QFC Annual Report 2024 - English

The report outlines Qatar Financial Centre's strategic growth plans and achievements for 2024.

ANNUAL REPORT 2024 STEADY GROWTH, BOLD STRATEGIES

34 A COMMITMENT TO EXCELLENCE Fuelling Innovation Strengthening Regulatory Environment Championing Clients Securing Data Protection and Privacy Empowering a Values-Driven Workforce Nurturing the Community 40 ACCOLADES 42 CLIENT SPOTLIGHT 44 LOOKING AHEAD: A FUTURE DEFINED BY INNOVATION, SUSTAINABILITY, AND GROWTH 04 INTRODUCTION Chairman Foreword CEO Foreword 08 QFC AT A GLANCE Vision and Mission Core Values Board of Directors Executive Committee QFC Governance QFC Benefits Strategic Vision 2030 22 QFC HIGHLIGHTS 2024 24 BUILDING TIES, DRIVING ECONOMIC TRANSFORMATION Fostering Collaboration, Enhancing Industry Insights Strategic Events and Engagements Strengthening Strategic Alliances CONTENT

156% GROWTH OVER 11,700 EMPLOYEES 836 FIRMS 5 6 Qatar Financial Centre recorded its best-performing year in 2024, licensing 836 firms the highest number of annual registrations since its establishment. This marks an impressive 156 per cent increase compared to the previous year and a 130 per cent rise from its previous record set in 2020. The year also reflects the success of the QFC Strategy in positioning Qatar as a leading regional hub for financial services and wealth management, as seen in the growth of Technology, Fintech and Wealth Management firms on its platform. Additionally, the QFC community saw a 17 per cent increase in its workforce, reaching over 11,700 employees by the end of 2024, reinforcing its role in job creation and economic growth. This report provides insight into QFCs achievements over the year, highlighting the progress made through strategic collaborations, landmark events, and a growing community of firms. It also sets out QFCs vision for the future, detailing both immediate priorities and long-term ambitions as it continues to play a pivotal role in advancing Qatars economic transformation in line with the Qatar National Vision 2030. INTRODUCTION

7 8 The achievements outlined in this report reflect QFCs commitment to driving Qatars future-focused economic evolution and broadening its global competitive edge. In 2024, QFC reinforced its role as a key player in attracting global enterprises to Qatar, welcoming businesses from over 80 countries and more than 25 sectors. With 77 per cent of QFC firms originating from international markets, QFC is not only advancing Qatars strategic diversification goals but also strengthening the nations global connectivity. As a thriving community, QFC is integral to generating employment opportunities and nurturing skills development across industries. QFC has been instrumental in promoting industry dialogues and fostering meaningful As we reflect on another successful year, it is evident that our journey has been influenced by global and regional trends reshaping the economic landscape. Shifting capital flows, the move towards deglobalisation, and pivotal advancements in AI, digital assets, and other emerging technologies are driving seismic changes across industries and redefining the future of finance. Against this backdrop, we have laid the groundwork for our 2030 Strategy, a dynamic roadmap to establish Qatar as a leading financial and commercial hub. This forward-looking strategy aims to capitalise on emerging markets and strengthen Qatars appeal as a wealth destination in an increasingly competitive region. At its core, the strategy seeks to establish QFC as a centre for wealth management, expand adjacent financial services such as digital assets and tokenisation, and diversify the broader business ecosystem by supporting sectors including sports, media, technology, and professional services. It also encompasses regulatory frameworks and incentives to partnerships, while enhancing both Qatars and its visibility on the global stage. The financial performance of QFCs regulated firms, with assets under management exceeding $22.5 billion in 2024, further highlights its role as a key driver of economic value creation. With the continued execution of its 2030 Strategy, QFC is poised to elevate Qatars position as a foremost global financial and commercial hub. H.E. Sheikh Faisal bin Thani bin Faisal Al Thani Minister of Commerce & Industry and Chairman of Qatar Financial Centre CHAIRMAN FOREWORD: BUILDING ON A RECORD OF PROGRESS AND INNOVATION CEO FOREWORD: POSITIONING QATAR AS A GLOBAL FINANCIAL LEADER attract firms and institutions that meet Qatars evolving market needs and complement its economic dynamics. With sustainability gaining prominence among businesses, individuals, and policymakers, we are intensifying efforts to promote sustainable finance and champion Islamic finance and leverage emerging technologies to create an equitable and accessible financial ecosystem. Our aim is to position Qatar as a leader in ethical investment, aligning with the growing momentum towards environmental and social responsibility. This growth report provides an overview of our efforts and the initiatives we have launched to foster an innovative financial ecosystem and create an attractive market for businesses of all sizes, particularly those critical to Qatars economic growth. I invite you to explore our achievements and strategic direction. Yousuf Mohamed Al-Jaida Chief Executive Officer of Qatar Financial Centre CHAIRMAN MESSAGE H.E. Sheikh Faisal bin Thani bin Faisal Al Thani CEO MESSAGE Yousuf Mohamed Al-Jaida

