employees (2% annual target). Semi-annual hiring rule introduced – 1% every six months instead of 2% yearly. Emiratisation expanded to 20-49 employee companies in 14 key sectors. First hiring deadline for businesses (with 20-49 employees) – one UAE National required. Second hiring deadline for businesses – another UAE National required. 2022 2023 Q3 2023 2024 2025 Year Key Milestones M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 4 Emiratisation Compliance & Targets (2025-2026) Emiratisation Targets – Companies With 50+ Employees All establishments registered with the Ministry that employ 50 or more employees must increase the current emiratisation rates by 2% annually in skilled positions, reaching 10% by 2026 by increasing the number of Emirati workers employed. Emiratisation Targets – Companies With 20-49 Employees Starting 2024, smaller private sector companies (20-49 employees) are now mandated to contribute to Emiratisation targets. At least 1 UAE National (in addition to current UAE nationals if any) At least 1 additional UAE National By Dec 2024 By Dec 2025 While Emiratisation policies have demonstrated notable success — surpassing established targets — private sector companies are expected to maintain full compliance with ongoing regulations and prepare for the final implementation phase by 2026. The strategic focus for 2025 remains on: • Sustained, year-round hiring efforts • Broadening private sector participation • Strengthening adherence through rigorous enforcement of existing laws KEY TAKEAWAY FOR 2025 Year Minimum Emirati Hires Required KEY UPDATE The policy update that mandates hiring 1% UAE Nationals every six months ensures that job creation is distributed throughout the year rather than concentrated at year-end. Companies must plan accordingly to remain compliant and avoid penalties. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 5

Non-Compliance Penalties Failure to meet the above targets will result in financial contributions as stipulated below: • AED 108,000 annually for companies failing to achieve their Emiratisation target per required UAE National by the end of 2025. Employer Responsibility & Flexibility MoHRE emphasises that compliance with Emiratisation policies is the sole responsibility of each establishment. Employers maintain complete discretion over: • Job categories • Compensation levels • Role locations • Sector-specific workforce planning This flexibility enables organisations to recruit UAE Nationals in roles best aligned with their operational and business needs. All private sector establishments can access their Emiratisation performance data via the MoHRE mobile application or on the official MoHRE website. These platforms provide real-time updates on target requirements and workforce status, enabling businesses to plan proactively and avoid non-compliance. Calculation of Emiratisation Rate The number of UAE Nationals required for Emiratisation compliance is determined by the total number of skilled workers within the company. To ensure clarity and ease of implementation, MoHRE has defined the following five occupational categories as skilled roles: Only employees who fall within these categories are considered when calculating the Emiratisation percentage. Managers Professionals Technicians and Associate Professionals Clerical Support Workers Service and Sales Workers FINAL REMINDER All private sector companies are advised to adopt a proactive approach to Emiratisation hiring and compliance. Timely adherence not only avoids financial penalties but also contributes meaningfully to the development of a balanced, skilled, and future-ready national workforce. How to Calculate Your Emiratisation Targets? The Ministry of Human Resources and Emiratisation (MoHRE) has taken significant steps to support private sector companies in tracking and meeting their Emiratisation targets. Through a set of digital tools and dashboards, employers can now easily monitor their compliance and progress. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 6 Company Classification Breakdown Companies that fully comply with Federal Decree-Law No. 33 of 2021 and all MoHRE regulations, while also achieving one or more of the following: • Exceeding Emiratisation targets by at least 3 times the required rate. • Partnering with NAFIS to train at least 500 UAE Nationals annually. • Classified as an SME or an innovative project at a federal/local level. • Operating as a training & employment center that supports workforce planning policies and cultural diversity. • Operating within a key sector as determined by the Cabinet. • One of the ZONE CORP establishments. Companies that comply with all MoHRE labor laws, including work permits, employment contracts, and the Wages Protection System (WPS), while also promoting cultural and demographic diversity in skilled workforce hiring. Companies that fail to meet their Emiratisation targets or do not adhere to UAE labor laws are categorized here. Through this system, MoHRE promotes fair labour practices, cultural and demographic diversity, and long-term workforce sustainability across the UAE’s private sector. Eligibility Requirements for Emiratisation Calculation For a UAE National employee to be counted toward the company’s Emiratisation quota, the following conditions must be met as per Ministerial Resolution No. (279) of 2022: Valid Work Permit The UAE National must hold a valid work permit issued by MoHRE. Wage Payment Compliance Salaries must be paid through the Wages Protection System (WPS) or any other authorised system. Pension Registration Employees must be registered with one of the UAE’s official pension plans, and employers must continue paying the pension contributions periodically. Legitimate Employment Contract The employment relationship must comply with Labour Relations Regulation Law No. 33 of 2021, along with its executive regulations and associated decisions. MoHRE Company Classification The Ministry of Human Resources and Emiratisation (MoHRE) introduced a structured company classification system in 2022, which remains in effect as of 2025. This system evaluates private sector establishments based on their compliance with Emiratisation targets, adherence to labour regulations, and alignment with national workforce policies. The classification framework is designed to reward companies that demonstrate a strong commitment to Emiratisation and regulatory compliance, while applying corrective measures to establishments that fall short of these standards. Through this system, MoHRE promotes fair labour practices, cultural and demographic diversity, and long-term workforce sustainability across the UAE's private sector. CATEGORY 1 CATEGORY 2 CATEGORY 3 M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 7

Why MoHRE Company Classification Matters Key Implications of Your Company’s Classification • Government service fees Category 1 companies benefit from the lowest applicable government charges. • Access to incentives Higher-ranked establishments are eligible for support programmes, public recognition, and other benefits. • Work permit approvals and hiring benefits Priority is given to companies in higher categories, streamlining hiring processes and renewals. • Financial penalties for non-compliance Non-compliant companies classified under Category 3 are subject to higher fees and operational restrictions. To maintain or improve classification, employers are encouraged to consistently meet Emiratisation targets, uphold labour laws, and contribute to the UAE’s workforce development initiatives. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 8 Understanding UAE National Employment Dynamics: Survey Summary and Highlights M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 1 9

