QFC Annual Report 2023 - English

ANNUAL REPORT 2023 PROMOTING QATAR AS A GLOBAL HUB FOR BUSINESS GROWTH

CONTENTS EVENTS A COMMITMENT TO EXCELLENCE Enhancing QFCs Proposition and Servicing Trusted Clients A Platform for Growth Focus on Financial Services Procedural Excellence Enhanced Compliance and Legislation Committed to Fighting Financial Crime and Enhancing Data Protection Placing People at the Heart of Business Success Nurturing New and Existing Talent Innovation in Infrastructure QFC A Brand Worthy of Recognition Clients, Community and Collaboration Relentless Drive SPOTLIGHT ON NEW FIRMS Rasmal Ventures Xiamen Airlines QATAR SCORES ON THE WORLD STAGE TOWARDS CONTINUED GROWTH IN 2024 FOREWORD Chairman Foreword CEO Foreword QFC AT A GLANCE Vision and Mission Board of Directors and Executive Committee QFC Governance Easing Entry into Qatars Business Ecosystem QFC: World-class Benefits Key Milestones 2018-2023 Strategic Vision 2030 2023 IN NUMBERS BROADENING A GLOBAL NETWORK Collaboration Towards Common Goals Enhancing Value for Clients MoUs in Focus STRENGTHENING BILATERAL RELATIONS Delegations and Ambassador Meetings Global Channel Partners

CHAIRMAN MESSAGE H.E. Sheikh Mohammed Bin Hamad Bin Qassim Al-Abdullah Al-Thani I am pleased to witness the Qatar Financial Centre once again showcase its expertise in advancing its strategic goals, aligned with the Qatar National Vision 2030. Building on the momentum of commercial activities and business opportunities following the successful delivery of the FIFA World Cup Qatar 2022, QFC closed 2023 with significant achievements across its operations, leading to substantial growth. Its extensive domestic and international network, a critical factor in driving business and industry growth, has expanded further through partnerships spanning continents and industries, including healthcare, ICT, energy, venture capital, asset management, family office, and other financial services verticals. As part of its strategic plan to position Qatar as a hub for innovation and wealth, QFC launched two major initiatives: the Digital Assets Lab, which included the public consultation for its Digital Assets Regulatory Framework, and the inaugural Family Business Community Retreat, highlighting Qatars strength as a destination for wealth and wealth management among key stakeholders. CEO MESSAGE Yousuf Mohamed Al-Jaida It is a privilege to share with you QFCs 2023 Annual Report, which tells our story of growth and development over a phenomenal year. It will come as no surprise to anyone that we began 2023 on a high, the nation still jubilant after the successful delivery of one of the most iconic football tournaments the world had ever seen. Though a decade in planning, the FIFA World Cup Qatar 2022 TM positively impacted every aspect of our economy and gave us additional opportunities to diversify our economic base beyond hydrocarbons. Building on this momentum, we strengthen or global network, forming partnerships with key markets such as Trkiye, Rwanda, Singapore, Hong Kong, Germany, Canada, and Latin America by signing 18 agreements. The second half of the year proved the effects of the World Cup were not a fleeting triumph, and the country recorded a strong performance with growth rates for output and new businesses remaining well above the six-year trend. Companies continued to point to tourism as spurring growth, and financial services continued to expand sharply. We capitalised on this renewed vigour to create a framework of cooperation focused on developing the financial services industry through shared resources and initiatives. In the fintech sector, QFC established collaboration platforms with key entities from the Middle East, Asia, and Africa. Another key highlight of 2023 was our full calendar of events. We organised as many as 84 events, bringing together business leaders and innovators from across the world to demonstrate first-hand Qatars prowess on the global economic stage whilst also fostering a culture of knowledge exchange and best practice. One of our standout events was the inaugural Family Business Community Retreat, held in collaboration with leading wealth manager Julius Baer. It brought together over 100 of the worlds most distinguished family business leaders for a two-day retreat which explored the latest trends and shifting priorities in global family businesses, emphasising shared responsibility and a sense of duty. And notably, through our global outreach, we concluded the year having successfully onboarded 327 new firms. With eyes fixed firmly on the future, we are on a renewed trajectory of growth, innovation and expansion - one that is underpinned by Qatars keen desire to evolve and embrace all that digital and technological capabilities can provide. Having built such strong foundations, Im incredibly excited to see what we can collectively achieve in 2024. QFC has also made significant strides in enhancing the ease of business incorporation and excelling in service delivery. These strategic efforts have resulted in the continued growth of firms registered under its platform, with 327 new firms added, raising its assets under management to US$ 21.1 billion, an 85% increase from US$ 11.4 billion in 2018. As we look ahead to 2024, I am confident that QFC is well-positioned to further its mission of attracting global corporations and businesses to Qatar, fostering our dynamic and thriving financial ecosystem. EVENTS

VISION Transforming Doha into a leading global financial and commercial capital. MISSION Drive economic development and diversification by providing a world-class, commercial, legal and regulatory environment. QFC AT A GLANCE