10 9 AUTHENTICITY We are genuine, transparent, and true to our purpose. Together, we create strategic solutions. CUSTOMER FOCUS We are dedicated to prioritising the needs, satisfaction, and success of our customers. We are in business together. FUTURE FOCUS We anticipate, adapt to, and capitalise on evolving business landscapes. We embrace learning and foster positive transformation. QUALITY We are determined to deliver excellence in all aspects of operations and perform at our best in all that we do. We consistently achieve outstanding outcomes with confidence. CORE VALUES MISSION Drive economic development and diversification by providing a world-class, commercial, legal and regulatory environment. VISION Transforming Doha into a leading global financial and commercial capital. QFC AT A GLANCE

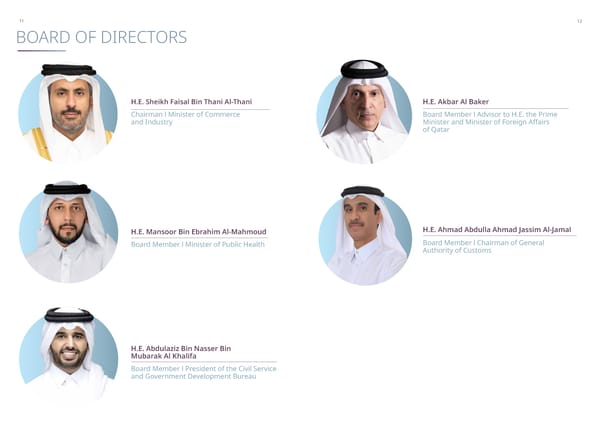

11 12 H.E. Akbar Al Baker Board Member l Advisor to H.E. the Prime Minister and Minister of Foreign Affairs of Qatar H.E. Ahmad Abdulla Ahmad Jassim Al-Jamal Board Member l Chairman of General Authority of Customs H.E. Mansoor Bin Ebrahim Al-Mahmoud Board Member l Minister of Public Health H.E. Abdulaziz Bin Nasser Bin Mubarak Al Khalifa Board Member l President of the Civil Service and Government Development Bureau H.E. Sheikh Faisal Bin Thani Al-Thani Chairman l Minister of Commerce and Industry BOARD OF DIRECTORS

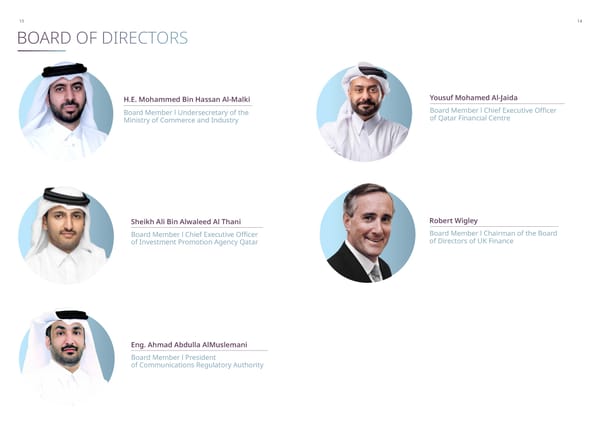

13 14 Robert Wigley Board Member l Chairman of the Board of Directors of UK Finance Yousuf Mohamed Al-Jaida Board Member l Chief Executive Officer of Qatar Financial Centre Eng. Ahmad Abdulla AlMuslemani Board Member l President of Communications Regulatory Authority Sheikh Ali Bin Alwaleed Al Thani Board Member l Chief Executive Officer of Investment Promotion Agency Qatar H.E. Mohammed Bin Hassan Al-Malki Board Member l Undersecretary of the Ministry of Commerce and Industry BOARD OF DIRECTORS