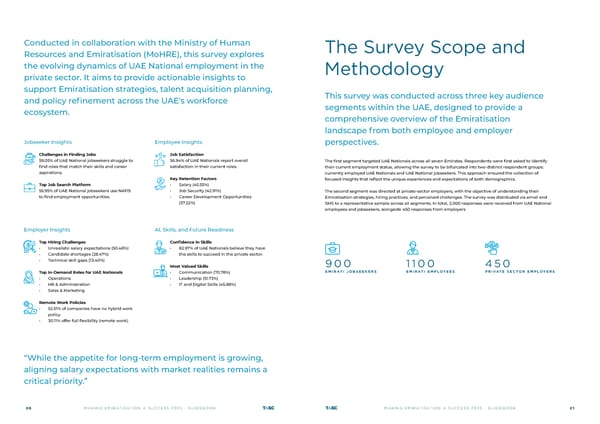

Jobseeker Insights Challenges in Finding Jobs 59.05% of UAE National jobseekers struggle to find roles that match their skills and career aspirations. Top Job Search Platform 55.95% of UAE National jobseekers use NAFIS to find employment opportunities. Employee Insights Job Satisfaction 56.94% of UAE Nationals report overall satisfaction in their current roles. Key Retention Factors • Salary (45.55%) • Job Security (42.91%) • Career Development Opportunities (37.22%) Employer Insights Top Hiring Challenges • Unrealistic salary expectations (50.48%) • Candidate shortages (28.47%) • Technical skill gaps (13.40%) Top In-Demand Roles for UAE Nationals • Operations • HR & Administration • Sales & Marketing Remote Work Policies • 52.51% of companies have no hybrid work policy. • 30.11% offer full flexibility (remote work). AI, Skills, and Future Readiness Confidence in Skills • 82.97% of UAE Nationals believe they have the skills to succeed in the private sector. Most Valued Skills • Communication (70.78%) • Leadership (51.73%) • IT and Digital Skills (45.88%) “While the appetite for long-term employment is growing, aligning salary expectations with market realities remains a critical priority.” Conducted in collaboration with the Ministry of Human Resources and Emiratisation (MoHRE), this survey explores the evolving dynamics of UAE National employment in the private sector. It aims to provide actionable insights to support Emiratisation strategies, talent acquisition planning, and policy refinement across the UAE's workforce ecosystem. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 0 This survey was conducted across three key audience segments within the UAE, designed to provide a comprehensive overview of the Emiratisation landscape from both employee and employer perspectives. The first segment targeted UAE Nationals across all seven Emirates. Respondents were first asked to identify their current employment status, allowing the survey to be bifurcated into two distinct respondent groups: currently employed UAE Nationals and UAE National jobseekers. This approach ensured the collection of focused insights that reflect the unique experiences and expectations of both demographics. The second segment was directed at private-sector employers, with the objective of understanding their Emiratisation strategies, hiring practices, and perceived challenges. The survey was distributed via email and SMS to a representative sample across all segments. In total, 2,000 responses were received from UAE National employees and jobseekers, alongside 450 responses from employers The Survey Scope and Methodology 9 0 0 E M I R AT I J O B S E E K E R S 1 1 0 0 E M I R AT I E M P LOY E E S 4 5 0 P R I VAT E S E C T O R E M P LOY E R S M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 1

Which Economic Sector Are You Currently Working In? - Employees Economic Sectors and Job Roles Which Economic Sector Are You Looking To Work In? - Jobseekers Among UAE National jobseekers who responded to the survey, a strong interest was observed in Information & Communication (23.98%), followed by Manufacturing (11.20%) and Financial Services (10.57%). This suggests a growing appeal of digital, industrial, and finance-oriented career paths. Sectors such as Agriculture (6.83%) and Trade Services (6.59%) also attracted attention, likely reflecting opportunities in local production and commerce. For employees, responses indicate participation across a broad range of sectors, with Information & Communication (11.10%), Trade Services (8.79%), and Financial Services (8.72%) among those noted. While this does not represent the total distribution of Emiratis across sectors, it provides a directional view of where some are currently employed, based on the survey sample. AG R I C U LT U R E & N AT U R A L R E S O U R C E S M A N U FAC T U R I N G & I N D U S T R Y T R A D E S E R V I C E S I N F O R M AT I O N & C O M M U N I C AT I O N F I N A N C I A L S E R V I C E S R E A L E S TAT E OT H E R S AG R I C U LT U R E & N AT U R A L R E S O U R C E S M A N U FAC T U R I N G & I N D U S T R Y T R A D E S E R V I C E S I N F O R M AT I O N & C O M M U N I C AT I O N F I N A N C I A L S E R V I C E S R E A L E S TAT E OT H E R S 1 0 . 5 7 % 23.98% 3 7. 0 9 % 6.59% 6 . 8 3 % 3 . 74 % 1 1 . 2 0 % 8 . 7 2 % 57. 3 9 % 1 1 .1 0 % 2 . 3 8 % 7. 8 4 % 8 . 7 9 % 3 . 7 9 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 2 Which Roles Are You Hiring UAE Nationals For? - Employers *MULTIPLE SELECTION APPLY* A notable trend emerging from this year’s survey is the increased focus on hiring Emiratis in technology-driven roles. 28.23% of employers reported hiring UAE Nationals for Tech roles, marking a year-on-year rise that reflects the growing demand for digitally skilled talent in line with the UAE’s digital transformation agenda. Beyond technology, Operations roles have gained prominence as the most sought-after function, with 46.17% of employers actively recruiting in this area—up from 33.57% in the previous year. HR & Administration follows closely at 45.69%, signalling an enhanced focus on Emirati participation in workforce and organisational management. Traditional yet critical functions such as Sales & Marketing (43.06%) and Customer Service (41.15%) continue to see stable demand, maintaining similar levels of interest compared to last year (42.05% and 42.40%, respectively). These figures reaffirm the private sector’s ongoing commitment to integrating UAE Nationals across both client-facing and operationally strategic domains. There is a growing preference among employers for permanent hiring, with 63.40% indicating their intent to recruit UAE Nationals on a long-term basis. This marks an increase from last year's 52.30%, reinforcing the private sector’s commitment to workforce stability and Emirati talent integration. Meanwhile, 25.36% of employers are considering a mix of both permanent and contractual employment, ensuring flexibility in workforce planning. Contract-based hiring has seen a lower preference at 11.24%, reflecting a shift towards more stable career opportunities for UAE Nationals in the private sector. 0 1 0 2 0 3 0 4 0 5 0 S A L E S & M A R K E T I N G 4 3 . 0 6 % 4 1 .1 5 % 4 6 .1 7 % 4 5 . 6 9 % 2 8 . 2 3 % 2 8 . 2 3 % C U S TO M E R S E R V I C E O P E R AT I O N S H R & A D M I N T E C H R O L E S OT H E R Will You Be Recruiting Them On A Contractual Or Permanent Basis? - Employers *MULTIPLE SELECTION APPLY* 0 5 0 1 0 0 1 5 0 2 0 0 2 5 0 3 0 0 C O N T R AC T U A L 1 1 . 2 4 % P E R M A N E N T A M I X O F B OT H 6 3 . 4 0 % 2 5 . 3 6 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 3

At What Experience Level Are You Seeking To Hire UAE Nationals? - Employers *MULTIPLE SELECTION APPLY* 2025 reaffirms the strong preference for hiring fresh talent, with 85.41% of employers seeking UAE Nationals with 0–2 years of experience, an increase from last year’s 81.27%. This highlights a continued focus on developing young Emirati professionals and integrating them into the private sector workforce. The demand for executives (3–8 years of experience) has also grown, with 52.63% of employers looking to hire at this level, compared to 47.35% last year. While hiring for managerial (14.83%) and senior-level (9.09%) roles remains lower, it indicates that organisations are prioritizing early to mid-career professionals, ensuring a strong pipeline of talent for future leadership positions. 0 2 0 4 0 6 0 8 0 1 0 0 F R E S H E R S ( 0 - 2 Y E A R S ) E X E C U T I V E S ( 3 - 8 Y E A R S ) 8 5 . 4 1 % 5 2 . 6 3 % 1 4 . 8 3 % 9 . 0 9 % OT H E R S E N I O R L E V E L ( 1 5 + Y E A R S ) 0 . 9 6 % M A N AG E R S ( 9 - 1 5 Y E A R S ) M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 4 Emirati jobseekers in 2025 are pivoting towards tech and public service, with a clear shift from traditional sectors to digitally-driven and diverse career paths. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 5