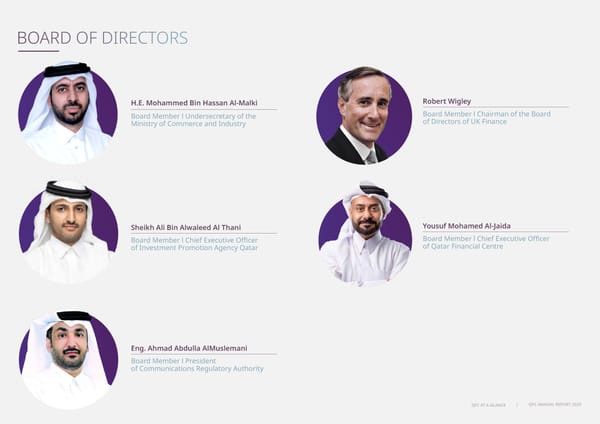

| QFC ANNUAL REPORT 2023 BOARD OF DIRECTORS H.E. Sheikh Mo hamm ed Bin Hamad Bin Qassim Al-Abdullah Al-Thani Chairman l Minister of Commerce and Industry H.E. Akbar Al Baker Board Member l Advisor to H.E. the Prime Minister and Minister of Foreign Affairs of Qatar Bureau H.E. Ahmad Abdulla Ahmad Jassim Al-Jamal Board Member l Chairman of General Authority of Customs Mansoor Bin Ebrahim Al-Mahmoud Board Member l CEO of Qatar Investment Authority H.E. Abdulaziz Bin Nasser Bin Mubarak Al Khalifa Board Member l President of the Civil Service and Government Development Bureau QFC AT A GLANCE

| QFC ANNUAL REPORT 2023 Robert Wigley Board Member l Chairman of the Board of Directors of UK Finance Yousuf Mohamed Al-Jaida Board Member l Chief Executive Officer of Qatar Financial Centre Eng. Ahmad Abdulla AlMuslemani Board Member l President of Communications Regulatory Authority Sheikh Ali Bin Alwaleed Al Thani Board Member l Chief Executive Officer of Investment Promotion Agency Qatar BOARD OF DIRECTORS H.E. Mohammed Bin Hassan Al-Malki Board Member l Undersecretary of the Ministry of Commerce and Industry QFC AT A GLANCE

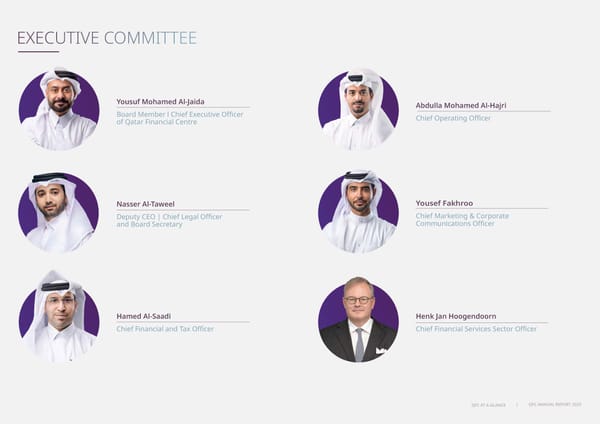

| QFC ANNUAL REPORT 2023 EXECUTIVE COMMITTEE Abdulla Mohamed Al-Hajri Chief Operating Officer Yousuf Mohamed Al-Jaida Board Member l Chief Executive Officer of Qatar Financial Centre Nasser Al-Taweel Deputy CEO | Chief Legal Officer and Board Secretary Hamed Al-Saadi Chief Financial and Tax Officer Yousef Fakhroo Chief Marketing & Corporate Communications Officer Henk Jan Hoogendoorn Chief Financial Services Sector Officer QFC AT A GLANCE

Four independent bodies oversee the QFC ensuring companies under its umbrella enjoy optimal operational, judiciary, and legal support, as well as a business-friendly environment on par with top global standards. Under a firm commitment to drive Qatars economic diversification and promote bilateral trade and investment, QFC provides a world-class platform to domestic and international companies looking to set up operations in Qatar and expand to the region and beyond. As a member of QFCs vibrant community, registered firms gain abundant opportunities for knowledge exchange and partnerships, in addition to a suite of competitive advantages for seamless integration into Qatars business ecosystem. QFC GOVERNANCE EASING ENTRY INTO QATARS BUSINESS ECOSYSTEM 1. The Qatar Financial Centre Authority. 2. Qatar Financial Centre Regulatory Authority. 3. The Civil & Commercial Court of the Qatar Financial Centre. 4. Regulatory Tribunal.

| QFC ANNUAL REPORT 2023 ENGLISH COMMON LAW Companies registered with the QFC are governed by a legal and judicial framework based on English common law, with access to an independent court, regulatory tribunal and dispute-resolution centre. ONSHORE JURISDICTION The QFC is an onshore business and financial centre that licenses companies, allowing them to operate in Qatar and in the region within a legal and tax environment aligned with international standards. 100% FOREIGN OWNERSHIP Companies in the QFC benefit from up to 100 per cent ownership of their business in Qatar COMPETITIVE TAX SYSTEM The QFC offers a fair and transparent tax regime, allowing access to a wide Double Taxation Agreements network with over 80 countries, 10 per cent corporate tax on locally sourced profit, no personal income tax, wealth tax or Zakat, and an efficient advance ruling service. 100 % REPATRIATION OF PROFITS Payments of dividends, interests, royalties, and management fees to recipients outside of Qatar are free from withholding tax, enabling tax-free returns and profit repatriation for shareholders. TAILORED SOLUTIONS Access to a team of experts across disciplines to help tailor product structures and solutions to meet the QFC-registered companys business needs. ONE STOP SHOP A quick and easy set-up process that licenses, establishes, and supports businesses in and from Qatar. TRADE IN ANY CURRENCY Conduct business from Qatar with no restrictions on the currency used for trading. QFC: WORLD-CLASS BENEFITS QFC AT A GLANCE | QFC ANNUAL REPORT 2023