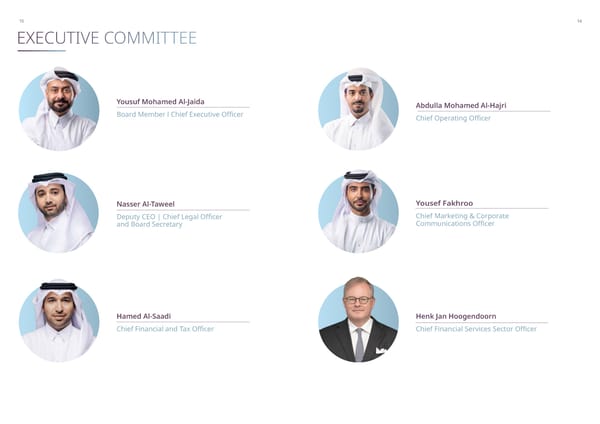

15 16 EXECUTIVE COMMITTEE Abdulla Mohamed Al-Hajri Chief Operating Officer Yousuf Mohamed Al-Jaida Board Member l Chief Executive Officer Nasser Al-Taweel Deputy CEO | Chief Legal Officer and Board Secretary Hamed Al-Saadi Chief Financial and Tax Officer Yousef Fakhroo Chief Marketing & Corporate Communications Officer Henk Jan Hoogendoorn Chief Financial Services Sector Officer

17 The QFC is governed by four independent bodies, ensuring the platform operates in line with the highest global standards while providing its firms with robust operational, judicial, and legal support in a business-friendly environment. These independent bodies are: Qatar Financial Centre Authority (QFCA) : The QFCA manages and maintains the QFC legal and tax environment and licenses fi rms to conduct business in or from the QFC. The QFCA also fosters ties with local and global fi nancial communities and key institutions to enhance market connectivity, attract investments, and drive sustainable economic growth. Qatar Financial Centre Regulatory Authority (QFCRA) : The QFCRA is the independent regulator of the QFC, established to authorise, regulate and supervise firms and individuals conducting financial services and regulated activities in or from the QFC. Qatar International Court and Dispute Resolution Centre (QICDRC) : The QICDRC comprises two independent judicial bodies: a world-class Court specialised in the resolution of civil and commercial disputes, and a Regulatory Tribunal tasked with hearing appeals raised against decisions of the QFC Authority, the QFC Regulatory Authority and QFC institutions. Together, the Civil and Commercial Court and the Regulatory Tribunal facilitate the resolution of disputes fairly and efficiently, adhering to internationally recognised best practice and the rule of law. QFC GOVERNANCE 18

This is a modal window.

19 20 19 COMMON LAW Companies registered with the QFC are governed by a legal and judicial framework based on common law, with access to an independent court, regulatory tribunal and dispute-resolution centre. ONSHORE JURISDICTION The QFC is an onshore business and financial centre that licenses companies to operate in Qatar and in the region within a legal and tax environment aligned with international standards. 100% FOREIGN OWNERSHIP Companies in the QFC benefit from up to 100 per cent ownership of their business in Qatar. COMPETITIVE TAX SYSTEM The QFC offers a fair and transparent tax regime, allowing access to a wide Double Taxation Agreements network with 80+ countries, 10% corporate tax on locally sourced profit, no personal income tax, wealth tax or Zakat, and an efficient advance ruling service. 100 % REPATRIATION OF PROFITS Payments of dividends, interests, royalties, and management fees to recipients outside of Qatar are free from withholding tax, enabling tax-free returns and profit repatriation for shareholders. TAILORED SOLUTIONS Access to a team of experts across disciplines to help tailor product structures and solutions to meet the QFC-registered companys business needs. ONE STOP SHOP A quick and easy set-up process that licenses, establishes, and supports businesses in and from Qatar. TRADE IN ANY CURRENCY Conduct business from Qatar with no restrictions on the currency used for trading. 19 QFC BENEFITS 20