Career Plans and Industry Preferences What Is Your Career Plan? - Jobseekers What Is Your Career Plan? - Employees More than 71.96% of employed UAE Nationals are seeking roles with a better purpose, reflecting a strong desire for meaningful and fulfilling careers. Meanwhile, 11.79% of respondents plan to stay with their current employer, suggesting a smaller but stable group of employees committed to their organisations. Additionally, 9.85% aim to establish their own businesses, indicating growing entrepreneurial interest, while 6.39% are considering changing industries. These insights showcase a workforce eager for career progression and diverse opportunities. 67.68% of Emirati job seekers remain open to both public and private sector opportunities, reflecting continued flexibility in career preferences. While 27.75% still favor public sector roles, only 4.56% are actively seeking opportunities in the private sector. This trend highlights the need for ongoing efforts to attract more UAE Nationals to private sector careers, ensuring a balanced and diversified workforce. F I N D A R O L E I N A P U B L I C S E C TO R I ' M O P E N TO B OT H F I N D A R O L E I N A P R I VAT E S E C TO R 4.56% 6 7. 6 8 % 27.75% F I N D R O L E S W I T H A B E T T E R P U R P O S E S E T U P M Y OW N B U S I N E S S S TAY W I T H M Y C U R R E N T E M P LOY E R C H A N G E T H E I N D U S T R Y 11.79% 9 . 8 5 % 7 1 . 9 6 % 6 . 3 9 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 6 When Do You Plan To Hire The Majority? - Employers *MULTIPLE SELECTION APPLY* How Soon Are You Willing To Join Your Next Job? - Jobseekers Nearly half (49.13%) of UAE National jobseekers are ready to start a new job within 30 days, indicating strong availability in the job market. While this is lower than last year's 81.81%, a sizable portion (26.06%) are open to joining within a year, showing a more varied approach to job transitions. Additionally, 16.41% are willing to move within 3 months, and 8.39% within 6 months, reflecting a mix of urgency and strategic career planning among jobseekers. Employers are showing a stronger preference for hiring in Q2, with 61.96% planning to recruit during this period, up from 47.00% last year. While Q1 hiring has declined from 43.82% to 31.10%, Q3 (42.11%) and Q4 (40.43%) remain key hiring periods. This indicates a more balanced recruitment strategy spread across the year, likely influenced by business cycles, workforce planning, and operational needs. 0 1 0 2 0 3 0 4 0 5 0 6 0 7 0 8 0 Q 1 3 1 .1 0 % 6 1 . 9 6 % 4 5 . 9 7 % 4 2 .1 1 % 4 0 . 4 3 % Q 2 Q 3 OT H E R W I T H I N 3 0 DAYS W I T H I N 6 M O N T H S W I T H I N 3 M O N T H S W I T H I N 1 Y E A R 16.41% 8 . 3 9 % 2 6 . 0 6 % 4 9 .1 3 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 7

How Many Nationals Do You Aim To Hire In 2025? - Employers The majority of employers (70.57%) plan to hire up to 10 UAE Nationals in 2025, showing a continued focus on targeted hiring rather than large-scale recruitment. This marks a slight decrease from last year's 79%. Meanwhile, 21.29% of employers aim to recruit between 11-50 Emiratis, an increase from last year's 14.84%, suggesting a growing commitment to Emiratisation. The proportion of employers planning to hire more than 50 UAE Nationals remains steady at 8.14% (compared to 6.36% last year), indicating that while large-scale hiring remains limited, some businesses are expanding their national workforce. 0 - 1 0 5 1 - 1 0 0 1 1 - 5 0 1 0 1 A N D A B OV E 70.57% 2 1 . 2 9 % 27.75% When Do You Plan To Change Jobs And Join A New Company? - Employees More than half (53.02%) of UAE National employees plan to change jobs within six months, reflecting an increase in workforce mobility compared to last year's 48.61%. Meanwhile, 12.39% are satisfied with their current roles, a drop from last year's 23.25%, indicating a shift towards active job-seeking. Additionally, 16.52% aim to transition within a year, while 18.07% plan to make a change within 1-3 years, highlighting varied career planning approaches among Emirati employees. I ’ M H A P P Y W I T H M Y C U R R E N T J O B W I T H I N 1 Y E A R I N L E S S T H A N 6 M O N T H S 1 - 3 Y E A R S 53.02% 16.52% 1 8 . 0 7 % 1 2 . 3 9 % 4 . 0 7 % 4 . 0 7 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 8 In 2025, most Emirati jobseekers are open to both public and private sectors, value purpose-driven careers, and show growing interest in entrepreneurship, while employers focus on steady, national hiring throughout the year. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 2 9