| QFC ANNUAL REPORT 2023 KEY MILESTONES 2018-2023 2019 2021 2023 2018 517 firms registered by the end of 2018. Recognised by the International Swaps and Derivatives Association (ISDA) as an effective netting regime in July 2018. Assets Under Management reached US$ 11.4 billion. QFC Legal team awarded Legal Department of the Year Large Team at the fourth annual Qatar Business Law Forum and Awards. Launched Strategy to 2022 with renewed focus on digital, media, sports and financial services sectors. Investment Promotion Agency of Qatar (IPAQ) launched and registered on the QFC platform. Joined the World Alliance of International Financial Centres, and the Islamic Financial Services Board. Amended Data Protection Regulations and Rules to align with international standards. Opened the Ministry of Justice Real Estate Registration and Authentication office at QFC. Joined the Asian Financial Cooperation Association (AFCA). Issued QFC Real Estate Ownership Regulations 2021. Assets Under Management reached US$ 21.1 billion. Digital Assets Regulatory Framework approved for public consultation. Introduced a new online registrationprocess, streamlining licensing and incorporation of firms in QFC. Hosted inaugural edition of Family Business Community Retreat in collaboration with Julius Baer, bringing together 100+ family business leaders, industry experts from around the world. Launched Digital Assets Lab in alignment with Qatar Central Banks Fintech Strategy, advancing innovation within the financial industry. 2020 US$ 2.77 billion total gross value added by QFC. Unveiled #AccessQatar: QFC Webcast Series, engaging existing and prospective clients, and wider business community amidst COVID-19 pandemic and social distancing measures. Launched the QFC Tech Talk Series, designed to engage Qatars fintech community. Achieved and surpassed target of registering 1,000 firms by 2022. Received the Silver Telly Award 2020 for The Business Trip series - produced in partnership with Bloomberg Media Studios - profiling Qatar as the worlds leading investment destination. Introduced a new policy statement on licensing new international law firms in Qatar. 2022 Exceeded the 2022 target of registering 1,000 firms, achieving a total of 1,550. Launched the QFC Sustainable Sukuk and Bonds Framework - a first in the GCC region. QFC Legal Team won Legal Department of the Year 2022 at the Qatar LexisNexis Business Law Forum. US$ 1.89 BILLION of total gross value added by QFC Employees in the QFC registered entities grew from 2,843 in 2017 to 10,125 by the end of 2022 800 FIRMS registered by the end of the year QFC AT A GLANCE 1,799 FIRMS registered by the end of the year

Building on the successes of the QFC Strategy 2018-2022, QFCs sights are affixed on renewed priorities and focus areas to power Dohas transformation into a premier hub of wealth and innovation by 2030. Global macroeconomic trends in the lead-up to 2030, characterised by increasing demand for digital payments, a stronger focus on sustainability in business and community, and accelerated mobility of skilled talent and private wealth, among others, reveal considerable prospects for QFC. It aspires to build on existing efforts, particularly in the areas of wealth management and digitalisation of finance, to continue being a front-runner in strengthening Qatars financial industry. STRATEGIC VISION 2030 QFCs path to 2030 will be guided by four strategic priorities revolving around attracting wealth to Qatar, developing the local financial services sector, encouraging Foreign Direct Investment (FDI) to Qatar, and increasing customer- centricity, reinforcing Qatars highly welcoming and favourable business and investment environment. As such, QFC envisions evolving into a leading wealth hub serving as a magnet for High-Net-Worth Individual (HNWI) and Ultra-High-Net-Worth-Individual (UHNWI) wealth capital flows, in particular from emerging economies. Further, as an active enabler of the diversification of financial services in Qatar, QFC will utilise every opportunity to cement its new Digital Assets Regime to enable the development of a new sector in Qatar.

