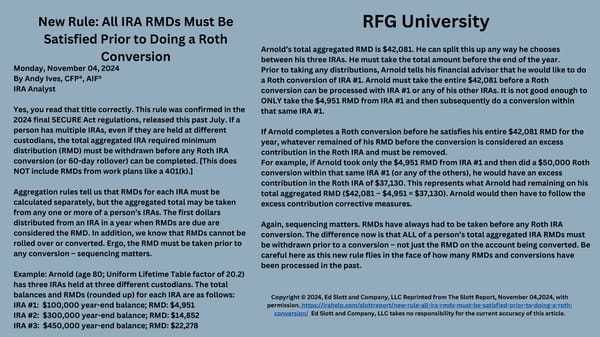

New Rule: All IRA RMDs Must Be RFG University Satisfied Prior to Doing a Roth Arnold’s total aggregated RMD is $42,081. He can split this up any way he chooses Conversion between his three IRAs. He must take the total amount before the end of the year. Monday, November 04, 2024 Prior to taking any distributions, Arnold tells his financial advisor that he would like to do By Andy Ives, CFP®, AIF® a Roth conversion of IRA #1. Arnold must take the entire $42,081 before a Roth IRA Analyst conversion can be processed with IRA #1 or any of his other IRAs. It is not good enough to ONLY take the $4,951 RMD from IRA #1 and then subsequently do a conversion within Yes, you read that title correctly. This rule was confirmed in the that same IRA #1. 2024 final SECURE Act regulations, released this past July. If a person has multiple IRAs, even if they are held at different If Arnold completes a Roth conversion before he satisfies his entire $42,081 RMD for the custodians, the total aggregated IRA required minimum year, whatever remained of his RMD before the conversion is considered an excess distribution (RMD) must be withdrawn before any Roth IRA contribution in the Roth IRA and must be removed. conversion (or 60-day rollover) can be completed. [This does For example, if Arnold took only the $4,951 RMD from IRA #1 and then did a $50,000 Roth NOT include RMDs from work plans like a 401(k).] conversion within that same IRA #1 (or any of the others), he would have an excess contribution in the Roth IRA of $37,130. This represents what Arnold had remaining on his Aggregation rules tell us that RMDs for each IRA must be total aggregated RMD ($42,081 – $4,951 = $37,130). Arnold would then have to follow the calculated separately, but the aggregated total may be taken excess contribution corrective measures. from any one or more of a person’s IRAs. The first dollars distributed from an IRA in a year when RMDs are due are Again, sequencing matters. RMDs have always had to be taken before any Roth IRA considered the RMD. In addition, we know that RMDs cannot be conversion. The difference now is that ALL of a person’s total aggregated IRA RMDs must rolled over or converted. Ergo, the RMD must be taken prior to be withdrawn prior to a conversion – not just the RMD on the account being converted. Be any conversion – sequencing matters. careful here as this new rule flies in the face of how many RMDs and conversions have been processed in the past. Example: Arnold (age 80; Uniform Lifetime Table factor of 20.2) has three IRAs held at three different custodians. The total balances and RMDs (rounded up) for each IRA are as follows: Copyright © 2024, Ed Slott and Company, LLC Reprinted from The Slott Report, November 04,2024, with permission. https://irahelp.com/slottreport/new-rule-all-ira-rmds-must-be-satisfied-prior-to-doing-a-roth- IRA #1: $100,000 year-end balance; RMD: $4,951 conversion/ Ed Slott and Company, LLC takes no responsibility for the current accuracy of this article. IRA #2: $300,000 year-end balance; RMD: $14,852 IRA #3: $450,000 year-end balance; RMD: $22,278

RFG Wealth Advisory Newsletter February '25 Page 2 Page 4

RFG Wealth Advisory Newsletter February '25 Page 2 Page 4