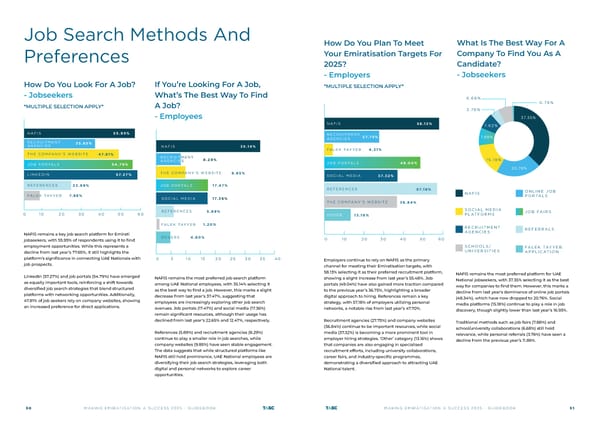

How Do You Look For A Job? - Jobseekers *MULTIPLE SELECTION APPLY* If You’re Looking For A Job, What’s The Best Way To Find A Job? - Employees NAFIS remains the most preferred job search platform among UAE National employees, with 35.14% selecting it as the best way to find a job. However, this marks a slight decrease from last year’s 37.47%, suggesting that employees are increasingly exploring other job search avenues. Job portals (17.47%) and social media (17.36%) remain significant resources, although their usage has declined from last year’s 22.65% and 12.47%, respectively. References (5.89%) and recruitment agencies (8.29%) continue to play a smaller role in job searches, while company websites (9.85%) have seen stable engagement. The data suggests that while structured platforms like NAFIS still hold prominence, UAE National employees are diversifying their job search strategies, leveraging both digital and personal networks to explore career opportunities. NAFIS remains a key job search platform for Emirati jobseekers, with 55.95% of respondents using it to find employment opportunities. While this represents a decline from last year’s 77.65%, it still highlights the platform’s significance in connecting UAE Nationals with job prospects. LinkedIn (57.27%) and job portals (54.79%) have emerged as equally important tools, reinforcing a shift towards diversified job search strategies that blend structured platforms with networking opportunities. Additionally, 47.81% of job seekers rely on company websites, showing an increased preference for direct applications. Job Search Methods And Preferences 0 1 0 2 0 3 0 4 0 5 0 6 0 N A F I S 5 5 . 9 5 % 3 5 . 8 5 % 4 7. 8 1 % 5 4 . 7 9 % 57. 2 7 % 2 3 . 6 9 % 7. 8 8 % R E C R U I T M E N T AG E N C I E S 8 . 2 9 % J O B P O R TA L S T H E C O M PA N Y ' S W E B S I T E L I N K E D I N R E F E R E N C E S FA L E K TAY Y E B 0 5 1 0 1 5 2 0 2 5 3 0 3 5 4 0 M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 0 N A F I S 3 5 .1 4 % R E C R U I T M E N T AG E N C I E S 9 . 8 5 % T H E C O M PA N Y ' S W E B S I T E 1 7. 4 7 % J O B P O R TA L S 1 7. 3 6 % S O C I A L M E D I A 5 . 8 9 % R E F E R E N C E S 1 . 2 0 % FA L E K TAY Y E B 4 . 8 0 % OT H E R S How Do You Plan To Meet Your Emiratisation Targets For 2025? - Employers *MULTIPLE SELECTION APPLY* What Is The Best Way For A Company To Find You As A Candidate? - Jobseekers NAFIS remains the most preferred platform for UAE National jobseekers, with 37.35% selecting it as the best way for companies to find them. However, this marks a decline from last year's dominance of online job portals (48.34%), which have now dropped to 20.76%. Social media platforms (15.18%) continue to play a role in job discovery, though slightly lower than last year’s 16.93%. Traditional methods such as job fairs (7.88%) and school/university collaborations (6.68%) still hold relevance, while personal referrals (3.76%) have seen a decline from the previous year’s 11.89%. Employers continue to rely on NAFIS as the primary channel for meeting their Emiratisation targets, with 58.13% selecting it as their preferred recruitment platform, showing a slight increase from last year’s 55.48%. Job portals (49.04%) have also gained more traction compared to the previous year’s 36.75%, highlighting a broader digital approach to hiring. References remain a key strategy, with 57.18% of employers utilizing personal networks, a notable rise from last year’s 47.70%. Recruitment agencies (27.75%) and company websites (36.84%) continue to be important resources, while social media (37.32%) is becoming a more prominent tool in employer hiring strategies. ‘Other’ category (13.16%) shows that companies are also engaging in specialised recruitment efforts, including university collaborations, career fairs, and industry-specific programmes, demonstrating a diversified approach to attracting UAE National talent. 7.88% 37.35% 20.76% 7. 6 2 % 1 5 .1 8 % 6 . 6 8 % 0 . 7 8 % 3 . 7 6 % 0 1 0 2 0 3 0 4 0 5 0 6 0 N A F I S 5 8 .1 3 % 2 7. 7 5 % 3 6 . 8 4 % 4 9 . 0 4 % 3 7. 3 2 % 57.1 8 % 4 . 3 1 % R E C R U I T M E N T AG E N C I E S J O B P O R TA L S T H E C O M PA N Y ' S W E B S I T E 1 3 .1 6 % OT H E R S O C I A L M E D I A R E F E R E N C E S FA L E K TAY Y E B N A F I S S O C I A L M E D I A P L AT F O R M S R E C R U I T M E N T AG E N C I E S S C H O O L S / U N I V E R S I T I E S O N L I N E J O B P O R TA L S J O B FA I R S R E F E R R A L S FA L E K TAY Y E B A P P L I C AT I O N M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 1

Have You Used ‘Falek Tayyeb’ – An Exclusive Job Search App For UAE Nationals To Apply For Jobs? - Jobseekers Have You Used ‘Falek Tayyeb’ – An Exclusive Job Search App For UAE Nationals To Apply For Jobs? – Employees Engagement with the ‘Falek Tayyeb’ app among UAE National employees has seen a slight improvement, with 16.01% of respondents indicating they have used the platform compared to just 4% last year. This growth suggests increasing awareness and adoption of the app as a resource for career opportunities. However, the majority (83.99%) have yet to explore the platform, signaling room for further outreach and promotion. As the app continues to evolve, efforts to enhance visibility and integration with employer recruitment strategies may encourage more UAE National employees to leverage it for career advancement. Adoption of the Falek Tayyeb app among UAE National jobseekers remains relatively low, with only 15.34% reporting they have used the platform. A significant 84.66% have yet to engage with it, highlighting a clear opportunity to boost awareness, visibility, and integration with job search strategies to better serve Emirati jobseekers. Y E S N O 84.66% 8 . 3 7 % 1 5 . 3 4 % Y E S N O 83.99% 8 . 3 7 % 1 6 . 0 1 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 2 Have You Used ‘Falek Tayyeb’ – An Exclusive Job Search App For UAE Nationals, For Recruitment Purposes? - Employers Employer adoption of the ‘Falek Tayyeb’ app for recruitment purposes remains limited, with 6.51% of private sector employers indicating they have used the platform — only a slight increase from last year’s 6.25%. While the platform is still in its early stages, this minimal growth suggests that further awareness and engagement efforts may be needed to encourage wider adoption among businesses. With 93.49% of employers yet to utilise the app, there is a significant opportunity to promote its benefits as a dedicated hiring tool for Emirati talent. Y E S N O 93.49% 8 . 3 7 % 6 . 5 1 % Emirati jobseekers are actively using a mix of platforms like NAFIS, LinkedIn, and job portals to search for opportunities. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 3

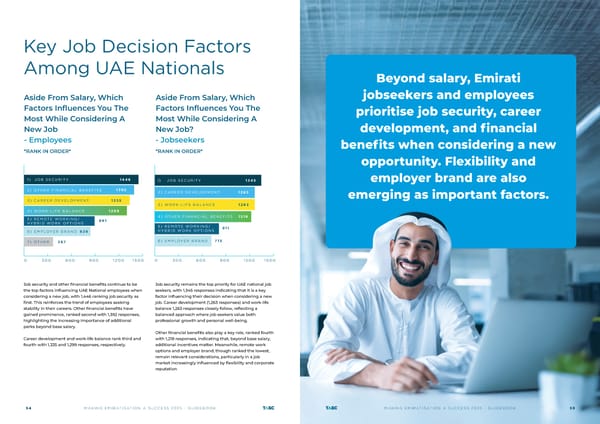

Key Job Decision Factors Among UAE Nationals Aside From Salary, Which Factors Influences You The Most While Considering A New Job? - Jobseekers *RANK IN ORDER* Job security remains the top priority for UAE national job seekers, with 1,345 responses indicating that it is a key factor influencing their decision when considering a new job. Career development (1,263 responses) and work-life balance 1,263 responses closely follow, reflecting a balanced approach where job seekers value both professional growth and personal well-being. Other financial benefits also play a key role, ranked fourth with 1,218 responses, indicating that, beyond base salary, additional incentives matter. Meanwhile, remote work options and employer brand, though ranked the lowest, remain relevant considerations, particularly in a job market increasingly influenced by flexibility and corporate reputation 0 3 0 0 6 0 0 9 0 0 1 2 0 0 1 5 0 0 1) J O B S E C U R I T Y 1 3 4 5 1 2 6 3 1 2 6 3 1 2 1 8 8 1 1 7 1 5 2 ) C A R E E R D E V E LO P M E N T 3 ) WO R K- L I F E B A L A N C E 4 ) OT H E R F I N A N C I A L B E N E F I T S 5 ) R E M OT E WO R K I N G / H Y B R I D WO R K O P T I O N S 6 ) E M P LOY E R B R A N D Aside From Salary, Which Factors Influences You The Most While Considering A New Job - Employees *RANK IN ORDER* Job security and other financial benefits continue to be the top factors influencing UAE National employees when considering a new job, with 1,446 ranking job security as first. This reinforces the trend of employees seeking stability in their careers. Other financial benefits have gained prominence, ranked second with 1,392 responses, highlighting the increasing importance of additional perks beyond base salary. Career development and work-life balance rank third and fourth with 1,335 and 1,299 responses, respectively. 0 3 0 0 6 0 0 9 0 0 1 2 0 0 1 5 0 0 1 ) J O B S E C U R I T Y 1 4 4 6 1 3 9 2 1 2 9 9 1 3 3 5 8 9 1 8 3 9 3 6 7 3 ) C A R E E R D E V E LO P M E N T 4 ) WO R K- L I F E B A L A N C E 2 ) OT H E R F I N A N C I A L B E N E F I T S 5 ) R E M OT E WO R K I N G / H Y B R I D WO R K O P T I O N S 6 ) E M P LOY E R B R A N D 7 ) OT H E R M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 4 Beyond salary, Emirati jobseekers and employees prioritise job security, career development, and financial benefits when considering a new opportunity. Flexibility and employer brand are also emerging as important factors. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 5