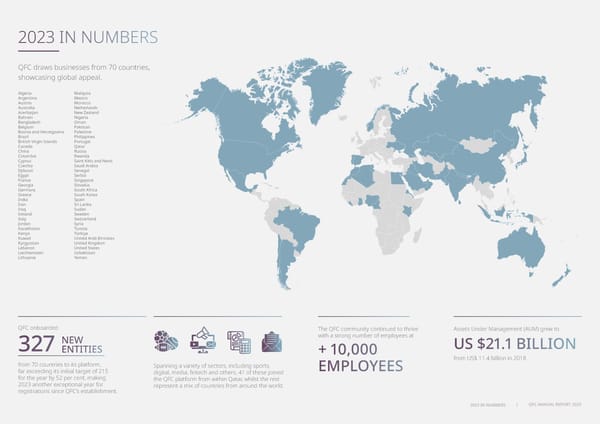

| QFC ANNUAL REPORT 2023 2023 IN NUMBERS Algeria Argentina Austria Australia Azerbaijan Bahrain Bangladesh Belgium Bosnia and Herzegovina Brazil British Virgin Islands Canada China Columbia Cyprus Czechia Djibouti Egypt France Georgia Germany Greece India Iran Iraq Ireland Italy Jordan Kazakhstan Kenya Kuwait Kyrgyzstan Lebanon Liechtenstein Lithuania QFC draws businesses from 70 countries, showcasing global appeal. QFC onboarded 327 from 70 countries to its platform, far exceeding its initial target of 215 for the year by 52 per cent, making 2023 another exceptional year for registrations since QFCs establishment. The QFC community continued to thrive with a strong number of employees at + 10,000 EMPLOYEES Assets Under Management (AUM) grew to US $21.1 BILLION from US$ 11.4 billion in 2018 Spanning a variety of sectors, including sports, digital, media, fintech and others, 41 of these joined the QFC platform from within Qatar, whilst the rest represent a mix of countries from around the world. NEW ENTITIES Malaysia Mexico Morocco Netherlands New Zealand Nigeria Oman Pakistan Palestine Philippines Portugal Qatar Russia Rwanda Saint Kitts and Nevis Saudi Arabia Senegal Serbia Singapore Slovakia South Africa South Korea Spain Sri Lanka Sudan Sweden Switzerland Syria Tunisia Trkiye United Arab Emirates United Kingdom United States Uzbekistan Yemen 2023 IN NUMBERS

| QFC ANNUAL REPORT 2023 BROADENING A GLOBAL NETWORK COLLABORATION TOWARDS COMMON GOALS ENHANCING VALUE FOR CLIENTS QFC worked in coordination with government bodies, ministries and other public sector institutions to finalise a total of 18 Memoranda of Understanding with entities in Qatar as well as in leading economies around the world. QFC continued to expand its strategic partnerships network driven by its focus on delivering excellent service to its community. These partnerships have widened opportunities for knowledge exchange, industry-specific capacity building, increased digital adoption, and enhanced regulatory frameworks, whilst providing impetus for further enterprise within the Qatari market. Strategic alliances were formed with local and international organisations in a wide range of industries, including: Financial Services (11 - Participation Banks Association of Turkiye, R3, Settlemint, MasterCard, Elevandi, Beijing Municipal Financial Regulation Bureau, Labuan IFC, College of Islamic Finance at HBKU, Qatar University, Asian Institute of Digital Finance at National University Singapore, and a joint Memorandum of Collaboration (MoC) with both Qatar Stock Exchange and the Malaysian Rating Corporation Berhad (MARC) Healthcare (2 - Elegancia Healthcare and Droobi) ICT ( 3 - National Cyber Security Agency, Vodafone Qatar, MEEZA) Energy (1 - Summit Oil and Shipping Company Limited) Commercial/Business Services (1 - American Chamber of Commerce) BROADENING A GLOBAL NETWORK | QFC ANNUAL REPORT 2023

This is a modal window.

| QFC ANNUAL REPORT 2023 MoU between QFC and Asian Institute of Digital Finance Building on the ongoing efforts to bolster Qatars financial services sector, the QFC signed an MoU with the AIDF, a research institute of the National University of Singapore (NUS). This strategic alliance aims to propel innovation and promote sustainable development across various fields, including ESG, FinTech, digital assets, Web 3.0, and other emerging technologies. Further to these efforts, both partners will actively facilitate knowledge exchange to advance their common goals. MOUS IN FOCUS MoU between QFC and American Chamber of Commerce The QFC signed a Memorandum of Understanding with the American Chamber of Commerce Qatar (AmCham) on the sidelines of the Fifth Qatar-US Strategic Dialogue in Qatar. Aimed at stimulating increased bilateral trade and investment between Qatar and the US, the MoU will see both parties promote QFC as an ideal financial and business platform for American investments. In addition, the agreement will ensure the provision of essential support to American companies desirous of setting up their business in Qatar. Further to that, QFC and AmCham will organise events and initiatives centred around the trade and investment goals of the partnership. MoU between QFC and College of Islamic Studies, Hamad Bin Khalifa University (HBKU) The promotion of Islamic finance has been high on QFCs agenda throughout 2023. QFC furthers this ambition through an MoU signed with the College of Islamic Studies (CIS) at Hamad Bin Khalifa University (HBKU), renewing their partnership in hosting the International Conference on Islamic Finance (ICIF). Under the agreement, the QFC will sponsor five more editions of the conference from 2023 to 2027 at CIS, opening more opportunities for the two institutions to jointly promote a deeper understanding of Islamic finance and the Shariah law. MoU between QFC and Settlemint QFC signed an MoU with Settlemint, a trusted blockchain technology platform, to collaborate on blockchain and digital asset initiatives. The partnership opens a significant pathway for collaboration between industry leaders, financial institutions, fintech firms, and corporate organisations to spur the adoption of blockchain and digital asset business models and solutions. It represents a step forward in identifying use cases for blockchain technology and digital assets in Qatars financial industry. Through this collaboration, the QFC and SettleMint will help business entities in Qatars financial sector innovate and develop safer and more efficient business practices. MoU with R3 QFC signed an MoU with R3, a leading global provider of enterprise distributed ledger technology (DLT) and services, to accelerate the development of Qatars fintech industry and to promote common interests. Under the partnership, the QFC and R3 will work together to create a potential laboratory environment that caters to commercial banks and fintechs. It also aims to promote education and training on asset digitisation and the use of DLT. Furthermore, the two organisations will also create working groups to observe new and emerging regulatory paradigms and support the QFCs deployment of DLT at a national level. MoU between QFC and Elegancia Healthcare QFC entered into an agreement with Elegancia Healthcare, a subsidiary of Estithmar Holding. The MoU aims to foster collaboration amongst key stakeholders, including public and private entities and academia, to advance innovative healthcare solutions, entrepreneurship and economic growth and build a supportive ecosystem for start-ups and small businesses within the healthcare sector.

