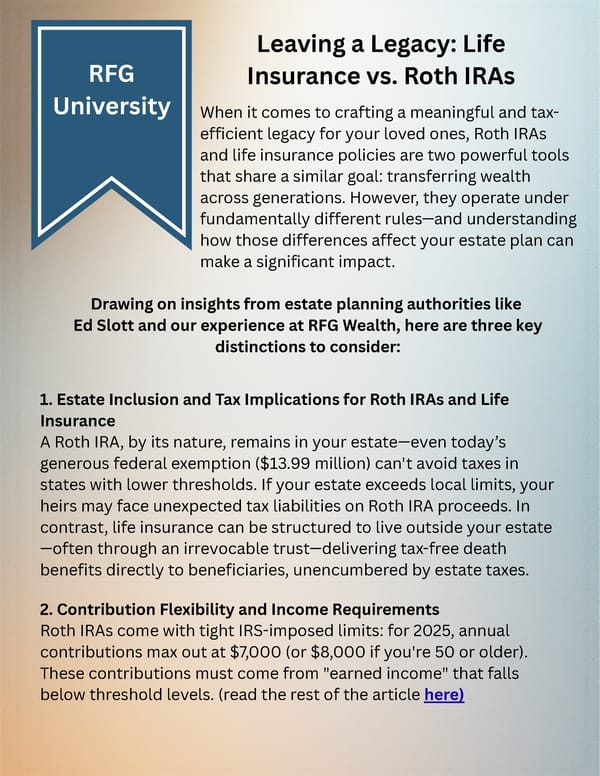

RFG University Leaving a Legacy: Life Insurance vs. Roth IRAs When it comes to crafting a meaningful and tax- efficient legacy for your loved ones, Roth IRAs and life insurance policies are two powerful tools that share a similar goal: transferring wealth across generations. However, they operate under fundamentally different rules—and understanding how those differences affect your estate plan can make a significant impact. Drawing on insights from estate planning authorities like Ed Slott and our experience at RFG Wealth, here are three key distinctions to consider: 1. Estate Inclusion and Tax Implications for Roth IRAs and Life Insurance A Roth IRA, by its nature, remains in your estate—even today’s generous federal exemption ($13.99 million) can't avoid taxes in states with lower thresholds. If your estate exceeds local limits, your heirs may face unexpected tax liabilities on Roth IRA proceeds. In contrast, life insurance can be structured to live outside your estate —often through an irrevocable trust—delivering tax-free death benefits directly to beneficiaries, unencumbered by estate taxes. 2. Contribution Flexibility and Income Requirements Roth IRAs come with tight IRS-imposed limits: for 2025, annual contributions max out at $7,000 (or $8,000 if you're 50 or older). These contributions must come from "earned income" that falls below threshold levels. (read the rest of the article here)

TEAM NEWS - RFG Wealth Advisory Fall 2025 Page 4 Page 6

TEAM NEWS - RFG Wealth Advisory Fall 2025 Page 4 Page 6