AI and IT Skills Readiness Among Emiratis Which AI-Related Skills Do You Currently Possess? - Jobseekers *SELECT ALL THAT APPLY* 0 1 0 2 0 3 0 4 0 5 0 6 0 BASIC AI: FAMILIARITY WITH THE CONCEPTS AND POTENTIAL APPLICATIONS OF ARTIFICIAL INTELLIGENCE. DATA ANALYSIS: THE ABILITY TO COLLECT, CLEAN, AND INTERPRET DATA EFFICIENTLY USING VARIOUS TOOLS AND ALGORITHMS. MACHINE LEARNING: KNOWLEDGE OF MACHINE LEARNING TECHNIQUES AND THE ABILITY TO APPLY THEM TO REAL-WORLD PROBLEMS. NATURAL LANGUAGE PROCESSING (NLP): SKILLS RELATED TO PROCESSING AND UNDERSTANDING HUMAN LANGUAGE USING COMPUTERS. ROBOTICS: KNOWLEDGE OF ROBOTS, THEIR MECHANISMS, AND HOW THEY ARE PROGRAMMED TO PERFORM TASKS. AUTOMATION TOOLS: EXPERIENCE WITH SOFTWARE OR SYSTEMS THAT AUTOMATE MANUAL TASKS. NONE OTHER 5 2 . 2 6 % 3 9 . 5 1 % 2 4 . 4 3 % 1 7. 9 0 % 1 1 . 3 2 % 2 4 . 7 9 % 2 4 . 3 8 % 1 . 8 0 % A majority of UAE National job seekers who responded to the survey (52.26%) have a basic understanding of AI concepts and applications, showcasing growing awareness of artificial intelligence in the job market. Data analysis (39.51%) follows closely, indicating the increasing importance of analytical skills in various industries. More advanced AI-related skills, such as machine learning (24.43%) and natural language processing (17.90%), remain less common, suggesting potential areas for upskilling. Automation tools (24.79%) are gaining traction, while robotics knowledge (11.32%) is still emerging. Notably, 24.38% of respondents report having no AI-related skills, highlighting a gap that could be addressed through targeted training and education initiatives. Verbatim responses also indicate specialised expertise in areas like deep learning, data engineering, and reinforcement learning. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 6 Which AI-Related Skills Do You Currently Possess? - Employees *SELECT ALL THAT APPLY* 0 1 0 2 0 3 0 4 0 5 0 6 0 BASIC AI: FAMILIARITY WITH THE CONCEPTS AND POTENTIAL APPLICATIONS OF ARTIFICIAL INTELLIGENCE. DATA ANALYSIS: THE ABILITY TO COLLECT, CLEAN, AND INTERPRET DATA EFFICIENTLY USING VARIOUS TOOLS AND ALGORITHMS. MACHINE LEARNING: KNOWLEDGE OF MACHINE LEARNING TECHNIQUES AND THE ABILITY TO APPLY THEM TO REAL-WORLD PROBLEMS. NATURAL LANGUAGE PROCESSING (NLP): SKILLS RELATED TO PROCESSING AND UNDERSTANDING HUMAN LANGUAGE USING COMPUTERS. ROBOTICS: KNOWLEDGE OF ROBOTS, THEIR MECHANISMS, AND HOW THEY ARE PROGRAMMED TO PERFORM TASKS. AUTOMATION TOOLS: EXPERIENCE WITH SOFTWARE OR SYSTEMS THAT AUTOMATE MANUAL TASKS. NONE OTHER 5 3 . 6 8 % 3 8 . 2 0 % 2 4 . 0 1 % 1 7. 3 8 % 1 1 . 0 5 % 2 0 . 8 2 % 2 5 . 0 4 % 1 . 6 5 % A significant portion of UAE National employees who responded to the survey (53.68%) report having a basic understanding of AI concepts and applications, reflecting a growing awareness of artificial intelligence in the workplace. Data analysis skills (38.20%) also show strong presence, highlighting the importance of data-driven decision making. While more specialised AI-related skills such as machine learning (24.01%) and natural language processing (17.38%) are less common, they represent areas for selective upskilling where relevant to specific job functions. Overall, the survey results indicate a positive baseline of AI awareness among UAE Nationals, with opportunities to further strengthen skills related to practical workplace applications rather than technical specialisation. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 7

Emiratis show rising familiarity with AI concepts, reflecting strong interest in digital skills. Advanced areas like machine learning and NLP are emerging, signaling promising tech readiness for the future. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 8 Work Location and Mobility Are You Willing To Work In A Different City In The Country From Your Hometown? - Jobseekers Are You Willing To Work In A Different City In The Country From Your Hometown? - Employees A majority of UAE National employees (58.91%) prefer to stay within their emirate of residence, continuing the trend from last year when 53.73% expressed the same preference. This highlights the importance of proximity to home, family ties, and community connections in job decision-making. However, 41.09% of employees are open to relocating for work, showing a slight decline from last year’s 46.27%. While there is still a willingness among a segment of the workforce to move for better opportunities, employers may need to consider location-based incentives, flexible work arrangements, or remote options to attract and retain talent across different emirates. A majority of UAE National jobseekers (60.62%) prefer not to relocate for work, reaffirming last year’s trend where 57.31% expressed the same preference. This suggests that family ties, community connections, and convenience remain key considerations for jobseekers when evaluating opportunities. On the other hand, 39.38% of jobseekers are open to working in a different emirate, indicating a willingness among a segment of candidates to explore opportunities beyond their immediate surroundings. This highlights the importance of employers offering flexible work arrangements, such as hybrid or remote options, to attract talent from different regions across the UAE. Y E S N O 60.62% 8 . 3 7 % 3 9 . 3 8 % Y E S N O 58.91% 8 . 3 7 % 4 1 . 0 9 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 3 9