21 The QFC envisions Qatar as a leading financial and wealth hub in the region. Its 2030 Growth Strategy outlines a clear roadmap to achieving this aspiration, aligned with the Qatar National Vision 2030 and the Qatar Central Banks Third Financial Sector Strategic Plan. The strategy focuses on strengthening Qatars financial services sector, attracting wealth and foreign direct investment, and advancing economic diversification. Its key priorities include establishing a competitive wealth hub through comprehensive visa schemes, supportive regulations, targeted incentives, and diverse investment opportunities. It seeks to expand into emerging financial services sectors, such as tokenisation and digital assets, by attracting major institutions and fintech firms through innovative regulatory frameworks and customised incentives. Additionally, it aims to stimulate growth in the broader business ecosystem by catering to a diverse range of industries. STRATEGIC VISION 2030 21 22

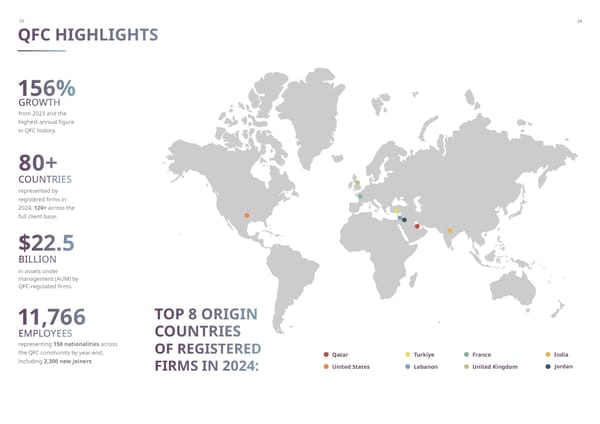

United Kingdom United States Turkiye France India Qatar Jordan Lebanon 23 24 QFC HIGHLIGHTS 156% 80+ GROWTH COUNTRIES BILLION from 2023 and the highest annual figure in QFC history. represented by registered firms in 2024, 120+ across the full client base. in assets under management (AUM) by QFC-regulated firms. $22.5 11,766 EMPLOYEES representing 150 nationalities across the QFC community by year-end, including 2,300 new joiners . TOP 8 ORIGIN COUNTRIES OF REGISTERED FIRMS IN 2024:

out of 836 Firms aligned with the priority industries 25 26 QFC more than doubled the number of new firms licensed in 2024 compared to the previous year. Notably, 74 per cent of the 836 firms registered align with the priority industries outlined in its 2030 strategy. Among these are six top-tier venture capital firms, now affiliated with the Qatar Investment Authoritys Fund of Funds initiative, as well as five regulated firms . This marks a tangible progress in strengthening Qatars financial sector by enriching its wealth and venture capital ecosystem, broadening market capital formation and liquidity, and expanding its professional services landscape. 25 BUILDING TIES, DRIVING ECONOMIC TRANSFORMATION Beyond this record-setting growth, QFC advanced economic diversification by attracting companies from more than 25 industries and over 80 countries .

attended across regional and global stages. 32 HIGH-PROFILE FORUMS local & international events. SPONSORED 13 26 . hosted, catalysing industry conversations. HIGH IMPACT EVENTS through MOUs & LOTs. STRATEGIC PARTNERSHIPS 24 across industries engaged, enabling connections and advancing sector expertise. INTERNATIONAL & LOCAL STAKEHOLDERS 2K+ 27 28 FOSTERING COLLABORATION, ENHANCING INDUSTRY INSIGHTS QFC RECOGNISES THAT COLLABORATION AND KNOWLEDGE EXCHANGE ARE ESSENTIAL FOR ECONOMIC GROWTH.

