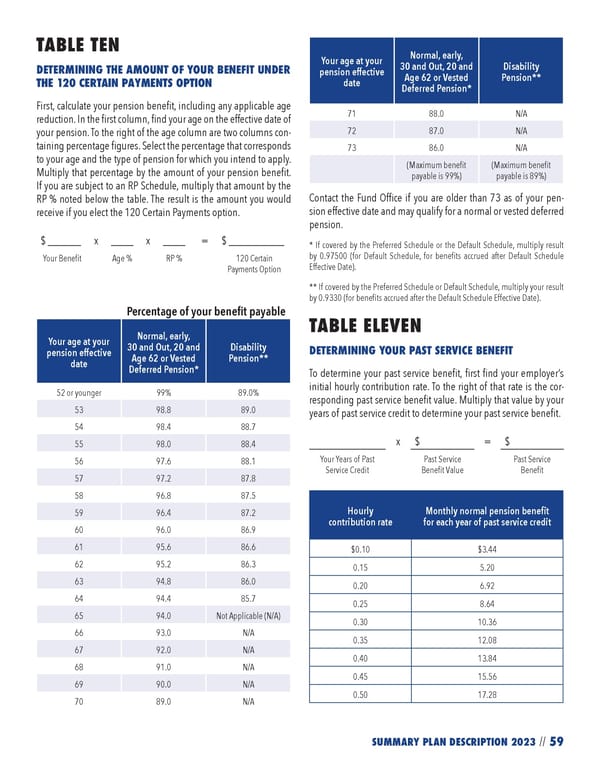

59 SUMMARY PLAN DESCRIPTION 2023 // TABLE TEN DETERMINING THE AMOUNT OF YOUR BENEFIT UNDER THE 120 CERTAIN PAYMENTS OPTION First, calculate your pension benefit, including any applicable age reduction. In the first column, find your age on the effective date of your pension. To the right of the age column are two columns con- taining percentage figures. Select the percentage that corresponds to your age and the type of pension for which you intend to apply. Multiply that percentage by the amount of your pension benefit. If you are subject to an RP Schedule, multiply that amount by the RP % noted below the table. The result is the amount you would receive if you elect the 120 Certain Payments option. $ __ ____ x ____ x ____ = $ __________ Your Benefit Age % RP % 120 Certain Payments Option Percentage of your benefit payable Your age at your pension effective date Normal, early, 30 and Out, 20 and Age 62 or Vested Deferred Pension* Disability Pension** 52 or younger 99% 89.0% 53 98.8 89.0 54 98.4 88.7 55 98.0 88.4 56 97.6 88.1 57 97.2 87.8 58 96.8 87.5 59 96.4 87.2 60 96.0 86.9 61 95.6 86.6 62 95.2 86.3 63 94.8 86.0 64 94.4 85.7 65 94.0 Not Applicable (N/A) 66 93.0 N/A 67 92.0 N/A 68 91.0 N/A 69 90.0 N/A 70 89.0 N/A Your age at your pension effective date Normal, early, 30 and Out, 20 and Age 62 or Vested Deferred Pension* Disability Pension** 71 88.0 N/A 72 87.0 N/A 73 86.0 N/A (Maximum benefit payable is 99%) (Maximum benefit payable is 89%) Contact the Fund Office if you are older than 73 as of your pen- sion effective date and may qualify for a normal or vested deferred pension. * If covered by the Preferred Schedule or the Default Schedule, multiply result by 0.97500 (for Default Schedule, for benefits accrued after Default Schedule Effective Date). ** If covered by the Preferred Schedule or Default Schedule, multiply your result by 0.9330 (for benefits accrued after the Default Schedule Effective Date). TABLE ELEVEN DETERMINING YOUR PAST SERVICE BENEFIT To determine your past service benefit, first find your employer’s initial hourly contribution rate. To the right of that rate is the cor- responding past service benefit value. Multiply that value by your years of past service credit to determine your past service benefit. x $ = $ Your Years of Past Service Credit Past Service Benefit Value Past Service Benefit Hourly contribution rate Monthly normal pension benefit for each year of past service credit $0.10 $3.44 0.15 5.20 0.20 6.92 0.25 8.64 0.30 10.36 0.35 12.08 0.40 13.84 0.45 15.56 0.50 17.28

2023 NPF Summary Plan Description Page 60 Page 62

2023 NPF Summary Plan Description Page 60 Page 62