| QFC ANNUAL REPORT 2023 STRENGTHENING BILATERAL RELATIONS As a platform dedicated to showcasing business and investment opportunities within Qatars promising market, QFC is heavily invested in consolidating the nations bilateral ties with key economies globally. This ambition continued to reflect in its efforts to welcome several ambassadors and high-profile delegations at its offices throughout 2023. QFC welcomed over 30 delegations from countries including China, France, Russia, Saudi Arabia, Singapore, South Korea, Trkiye and the United States. QFC also hosted the ambassadors of Austria, Australia, the Czech Republic, France, Poland, Portugal, Sweden, Portugal and Tajikistan to Qatar. DELEGATIONS AND AMBASSADOR MEETINGS GLOBAL CHANNEL PARTNERS Expanding global connections and fortifying relationships with existing channel partners remained at the top of QFCs agenda throughout 2023. Eleven new partnerships were established in key regions across the globe, bolstering QFCs leading role in nurturing alliances locally and internationally. Some of these include Enterprise Singapore, HK Trade and Development Council, Institute for Information Industry, Taiwan, Malaysia Digital Economy Corporation, Canada Arab Business Council, and German BVMW. BROADENING A GLOBAL NETWORK

This is a modal window.

| QFC ANNUAL REPORT 2023 EVENTS Engaging thought leaders, key entities and stakeholders within the finance and investment space remained at the top of QFCs priorities during 2023. Through a broad line-up of events, reaching a total of 84 by the end of the year, QFC created avenues for its community to forge vital industry connections, expand knowledge around the latest trends and insights, and explore collaboration prospects to bolster Qatars thriving business ecosystem and aid the development of Qatars knowledge-based economy. In addition, with its keen participation in international forums and gatherings, the QFC pressed forward on its endeavours to showcase Qatars attractiveness as a world-class destination for business and investment. 31 - Hosted. 29 - Speaking Engagements. 11 - Sponsored. 13 - Attended/Participated in. QFC significantly enhanced its presence at prestigious global events such as the World Economic Forum meetings, Web Summit in Lisbon, COP28 UN Climate Change Conference in Dubai, and the Singapore Fintech Festival. QFC delegations actively participated in several important industry events across the globe. Some of the standout gatherings comprise Capital Markets & ESG Finance Saudi Arabia Awards, UK City Week 2023, Astana Finance Day in Kazakhstan, Asia Capital Insurance Conference in Malaysia, China International Fair for Investment and Trade 2023, where QFC joined the Qatari delegation together with MOCI and other national entities. On the national front, QFC participated in the 7th CEOs and Islamic Finance Leaders Roundtable that explored Qatars economic growth post-World Cup and national initiatives to foster innovation, expand access to finance, and promote sustainable banking practices. The Pakistan-Qatar Tech Conference and the Doha Forum 2023 were some other notable Qatar-based events in which QFC played a pivotal role through participation and protocol arrangements. Additionally, QFC keenly participated in the Qatar Economic Forum 2023, where it signed MoUs with Labuan IBFC and MasterCard. QFC sponsored and took part in the first-ever Islamic Finance News (IFN) Qatar Dialogues that featured detailed discussions on key Islamic finance topics. The event leveraged IFNs position as the industrys leading capital markets-focused journal, providing unrivalled editorial coverage of the global Sharia-compliant financing market to over 20,000 industry leaders and decision-makers. QFC also sponsored the 6th International Conference on Islamic Finance, engaging scholars, researchers, and practitioners in discussions on an array of topics, such as the role of Islamic Finance in tackling environmental challenges and the importance of integrating emerging technologies with Islamic Finance to develop innovative solutions to challenges. One of the most significant events in the QFCs calendar was the launch of the QFC Digital Assets Lab, solidifying its foremost role in achieving the aspirations around financial innovation in line with Qatars Fintech Strategy. The event brought together notable dignitaries, including the Minister of Commerce and Industry, and the Governor of the Qatar Central Bank. QFC, together with Bloomberg Intelligence, organised the Qatar Financial Markets Forum convening economists, banking experts, and industry leaders. Held under the theme From Sustainable Financing to Debt Capital Markets, Uncovering Solutions for the Future of Banking in Qatar, the forum fostered discussions on Qatars banking funding landscape and delved into strategies for the sustainable and inclusive growth of the financial industry. A Talk Digital Assets session was held to enrich participants understanding of the digital assets ecosystem and underlying technology that enables the transition to the digital world of financial services. The session spotlighted various use cases and implementations of digital assets across industries, economics, finance, and the global regulatory landscape. QFC also hosted the Regulators and Regulatory Landscape for Digital Assets in the Middle East workshop to provide valuable insights into the regulatory environment surrounding digital assets and its impact on the financial sector. | QFC ANNUAL REPORT 2023 EVENTS

This is a modal window.