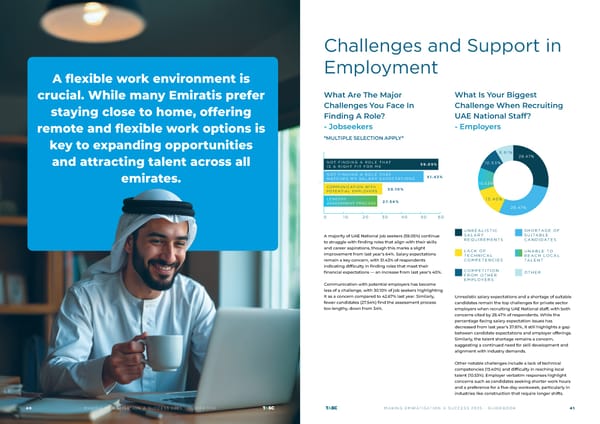

A flexible work environment is crucial. While many Emiratis prefer staying close to home, offering remote and flexible work options is key to expanding opportunities and attracting talent across all emirates. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 0 What Are The Major Challenges You Face In Finding A Role? - Jobseekers *MULTIPLE SELECTION APPLY* What Is Your Biggest Challenge When Recruiting UAE National Staff? - Employers Unrealistic salary expectations and a shortage of suitable candidates remain the top challenges for private sector employers when recruiting UAE National staff, with both concerns cited by 28.47% of respondents. While the percentage facing salary expectation issues has decreased from last year’s 37.81%, it still highlights a gap between candidate expectations and employer offerings. Similarly, the talent shortage remains a concern, suggesting a continued need for skill development and alignment with industry demands. Other notable challenges include a lack of technical competencies (13.40%) and difficulty in reaching local talent (10.53%). Employer verbatim responses highlight concerns such as candidates seeking shorter work hours and a preference for a five-day workweek, particularly in industries like construction that require longer shifts. A majority of UAE National job seekers (59.05%) continue to struggle with finding roles that align with their skills and career aspirations, though this marks a slight improvement from last year’s 64%. Salary expectations remain a key concern, with 51.43% of respondents indicating difficulty in finding roles that meet their financial expectations — an increase from last year’s 40%. Communication with potential employers has become less of a challenge, with 30.10% of job seekers highlighting it as a concern compared to 42.67% last year. Similarly, fewer candidates (27.54%) find the assessment process too lengthy, down from 34%. 0 1 0 2 0 3 0 4 0 5 0 6 0 N OT F I N D I N G A R O L E T H AT I S A R I G H T F I T F O R M E 5 9 . 0 5 % 5 1 . 4 3 % 4 5 . 9 7 % 3 0 .1 0 % 2 7. 5 4 % N OT F I N D I N G A R O L E T H AT M ATC H E S M Y S A L A R Y E X P E C TAT I O N S COMMUNICATION WITH POTENTIAL EMPLOYERS LENGTHY ASSESSMENT PROCESS Challenges and Support in Employment 10.53% 28.47% 28.47% 8 . 6 1 % 1 0 . 5 3 % 1 3 . 4 0 % U N R E A L I S T I C S A L A R Y R E Q U I R E M E N T S L AC K O F T E C H N I C A L C O M P E T E N C I E S C O M P E T I T I O N F R O M OT H E R E M P LOY E R S S H O R TAG E O F S U I TA B L E C A N D I DAT E S U N A B L E TO R E AC H LO C A L TA L E N T OT H E R M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 1

What Common Challenges Do You Face When Integrating UAE National Staff Within The Company - Employers *MULTIPLE SELECTION APPLY* Are You Provided With Enough Learning And Development Opportunities? - Employees A significant portion of UAE National employees (59%) feel they are provided with sufficient learning and development (L&D) opportunities, though this marks a slight decline from last year’s 62.56%. This indicates that while many employees still have access to career progression and skill enhancement resources, there may be a growing need to further expand or tailor these programmes. On the other hand, 41% of respondents believe L&D opportunities are insufficient, showing an increase from last year’s 37%. This suggests potential gaps in accessibility, relevance, or the depth of training programmes. Unrealistic salary expectations continues to be the most common challenge for private sector employers when integrating UAE National staff, with 50.48% of respondents highlighting this concern. While this is a slight decrease from last year’s 55.36%, it still underscores the ongoing gap between candidate expectations and employer compensation structures. Additionally, 43.78% of employers report difficulties with candidates being unavailable during standard working hours, an increase from last year’s 33.48%. Other challenges include the need for extensive training (29.19%) and communication barriers (21.05%). Employer verbatim responses further emphasise concerns regarding flexibility, initiative, and job commitment, reinforcing the need for better alignment between workplace expectations and candidate readiness. Y E S N O 41% 8 . 3 7 % 5 9 % 0 1 0 2 0 3 0 4 0 5 0 6 0 U N R E A L I S T I C S A L A R Y R E Q U I R E M E N T S 5 0 . 4 8 % 1 1 . 2 4 % 1 8 .1 8 % 4 3 . 7 8 % 2 9 .1 9 % 2 1 . 0 5 % C U LT U R A L M I S M ATC H UN AVA IL A B IL ITY TH R O UG H O UT STA N DA R D COM PA N Y WO R K I N G H O U R S N O C H A L L E N G E S FAC E D 1 1 . 7 2 % OT H E R E X T E N S I V E T R A I N I N G R E Q U I R E D COMMUNICATION BARRIER M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 2 Do You Offer Any Learning And Development Programs For Your UAE National Staff? - Employers A strong majority of private sector employers (68.90%) now offer learning and development (L&D) programmes for their UAE National staff, reflecting a significant increase in commitment to upskilling local talent compared to last year’s 47.77%. This indicates that companies are actively investing in workforce development to enhance employee skills and career growth. However, 22.25% of employers still do not have L&D programmes in place, while 8.85% have plans to introduce them in 2025. This suggests room for further improvement, particularly in expanding tailored training initiatives that align with Emirati employees' career aspirations and industry needs. 22.25% 68.90% 8 . 8 5 % Y E S P L A N N E D F O R 2 0 2 5 N O M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 3

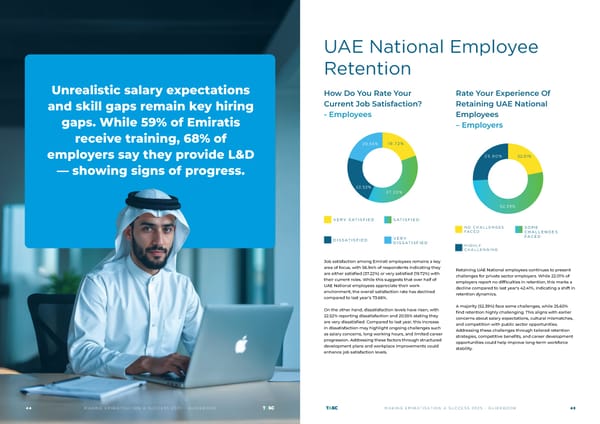

Unrealistic salary expectations and skill gaps remain key hiring gaps. While 59% of Emiratis receive training, 68% of employers say they provide L&D — showing signs of progress. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 4 UAE National Employee Retention How Do You Rate Your Current Job Satisfaction? - Employees Rate Your Experience Of Retaining UAE National Employees – Employers Retaining UAE National employees continues to present challenges for private sector employers. While 22.01% of employers report no difficulties in retention, this marks a decline compared to last year's 42.41%, indicating a shift in retention dynamics. A majority (52.39%) face some challenges, while 25.60% find retention highly challenging. This aligns with earlier concerns about salary expectations, cultural mismatches, and competition with public sector opportunities. Addressing these challenges through tailored retention strategies, competitive benefits, and career development opportunities could help improve long-term workforce stability. Job satisfaction among Emirati employees remains a key area of focus, with 56.94% of respondents indicating they are either satisfied (37.22%) or very satisfied (19.72%) with their current roles. While this suggests that over half of UAE National employees appreciate their work environment, the overall satisfaction rate has declined compared to last year’s 73.66%. On the other hand, dissatisfaction levels have risen, with 22.52% reporting dissatisfaction and 20.55% stating they are very dissatisfied. Compared to last year, this increase in dissatisfaction may highlight ongoing challenges such as salary concerns, long working hours, and limited career progression. Addressing these factors through structured development plans and workplace improvements could enhance job satisfaction levels. 1 9 . 7 2 % 3 7. 2 2 % 20.55% 22.52% V E R Y S AT I S F I E D D I S S AT I S F I E D S AT I S F I E D V E R Y D I S S AT I S F I E D N O C H A L L E N G E S FAC E D H I G H LY C H A L L E N G I N G S O M E C H A L L E N G E S FAC E D 52.39% 2 5 . 6 0 % 22.01% M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 5

