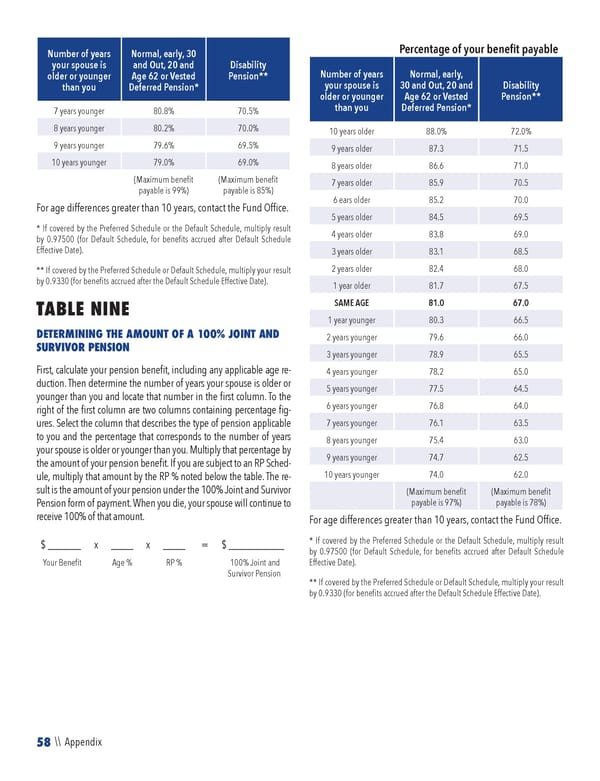

58 \\ Appendix Number of years your spouse is older or younger than you Normal, early, 30 and Out, 20 and Age 62 or Vested Deferred Pension* Disability Pension** 7 years younger 80.8% 70.5% 8 years younger 80.2% 70.0% 9 years younger 79.6% 69.5% 10 years younger 79.0% 69.0% (Maximum benefit payable is 99%) (Maximum benefit payable is 85%) For age differences greater than 10 years, contact the Fund Office. * If covered by the Preferred Schedule or the Default Schedule, multiply result by 0.97500 (for Default Schedule, for benefits accrued after Default Schedule Effective Date). ** If covered by the Preferred Schedule or Default Schedule, multiply your result by 0.9330 (for benefits accrued after the Default Schedule Effective Date). TABLE NINE DETERMINING THE AMOUNT OF A 100% JOINT AND SURVIVOR PENSION First, calculate your pension benefit, including any applicable age re- duction. Then determine the number of years your spouse is older or younger than you and locate that number in the first column. To the right of the first column are two columns containing percentage fig- ures. Select the column that describes the type of pension applicable to you and the percentage that corresponds to the number of years your spouse is older or younger than you. Multiply that percentage by the amount of your pension benefit. If you are subject to an RP Sched- ule, multiply that amount by the RP % noted below the table. The re- sult is the amount of your pension under the 100% Joint and Survivor Pension form of payment. When you die, your spouse will continue to receive 100% of that amount. $ __ ____ x ____ x ____ = $ __________ Your Benefit Age % RP % 100% Joint and Survivor Pension Percentage of your benefit payable Number of years your spouse is older or younger than you Normal, early, 30 and Out, 20 and Age 62 or Vested Deferred Pension* Disability Pension** 10 years older 88.0% 72.0% 9 years older 87.3 71.5 8 years older 86.6 71.0 7 years older 85.9 70.5 6 ears older 85.2 70.0 5 years older 84.5 69.5 4 years older 83.8 69.0 3 years older 83.1 68.5 2 years older 82.4 68.0 1 year older 81.7 67.5 SAME AGE 81.0 67.0 1 year younger 80.3 66.5 2 years younger 79.6 66.0 3 years younger 78.9 65.5 4 years younger 78.2 65.0 5 years younger 77.5 64.5 6 years younger 76.8 64.0 7 years younger 76.1 63.5 8 years younger 75.4 63.0 9 years younger 74.7 62.5 10 years younger 74.0 62.0 (Maximum benefit payable is 97%) (Maximum benefit payable is 78%) For age differences greater than 10 years, contact the Fund Office. * If covered by the Preferred Schedule or the Default Schedule, multiply result by 0.97500 (for Default Schedule, for benefits accrued after Default Schedule Effective Date). ** If covered by the Preferred Schedule or Default Schedule, multiply your result by 0.9330 (for benefits accrued after the Default Schedule Effective Date).

2023 NPF Summary Plan Description Page 59 Page 61

2023 NPF Summary Plan Description Page 59 Page 61