A COMMITMENT TO EXCELLENCE Guided by its mandate to consolidate Qatars profile as a destination of choice for global businesses and investors, QFC intensified efforts to enhance service delivery and operational processes across all QFC functions. Its dedicated teams worked hand-in-hand internally, as well as with external entities, creating a seamless and robust environment for QFC clients and partners. The year began with QFC teams enhancing client interactions significantly. The QFC proudly served over 18,000 prospects face-to-face, and efficiently processed more than 17,000 service requests including visa assistance, labour approvals, and more, achieving an impressive 98.6% processing rate within the SLA timeline. QFCs dedication resonated through its bustling call centres, handling nearly 21,000 calls and responding to about 22,000 emails with diligence and care. Innovation took centre stage with the introduction of AskQFC, a chatbot that A PLATFORM FOR GROWTH FOCUS ON FINANCIAL SERVICES quickly became a crucial resource for clients seeking information, offering answers to FAQs at their fingertips. QFC also revamped its client affairs newsletter, providing valuable insights and updates, fostering stronger community engagement. A major stride in enhancing QFCs service delivery was the introduction of the VIP Onboarding Service. This service, designed to provide a seamless and personalised experience, offers new applicants access to a dedicated VIP relationship manager, ensuring a unique and smooth transition into QFCs ecosystem. ENHANCING QFCS PROPOSITION AND SERVICING TRUSTED CLIENTS QFCs reputation as a dynamic financial and business hub was further solidified with the addition of 327 new firms, including 25 Special Purpose Companies (SPCs), which marked a 19 per cent increase from the previous year. These entities are exclusively dedicated to commodity trading, including a number of industry giants, with projections indicating significant tax revenue growth for QFC in the coming years. Over 50 businesses from the digital sector and several others operating within the investment services, fintech, sports, and media were incorporated, representing Qatars innate ability to attract new tech talent to the region. Across the sphere of financial services, one of QFCs most notable feats was drafting and submitting the Digital Assets Regulatory Framework for public consultation in 2023. In tandem, QFC collaborated with multiple global partners, including banks, fintechs, technology companies, and technology infrastructure providers, to establish a first-of-its-kind Digital Assets Lab in Qatar. These initiatives represent a crucial step, forward in developing the countrys digital assets industry. It feeds into the nations growing appetite for digital innovation encapsulated within its strategic priorities for 2030. QFC continued to participate in, and contribute to, The Capital Markets Development Executive Action Plan, as well as the Executive Action Plan for the Development of Financial Sector, tasked with multiple action areas, including debt capital markets, asset management and Islamic finance. QFC also combined efforts with Qatar Central Bank as part of a task force to review new fintech applications, challenges and strategic initiatives. PROCEDURAL EXCELLENCE As part of QFCs ongoing endeavour to ease the process of firms incorporation within Qatars business ecosystem, it initiated significant work towards creating policies and procedures for conditional licensing for non-regulated fintechs, which it will continue working on through 2024.

EVENTS ENHANCED COMPLIANCE AND LEGISLATION Legislative enhancements were front and centre on QFCs agenda throughout 2023. As part of these developments, the organisation published new Non-Regulated Activities Rules that contain an extensive list of permitted activities that may be conducted in or from the QFC. Another landmark achievement was the launch of QFCs new online company incorporation process, enabling applicants to incorporate a company within QFC instantly. QFC witnessed a significant increase in voluntary tax compliance, with tax revenue from non- regulated firms steadily growing. Updates to the QFC Tax Regime ensured a fair, transparent, and efficient tax system aligned with global standards. Moreover, QFC made significant contributions to the design and implementation of a compliance framework for the Common Reporting Standard (CRS) in Qatar, working closely with the Government Tax Authority (GTA) and financial sector supervisory bodies. This was a pivotal step in securing Qatar a positive outcome in the Organisation for Economic Cooperation and Development (OECD) Global Forums assessment of the countrys CRS implementation. COMMITTED TO FIGHTING FINANCIAL CRIME AND ENHANCING DATA PROTECTION QFCs ability and expertise were further utilised in the ongoing monitoring of Qatars Anti- Money Laundering and Combating the Finance of Terrorism (AML/CFT) regime as part of its coordination with Qatars National Anti-Money Laundering Committee (NAMLC).To strengthen data privacy and protection, QFC updated its Data Protection Regulations and Rules and made enhancements to the Data Subject rights of erasure and rectification to align with the new international data transfer mechanisms, including the use of binding corporate rules and its digital assets initiative. Additionally, QFC issued documents to incorporated firms detailing supervisor priorities and compliance focus areas during the year and in 2024. An updated fact sheet was also released to provide quick and easy access to the main provisions of the Regulations. QFCs ability and expertise were further utilised in the ongoing monitoring of Qatars Anti-Money Laundering and Combating the Finance of Terrorism (AML/CFT) regime as part of its coordination with Qatars National Anti-Money Laundering Committee (NAMLC). To strengthen data privacy and protection, QFC updated its Data Protection Regulations and Rules and made enhancements to the Data Subject rights of erasure and rectification to align with the new international data transfer mechanisms, including the use of binding corporate rules and its digital assets initiative. Additionally, QFC issued documents to incorporated firms detailing supervisor priorities and compliance focus areas during the year and in 2024. An updated fact sheet was also released to provide quick and easy access to the main provisions of the Regulations. QFC also issued an Oversight & Regulatory Action Framework focused on its authority to oversee non-compliance with the Regulations, in addition to a self-assessment tool to help firms monitor their compliance with the Regulations and identify areas of improvement. Furthermore, QFC renewed its membership with the Global Privacy Assembly (Observer) and Global Privacy Enforcement Network, reaffirming its commitment to adopting internationally acknowledged best practices and enforcement initiatives in data protection. PLACING PEOPLE AT THE HEART OF BUSINESS SUCCESS QFC prioritises adherence to Environmental, Social, and Governance (ESG) standards. Recognising human capital as a core asset for any business, it fosters sound, healthy, and inclusive workplaces among its firms, unlocking talent, maximising employee potential and optimising business outcomes. Advisory services were provided to QFC firms to raise awareness of employment standards and enhance compliance, minimising disputes and reducing legal costs the firms would otherwise incur. The frequency of monitoring activities and labour inspections was increased, resulting in the early identification of non-compliance incidents, which were promptly resolved without resorting to formal enforcement. QFCs mediation and conciliation services reaped positive outcomes, with all 41 grievances received resolved outside of court without requiring adjudication. As a proponent of the United Nations Sustainable Development Goals (SDGs), QFC persisted in its partnerships with the International Labour Organisation (ILO), World Health Organisation (WHO), EU Delegation in the State of Qatar, the Ministry of Labour, and many other national and international institutes to optimise its efforts in human development and initiatives to accelerate Qatars transition into a knowledge- based economy by 2030. Significantly, QFC established a task force of experts to review and update its employment framework, taking into consideration the prominent changes in the world of work over the past 10 years. Moreover, QFC implemented several management and quality enhancements to improve its human capital function. These included streamlining internal processes, updating systems and reporting line mechanisms and enhancing the efficiency of communicating with employees.