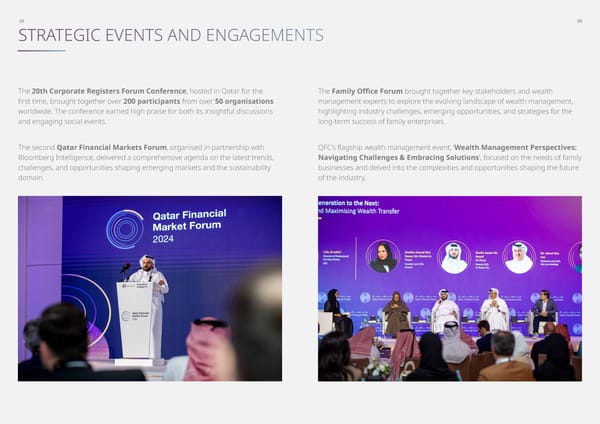

29 30 The 20th Corporate Registers Forum Conference , hosted in Qatar for the first time, brought together over 200 participants from over 50 organisations worldwide. The conference earned high praise for both its insightful discussions and engaging social events. The Family Office Forum brought together key stakeholders and wealth management experts to explore the evolving landscape of wealth management, highlighting industry challenges, emerging opportunities, and strategies for the long-term success of family enterprises. The second Qatar Financial Markets Forum , organised in partnership with Bloomberg Intelligence, delivered a comprehensive agenda on the latest trends, challenges, and opportunities shaping emerging markets and the sustainability domain. QFCs flagship wealth management event, Wealth Management Perspectives: Navigating Challenges & Embracing Solutions , focused on the needs of family businesses and delved into the complexities and opportunities shaping the future of the industry. STRATEGIC EVENTS AND ENGAGEMENTS

31 32 Another key initiative of the QFC in 2024 to advance the Wealth & Asset Management industry was the exclusive luncheon roundtable for family offices. Featuring specialists from the legal, tax, and professional services fields, the event facilitated dialogue on emerging trends and regulatory developments shaping the sector. In a parallel initiative, QFCs CEO Roundtables this year, which focused on banking, asset management, and insurance, brought C-suite executives together to address sector challenges, explore growth opportunities, and align strategic priorities for Qatars financial future. Beyond these efforts, QFC organised events in partnership with leading institutions to facilitate trade, promote a conducive business environment, and support sustainability agendas, such as: The International Conference on Islamic Finance 2024, organised by Hamad Bin Khalifa University and co-hosted by QFC, highlighted Sharia-compliant digital transformations and the critical role of Islamic finance in driving global economic recovery. Energy Outlook 2024: What impact the Middle Easts recent events have on the Energy Market & Financial Institutions , in collaboration with the London Stock Exchange Group (LSEG), explored the evolving dynamics of energy markets, assessed risks, and identified opportunities for investment and growth in the region. Strategic Dialogue on The Importance of Just Transition and Investment in Human Capital in cooperation with Gulf Sustain, promoted the importance of equality and inclusivity in labour practice. A Masterclass , in partnership with Labuan International Business and Financial Centre (Labuan IBFC), highlighted Labuans leasing and family office offerings from a Shariah perspective and family office solutions offered by QFC. Qatar-France Investor Meet-Up , in collaboration with the Economic Department of the French Embassy, coordinated connections between companies, funds, and investors between the two countries. Data Protection in the Age of AI, in collaboration with the U.S. Department of Commerce, shed light on global best practices in data privacy and protection. Furthermore, QFC participated in speaking engagements at both local and global events, affirming its role as a thought leader. These events include the Qatar Economic Forum, the Union of Arab Securities Markets Annual Conference, the Islamic FinTech Forum in Dubai, and the UK City Week 2024 . STRATEGIC EVENTS AND ENGAGEMENTS

33 34 STRENGTHENING STRATEGIC ALLIANCES QFC established 24 strategic partnerships in 2024 through Memoranda of Understanding and Letters of Intent, solidifying its dedication to driving economic growth through joint efforts. These partnerships, with local and global organisations, harness collective expertise and resources to foster knowledge sharing, fuel cross-sector initiatives, attract targeted investments, and drive joint marketing efforts, all focused on advancing long-term sectoral and economic development. QFC hosted 31 ambassadors and 40 delegations from Asia, Africa, the Americas, Europe, and Oceania, reinforcing international ties and opening doors for partnerships and collaborations among governments and private entities. These global engagements aim to drive investment flows and foster mutual growth and development

This is a modal window.