Unrealistic salary expectations and skill gaps remain key hiring gaps. While 59% of Emiratis receive training, 68% of employers say they provide L&D — showing signs of progress. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 4 UAE National Employee Retention How Do You Rate Your Current Job Satisfaction? - Employees Rate Your Experience Of Retaining UAE National Employees – Employers Retaining UAE National employees continues to present challenges for private sector employers. While 22.01% of employers report no difficulties in retention, this marks a decline compared to last year's 42.41%, indicating a shift in retention dynamics. A majority (52.39%) face some challenges, while 25.60% find retention highly challenging. This aligns with earlier concerns about salary expectations, cultural mismatches, and competition with public sector opportunities. Addressing these challenges through tailored retention strategies, competitive benefits, and career development opportunities could help improve long-term workforce stability. Job satisfaction among Emirati employees remains a key area of focus, with 56.94% of respondents indicating they are either satisfied (37.22%) or very satisfied (19.72%) with their current roles. While this suggests that over half of UAE National employees appreciate their work environment, the overall satisfaction rate has declined compared to last year’s 73.66%. On the other hand, dissatisfaction levels have risen, with 22.52% reporting dissatisfaction and 20.55% stating they are very dissatisfied. Compared to last year, this increase in dissatisfaction may highlight ongoing challenges such as salary concerns, long working hours, and limited career progression. Addressing these factors through structured development plans and workplace improvements could enhance job satisfaction levels. 1 9 . 7 2 % 3 7. 2 2 % 20.55% 22.52% V E R Y S AT I S F I E D D I S S AT I S F I E D S AT I S F I E D V E R Y D I S S AT I S F I E D N O C H A L L E N G E S FAC E D H I G H LY C H A L L E N G I N G S O M E C H A L L E N G E S FAC E D 52.39% 2 5 . 6 0 % 22.01% M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 5

Are You Satisfied With Your Current Salary? - Employees What Salary Hike Do You Expect In 2025? - Employees Expectations for salary increases among UAE National employees remain high, with 43.04% anticipating a raise of 10% or more – an increase from last year’s 37.63%. This suggests a growing demand for higher compensation, likely driven by inflation and evolving market conditions. Meanwhile, 19.61% expect an 8-10% hike, while 15.16% foresee a 5-8% increase. However, 22.19% of respondents do not anticipate any salary raise, a slight rise from last year’s 19%, highlighting that a segment of employees remains uncertain about their financial growth. Salary dissatisfaction remains a key concern among UAE National employees, with 74.24% expressing discontent with their current earnings – an increase from last year’s 68%. This suggests a widening gap between salary expectations and actual compensation. Meanwhile, only 25.76% of employees report being satisfied with their salary, a slight decline from last year’s 32%. These findings indicate a growing need for organisations to assess salary structures, benefits, and career progression opportunities to improve employee satisfaction and retention. Y E S N O 74.24% 8 . 3 7 % 2 5 . 7 6 % 1 5 .1 6 % 43.04% 2 2 .1 9 % 19. 61% 5 - 8 % 1 0 % A N D A B OV E 8 - 1 0 % N O S A L A R Y H I K E M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 6 A majority of private sector employers continue to offer salaries within the AED 4,000 - AED 10,000 range, with 55.98% of respondents falling into this category. While this remains the most common salary bracket, there is a slight decrease from last year’s 65.72%, suggesting a potential shift toward more competitive compensation for UAE Nationals. Additionally, 31.10% of employers are offering salaries between AED 10,000 - AED 20,000, while only a small percentage (8.37%) are providing AED 20,000 - AED 30,000. These figures indicate that while budget-conscious hiring remains prevalent, there is some movement toward attracting experienced talent with higher salary packages. What Salary Range Are You Offering? - Employers 55.98% 8 . 3 7 % 3 1 .1 0 % A E D 4 , 0 0 0 - A E D 1 0 , 0 0 0 A E D 2 0 , 0 0 0 - A E D 3 0 , 0 0 0 A B OV E A E D 5 0 , 0 0 0 A E D 1 0 , 0 0 0 - A E D 2 0 , 0 0 0 A E D 3 0 , 0 0 0 - A E D 4 0 , 0 0 0 1 . 2 0 % 3 . 3 5 % What Would Make You Continue With Your Existing Employer? - Employees *MULTIPLE SELECTION APPLY* Salary remains the top factor influencing UAE National employees’ decision to stay with their current employer, with 45.55% of respondents prioritizing it. This aligns with the broader trend of increasing salary expectations seen in other survey findings. Job security follows closely at 42.91%, reaffirming its continued importance for long-term employment decisions. Career path (37.22%) and company culture (28.93%) are also key considerations, suggesting that employees are looking for both stability and opportunities for professional growth. Company benefits (26.81%) continue to play a role, though slightly lower in priority compared to salary and job security. These insights highlight the evolving expectations of UAE Nationals in the workforce, emphasizing the need for competitive salaries, clear career progression, and a supportive work environment. 0 1 0 2 0 3 0 4 0 5 0 J O B S E C U R I T Y 4 2 . 9 1 % 4 5 . 5 5 % 3 7. 2 2 % 2 8 . 9 3 % 2 6 . 8 1 % 2 2 .1 0 % S A L A R Y C O M PA N Y C U LT U R E CA RE E R PATH C O M PA N Y B E N E F I T S OTHE R M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 7