| QFC ANNUAL REPORT 2023 NURTURING NEW AND EXISTING TALENT To ensure the competitiveness of its talent community, QFC launched its Talent and Performance Management project that saw the completion of a Core Values, Behavioral, and Technical Competency Framework, a review of INNOVATION IN INFRASTRUCTURE QFC laid greater emphasis on innovation, modernisation, and automation across its IT services and infrastructure throughout 2023. QFCs IT infrastructure saw significant advancements with a successful cloud migration and the integration of cutting-edge security services, enhancing security measures and threat detection capabilities. Other milestones in 2023 include achieving an SLA compliance of 99.78 per cent vs its KPI of 95 per cent, IT service availability of 99.99 per cent vs the KPI of 99.98 per cent, and customer satisfaction feedback of 99.5 per cent vs the KPI of 90 per cent. QFCs Performance Management Framework, as well as its Graduate Developer and Internship Development Program, and alignment of the QFC Employee Value Proposition Report with the QFC strategy 2023-2030. QFC - A BRAND WORTHY OF RECOGNITION Over the course of the year, QFC took considerable steps towards raising its brand visibility and attractiveness. The culmination of these efforts was seen in a substantial surge in QFCs social media audience size, marking an impressive 225.5 per cent increase in contrast to the audience growth recorded in previous years. A combination of media engagements through various channels enabled the QFC to secure a media reach of 188 million. Broadening its online presence, the QFC also added a new dimension to its social media strategy with the launch of QFCs own TikTok channel. CLIENTS, COMMUNITY AND COLLABORATION QFC reaffirmed its commitment to positively impact the community and promote financial well-being and awareness amongst key segments of society, particularly the youth. Extending efforts under the QFC social investment programme that hinges upon three key pillars - Financial Literacy, Youth Empowerment, and Sustainability, the QFC- led initiatives such as the Kawader Malia Sponsorship, a three-month development programme designed for fresh Qatari graduates poised to enter the financial industry. The programme equips participants with essential skills and practical knowledge to bridge performance gaps between academic and professional practices.In collaboration with Teach for Qatar, QFC maintained its sponsorship of the 3yalna programme that draws attention to students with outstanding skills in various fields, including academics and art, and those making notable contributions to innovation and the community in general. The programme seeks to further develop the skills of these students and empower them to broaden their impact on society. RELENTLESS DRIVE The story of QFC is one of continuous innovation and dedication to excellence. Each stride it has taken is woven into the broader narrative of its commitment to not just meet but also exceed the expectations of QFC clients and contribute to the sustainable development of Qatars economy. The journey continues, and QFC is excited about what the future holds as it keeps building on this foundation of success. EVENTS

SPOTLIGHT ON NEW FIRMS QFCs platform became the pathway for Rasmal Ventures LLC, Qatars first independent venture capital company, to set up and initiate its operations in the region in 2023. Led by a team of seasoned venture capital experts, Rasmal Ventures aspires to leverage the combined experience of its team of seasoned venture capital experts to actively contribute to the regions burgeoning startup and innovation ecosystem. Rasmal Ventures on leveraging QFCs offering: Whilst we recognised the strength of the Qatari ecosystem based on the experiences of one of our local partners, choosing QFC as an entry point into the region proved to be a pivotal decision. Of course, at the top of our considerations was ensuring a seamless and successful path for our establishment. The QFC teams meticulous support and open communication especially stood out during the regulatory assessments and review of Rasmal Ventures. Even beyond incorporation, we were pleased with the collaboration prospects available to us as part of the local ecosystem. Over the course of the next six months, we forged a great working relationship with not just QFC but also key stakeholders in Qatar Xiamen Airlines on joining QFCs platform: We are pleased with our decision to have joined QFCs platform as our first step into the region. One of the most notable parts of our integration into the market here was the simplified company registration process we went through with QFC. We also appreciate the opportunities made available to us as part of the QFC community in terms of personnel recruitment, business development and business exchanges. Since Xiamen Airlines incorporation within QFC, the airline has opened two routes - Beijing-Doha and Xiamen-Doha, with a frequency of nine flights per week. and across the region. We worked closely with Qatari private investors, institutions as well as the QFCRA to lay the groundwork for the unveiling of the first Rasmal Innovation Fund that will be a landmark initiative aiming to reach USD$100 million in investment commitments. The fund will target investments in innovative and high-performance technology startups and scaleups in Qatar, the wider MENA region, and internationally at pre-Series A, Series A, and Series B stages. It will consider all technology sectors, but maintain strategic interest in climate and energy tech, fintech, supply chain logistics, B2B SaaS and Artificial Intelligence (AI). This initiative is in perfect alignment with national priorities focused on the creation of a buoyant tech ecosystem. Xiamen Airlines, established in 1984, is headquartered in Xiamen, a coastal city in southeastern Chinas Fujian Province. It is the first airline in China to operate under the modern enterprise system. Currently, Xiamen Airlines has a fleet of 211 aircraft and operates over 400 domestic and international routes. The airline serves nearly 40 million passengers annually, and more than 23 million people have joined its frequent flyer program. Among the more than 270 member airlines of the International Air Transport Association (IATA), Xiamen Airlines ranks among the top 30 in terms of revenue and among the top 13 in terms of passenger turnover. 2023 also saw Xiamen Airlines, one of Chinas top-ranked airlines, choose QFC as its gateway into the region. Becoming the first Chinese airline to operate passenger nonstop flights between Mainland China and Qatar (under a codeshare agreement with Qatar Airways), entering Qatars market allowed Xiamen Airlines to expand its route network, reaching 110 countries and 332 overseas destinations. Qatars strategic location at the crossroads between the East and West as well as its centrality in the GCC region, coupled with a robust business environment, strong economy, and political stability, were among the top reasons for Xiamen Airlines decision to establish its operational base in Qatar.