35 A COMMITMENT TO EXCELLENCE FUELLING INNOVATION STRENGTHENING REGULATORY ENVIRONMENT CHAMPIONING CLIENTS QFC made significant progress in reinforcing its regulatory framework. Notable achievements include the enactment of the Digital Assets Framework , establishing Qatar as a leader in the digital assets space and creating an innovative environment for businesses in digital finance. Additionally, QFC introduced amendments to the Arbitration Regulations, Contract Regulations, Special Companies Regulations, and Company Regulations . These updates further streamline legal processes and enhance business certainty, demonstrating QFCs QFC commenced activities at the QFC Digital Assets Lab with 29 participants selected from 50 applicants who underwent a thorough vetting process. The first cohort includes 10 local companies and 19 from 13 countries, all to receive extensive support to develop, test, and commercialise their digital solutions. The Labs focus on collaboration was evident early on, when a participant signed an MoU with a partner to promote global blockchain adoption , aligning with QFCs commitment to enabling the deployment of digital solutions that commitment to providing a stable, business- friendly environment with clarity, improved efficiency, and alignment with global best practices for its stakeholders. The QFC also played an active role in sectoral financial policy development and advocacy throughout the year, responding to multiple consultation papers and information requests from private institutions and regulatory authorities. This included providing extensive feedback related to policies on asset management funds and financial technology. QFC delivered services with exceptional efficiency, surpassing key performance indicators and setting new standards of operational excellence. With a remarkable 96.36% adherence to Service Level Agreements (SLAs), QFC exceeded its annual KPI target by 6.36%. Client satisfaction reached an outstanding 97%, while valid complaints dropped to an exceptionally low 0.03%. 36 35 CLIENT SATISFACTION 97% CERTIFICATION To enhance its digital service offerings, QFC upgraded the E-Services portal by introducing ChatBot functionalities, expanded the FAQ section, and automated appointment scheduling for Relationship Managers. Furthermore, QFC secured the ISO 9001 Quality Management System certification, strengthening its alignment with global operational standards. enhance transparency, sustainability, and equity. The Digital Assets Lab operates within QFCs Digital Assets Framework, a comprehensive regulatory regime that ensures a secure and transparent ecosystem for digital asset development. Aligned with international standards, the framework provides a strong legal foundation for tokenisation, property rights, custody, transfer, exchange, and the recognition of smart contracts.

37 38 Another key milestone for QFC in 2024 was the acceptance of its Data Protection Office (DPO) as a member of the Global Privacy Assembly (GPA) , the premier global forum for data protection and privacy authorities. This achievement reflects QFCs progress in advancing data protection and privacy through the establishment of the DPO and the implementation of the QFC Data Protection Regulations and Rules 2021, which govern the processing of personal data within the QFC. These regulations introduced stronger compliance measures and enhanced rights for data subjects, ensuring the protection of individuals rights and legitimate interests. Underscoring the importance of international collaboration in data governance, the DPO, in partnership with the US Department of Commerce, hosted a high-level seminar on Data Protection in the Age of AI , marking QFC reinforced its strong emphasis on workforce development through a series of targeted training and learning programmes. A central component of this commitment in 2024 was the launch of the Values Integration Programme , a two-day workshop aimed at embedding QFCs core valuesQuality, Future Focus, Customer Focus, and Authenticity across the organisation. As part of QFCs Cultural Change Programme and aligned with the 2030 Growth Strategy, four rounds of training sessions on Mastering Coaching Feedback in Performance Management Reviews and Beyond were conducted for employees and line managers to strengthen their skills in delivering and receiving feedback, as well as in effective performance management. The QFC Synergy Series, interactive learning sessions for specialised topics, was also launched to include in-depth discussions on Generative AI and the QFC Digital Assets Framework. the International Data Protection Day. The event convened experts from the US National Institute for Standards and Technology, Microsoft, Google, Clyde & Co, and regional regulators from DIFC and ADGM to discuss evolving global standards and emerging challenges in AI-driven data ecosystems. Complementing QFCs awareness efforts with practical guidance, QFC published a reference list of processing activities that require a Data Protection Impact Assessment (DPIA) . The activities in this list are deemed to pose higher risks to individuals rights and interests, thereby mandating a DPIA. Finalised after a 30-day public consultation, the list helps ensure QFC firms align with best practices in personal data protection. To build financial literacy, QFC introduced the Financial Aptitude Skills Training Programme in partnership with the Chartered Institute for Securities and Investments (CISI), preparing employees for professional certification. QFC also offered employees access to structured, curriculum-based learning programmes through the Coursera platform, expanding opportunities for continuous learning. Consistent with its commitment to human capital development, QFC enhanced the Graduate Development Programme by emphasising career readiness through job rotations, mentorship, certifications, and peer learning. In 2024, 33 interns and one graduate trainee successfully completed the programme. SECURING DATA PROTECTION AND PRIVACY EMPOWERING A VALUES-DRIVEN WORKFORCE 38 37