Overall, Which Benefit Is Most Important To You? - Employees Better location or working hours remains the most important benefit for UAE National employees, with 60.42% prioritizing it. This reinforces the ongoing emphasis on work-life balance and convenience in employment decisions. Support for professional studies or upskilling (23.44%) has gained increased importance compared to last year, highlighting a growing interest in career advancement and continuous learning. Meanwhile, child education allowances (9.36%) and transportation benefits (6.78%) remain relevant but are secondary considerations. These findings indicate that beyond salary, flexible working conditions and opportunities for professional growth are key factors in employee satisfaction and retention. C O M PA N Y C A R O R T R A N S P O R TAT I O N A L LOWA N C E C H I L D E D U C AT I O N A L LOWA N C E B E T T E R LO C AT I O N O R WO R K I N G H O U R S S U P P O R T F O R P R O F E S S I O N A L S T U D I E S O R U P S K I L L I N G 60.42% 9.36% 2 3 . 4 4 % 6.78% What Remote Or Hybrid Working Policy Do You Have In Your Workplace? - Employees More than half (52.51%) of UAE National employees who responded to the survey work in organisations without a remote or hybrid work policy, indicating that traditional office-based work is still the norm. However, flexibility is increasing, with 30.11% of employees reporting complete remote work options — more than doubling compared to last year. The proportion of employees allowed to work remotely one day a week (13.45%) has also grown, while 3.93% have limited remote work options of two days a month. Compared to last year, this shift suggests a gradual adoption of hybrid work models, although full flexibility remains available to only a minority of the workforce. N O R E M OT E O R H Y B R I D WO R K P O L I C Y O N E DAY A W E E K 52.51% 30.11% 1 3 . 4 5 % 3.93% C O M P L E T E R E M OT E WO R K O P T I O N S 2 DAYS A M O N T H M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 8 0 1 0 2 0 3 0 4 0 5 0 6 0 What Are The Benefits You Are Offering To Attract And Retain UAE Nationals? - Employers *MULTIPLE SELECTION APPLY* Private sector employers are actively implementing Emiratisation policies, with internal awareness campaigns (46.65%) being the most widely adopted initiative. This reflects ongoing efforts to integrate and promote Emiratisation within organisations. Partnerships with educational institutions (35.17%) continue to be a strong strategy for sourcing Emirati talent, while Emirati-specific career development plans (34.45%) and specialised training programmes (34.21%) demonstrate a growing commitment to professional growth and upskilling. Compared to last year, these initiatives have gained traction, highlighting a more structured approach toward Emiratisation efforts. Private sector employers continue to prioritise better location or working hours (57.89%) as a key benefit to attract and retain UAE Nationals, reflecting alignment with employee preferences for work-life balance. Remote or hybrid working policies have seen a significant rise, with 55.50% of employers offering this flexibility, indicating a growing adaptation to modern workplace expectations. Support for professional studies (34.45%) remains a valuable incentive, reinforcing employers' commitment to upskilling UAE National talent. Child education allowances (15.31%) remain a secondary benefit, while other responses highlight fuel allowances, medical insurance, and travel benefits as additional incentives. These findings suggest that employers are increasingly tailoring their benefits to meet the evolving needs of the local workforce. What Specific Emiratisation Policies Does Your Company Currently Have In Place? - Employers *MULTIPLE SELECTION APPLY* CHILD EDUCATION ALLOWANCE 1 5 . 3 1 % 5 5 . 5 % 5 7. 8 9 % 3 4 . 4 5 % 1 6 . 9 9 % R E M OT E O R H Y B R I D WO R K I N G P O L I C Y B E T T E R LO C AT I O N O R WO R K I N G H O U R S S U P P O R T I N G P R O F E S S I O N A L S T U D I E S OT H E R S 0 1 0 2 0 3 0 4 0 5 0 PARTNERSHIPS WITH EDUCATIONAL INSTITUTIONS FOR HIRING EMIRATI TALENT 3 5 .1 7 % 3 4 . 4 5 % 3 4 . 2 1 % 4 6 . 6 5 % 1 1 . 0 0 % E M I R AT I - S P E C I F I C C A R E E R D E V E LO P M E N T P L A N S S P E C I A L I S E D T R A I N I N G P R O G R A M M E S F O R E M I R AT I E M P LOY E E S INTERNAL AWARENESS CAMPAIGNS ABOUT EMIRATISATION OT H E R M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 4 9

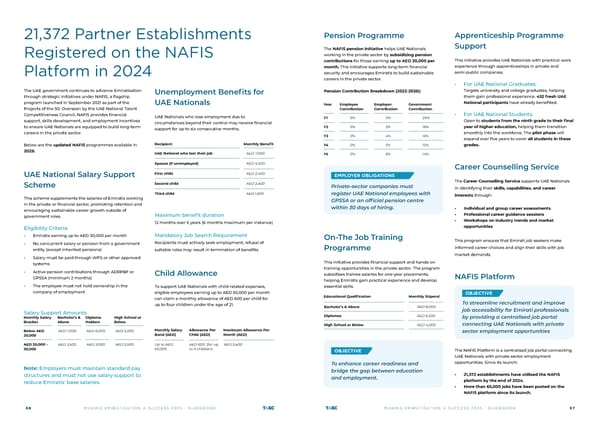

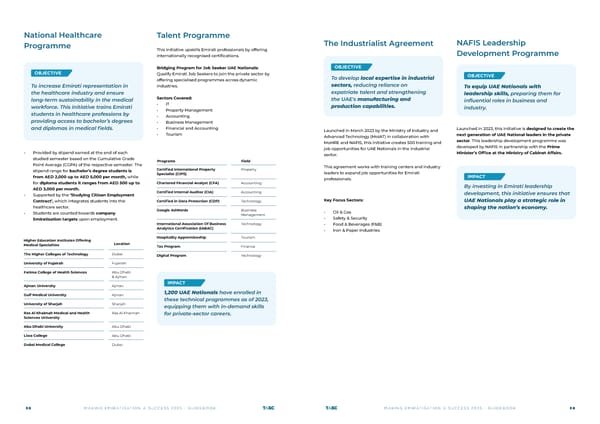

To retain Emirati employees, employers must focus on offering competitive salaries, ensuring strong job security, and creating clear career development pathways. M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 5 0 What Skills Do You Believe Are Most Important For Your Desired Job? - Jobseekers *MULTIPLE SELECTION APPLY* Communication remains the most valued skill among UAE National job seekers who responded to the survey, with 70.69% emphasizing its importance. This marks a slight decrease from last year’s 77.8%, but it continues to be the most sought-after competency. IT skills (45.78%) have also maintained their relevance, though at a lower rate than last year’s 60.86%, reflecting potential shifts in industry demands. Leadership (51.73%) and analytics (27.65%) are emerging as key skills, indicating a growing interest in management and data-driven roles. Meanwhile, creative design (29.73%) and marketing (23.56%) have gained traction, suggesting that job seekers are recognizing the value of creative and strategic thinking in their career paths. Skills and Development 0 1 0 2 0 3 0 4 0 5 0 6 0 7 0 8 0 I T S K I L L S C O M M U N I C AT I O N AC C O U N T I N G & F I N A N C E A N A LY T I C S L E A D E R S H I P C R E AT I V E D E S I G N E N G I N E E R I N G M A R K E T I N G 4 5 . 7 8 % 2 3 . 5 6 % 1 4 . 9 1 % 2 7. 6 5 % 5 1 . 7 3 % 2 9 . 7 3 % 2 1 . 5 4 % 7 0 . 6 9 % What Skills Do You Find Most Valuable In Your Current Role? - Employees *MULTIPLE SELECTION APPLY* Communication remains the most valued skill among UAE National employees who responded to the survey, with 65.35% rating it as essential in their current roles. While this is slightly lower than last year’s 66.78%, it continues to be the most in-demand competency. IT skills (38.93%) have seen a decline from last year’s 45%, reflecting potential shifts in workplace requirements. Leadership skills (36.84%) have gained importance compared to last year’s 30.64%, indicating a growing focus on managerial and decision-making abilities. Additionally, analytics (24.08%) and project management (25.95%) are emerging as key skills, suggesting an increasing emphasis on data-driven insights and structured execution within organisations. 0 1 0 2 0 3 0 4 0 5 0 6 0 7 0 8 0 C O M M U N I C AT I O N AC C O U N T I N G & F I N A N C E A N A LY T I C S L E A D E R S H I P PROJECT MANAGEMENT CREATIVE DESIGN E N G I N E E R I N G OT H E R I T S K I L L S M A R K E T I N G 3 8 . 9 3 % 1 9 . 5 9 % 1 7. 9 8 % 2 4 . 0 8 % 1 7. 8 7 % 1 0 .1 1 % 2 5 . 9 5 % 1 0 . 8 4 % 3 6 . 8 4 % 6 5 . 3 5 % M A K I N G E M I R AT I S AT I O N A S U C C E S S 2 0 2 5 - G U I D E B O O K 5 1