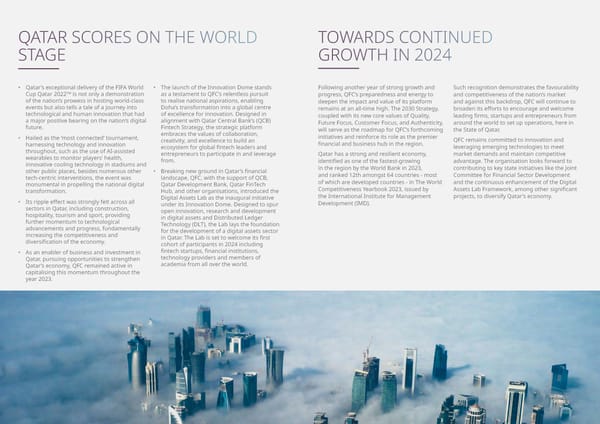

| QFC ANNUAL REPORT 2023 QATAR SCORES ON THE WORLD STAGE Qatars exceptional delivery of the FIFA World Cup Qatar 2022 TM is not only a demonstration of the nations prowess in hosting world-class events but also tells a tale of a journey into technological and human innovation that had a major positive bearing on the nations digital future. Hailed as the most connected tournament, harnessing technology and innovation throughout, such as the use of AI-assisted wearables to monitor players health, innovative cooling technology in stadiums and other public places, besides numerous other tech-centric interventions, the event was monumental in propelling the national digital transformation. Its ripple effect was strongly felt across all sectors in Qatar, including construction, hospitality, tourism and sport, providing further momentum to technological advancements and progress, fundamentally increasing the competitiveness and diversification of the economy. As an enabler of business and investment in Qatar, pursuing opportunities to strengthen Qatars economy, QFC remained active in capitalising this momentum throughout the year 2023. The launch of the Innovation Dome stands as a testament to QFCs relentless pursuit to realise national aspirations, enabling Dohas transformation into a global centre of excellence for innovation. Designed in alignment with Qatar Central Banks (QCB) Fintech Strategy, the strategic platform embraces the values of collaboration, creativity, and excellence to build an ecosystem for global fintech leaders and entrepreneurs to participate in and leverage from. Breaking new ground in Qatars financial landscape, QFC, with the support of QCB, Qatar Development Bank, Qatar FinTech Hub, and other organisations, introduced the Digital Assets Lab as the inaugural initiative under its Innovation Dome. Designed to spur open innovation, research and development in digital assets and Distributed Ledger Technology (DLT), the Lab lays the foundation for the development of a digital assets sector in Qatar. The Lab is set to welcome its first cohort of participants in 2024 including fintech startups, financial institutions, technology providers and members of academia from all over the world. TOWARDS CONTINUED GROWTH IN 2024 Following another year of strong growth and progress, QFCs preparedness and energy to deepen the impact and value of its platform remains at an all-time high. The 2030 Strategy, coupled with its new core values of Quality, Future Focus, Customer Focus, and Authenticity, will serve as the roadmap for QFCs forthcoming initiatives and reinforce its role as the premier financial and business hub in the region. Qatar has a strong and resilient economy, identified as one of the fastest-growing in the region by the World Bank in 2023, and ranked 12th amongst 64 countries - most of which are developed countries - in The World Competitiveness Yearbook 2023, issued by the International Institute for Management Development (IMD). Such recognition demonstrates the favourability and competitiveness of the nations market and against this backdrop, QFC will continue to broaden its efforts to encourage and welcome leading firms, startups and entrepreneurs from around the world to set up operations, here in the State of Qatar. QFC remains committed to innovation and leveraging emerging technologies to meet market demands and maintain competitive advantage. The organisation looks forward to contributing to key state initiatives like the Joint Committee for Financial Sector Development and the continuous enhancement of the Digital Assets Lab Framework, among other significant projects, to diversify Qatars economy. TOWARDS CONTINUED GROWTH IN 2024 | QFC ANNUAL REPORT 2023