39 40 NURTURING THE COMMUNITY QFCs Corporate Social Responsibility (CSR) initiatives reaffirmed its commitment to promoting financial literacy, sustainability, and community engagement. Notable sponsorships included the Future Assets and Train the Trainer programmes at the Qatar Finance and Business Academy (QFBA), aimed at equipping fresh graduates and young professionals with essential financial skills. In collaboration with the Ministry of Education, QFC introduced a three-month entrepreneurship programme for fifth- grade students across Qatar and partnered with the Alnoor Center for the Blind to improve access to financial education and employment opportunities for visually impaired individuals by 40 39 offering seats in QFBAs literacy programmes to the Centres graduates. Alongside its educational and youth-focused programmes, QFC supported environmental and cultural initiatives through its participation in the Ooredoo Marathon and Qatar Environment Day, and by empowering local artists via the Fire Stations Artists in Residence Workshops. During Qatar Social Responsibility Week, QFC was recognised for an AI education initiative with the Imtiyaz Center, which reached a diverse group of student groups, including those in refugee camps. The AI Camp, modelled on European frameworks, was open to community members of all ages.

41 42 ACCOLADES Forbes Middle East Top 100 CEO: Yousuf Mohamed Al-Jaida was named among the regions top 100 CEOs, reflecting his outstanding leadership and QFCs vital role in shaping Qatars business landscape. National Cybersecurity Agency Recognition: QFC was acknowledged for its independent and collaborative efforts in strengthening cybersecurity. Ministry of Social Development and Family Recognition: QFC was honoured for its contributions to community development and social responsibility initiatives. Emerging Technology Initiative Award: QFC received this recognition at the 8th Middle East Enterprise AI & Analytics Summit for its leadership in fintech innovation, as evidenced by the launch of the QFC Digital Assets Lab and the Digital Assets Regulatory Framework. Banking and Financial Technology Award: The University of Doha for Science and Technology (UDST) recognised QFC for its support in fostering innovation and academic excellence. 41 42

43 44 CLIENT SPOTLIGHT EM PROFESSIONAL SERVICES EM Professional Services (EMPS) is a Qatar-based consultancy firm that provides tailored, value-driven solutions to support businesses across key operational areas. With a focus on agility and a personalised approach, EMPS enables clients to focus on their core objectives while the firm manages essential support functions. Its core offerings span three main areas: financial advisory, HR consultancy, and global mobility services. In financial advisory, EMPS supports strategic planning, budgeting, risk mitigation, and corporate governance, including market entry consulting. Its HR consultancy services help align human capital with business goals, offering expertise in recruitment, HR policies, compensation planning, and professional development. Based in West Bay, Doha, EMPS is committed to enhancing business productivity and competitiveness through practical and customised consultancy solutions. Our journey with the QFC has been defined by genuine support, professionalism, and a shared commitment to growth. From the beginning, the QFC team made us feel like valued partners rather than just license holders. Their proactive assistance and business- friendly environment have been instrumental in enabling us to move forward with confidence and agility. We are grateful for the strong relationship we have built and look forward to the opportunities ahead as part of the thriving QFC community. RESONA8 MEDIA Resona8 Media is an established creative media company licensed under both QFC and Media City in Qatar, with a strong international footprint spanning Canada, Turkey, the UAE, and Qatar. Specialising in broadcast graphics, real-time data aggregation, and full-spectrum channel branding, Resona8 offers end-to-end solutions that elevate media production beyond conventional limits. We had the company up and running and operational in less than four weeks. We understand the legal, financial, and organisational aspects of forming a company, and QFC offered all of this with clarity and speed. Elie Abdallah Managing Partner l EM Professional Services Ali Husseini Managing Partner & CTO l Reson8 Media

45 46 LOOKING AHEAD A FUTURE DEFINED BY INNOVATION,SUSTAINABILITY, AND GROWTH QFC enters 2025 marking an exciting new chapter. This year celebrates the financial and business platforms 20th anniversary two decades of cultivating a dynamic, innovative, and globally competitive investment ecosystem in Qatar. This milestone also aligns with QFCs relocation to Lusail City , Qatars emerging smart financial district, positioning it at the centre of a state-of-the-art business hub. These developments signify not just achievement and transition, but a continued evolution towards greater impact and influence. Qatars standing as a premier investment destination continues to gain global confidence, underpinned by its economic resilience, strategic location, and investor-friendly policies. With a clear focus on innovation, sustainability, and economic diversification, QFC aims to harness and promote these strengths to drive progress and foster a thriving market. 46 45