Journey to Retirement Microsite

NAVIGATING THE WAY 07 Preventive Care: Keeping Your Health Afloat 08 Staying the Charted Course: A Retirement Readiness Routine Maintenance Plan 09 Bridging the Gap: Income Security in Retirement SEARCHING FOR A LIGHTHOUSE 10 Beyond Retirement: Benefits for Your Survivor(s) 11 Safeguarding Your Personal Assets: Cybersecurity & You 12 Top Five Risks Rocking the Boat to Retirement Readiness DISCOVERING NEW LAND 14 Freedom & Fun in Retirement: Current Trends for Age 50-Plus CONTENTS PAGE 03: SETTING SAIL 2010 2020

IAM National Pension Fund Trustees Union STEVE GALLOWAY Co-Chairman BRIAN BRYANT DORA CERVANTES RICKEY WALLACE Employer JUSTIN WELNER Co-Chairman ANDY CHEN KELVIN JONES JIM MCGRATH IAM National 401(k) Fund Trustees Union RICKEY WALLACE Co-Chairman DORA CERVANTES STEVE GALLOWAY Employer JUSTIN WELNER Co-Chairman JADE BADER JIM MCGRATH National IAM Benefit Trust Fund Union DORA CERVANTES Co-Chairman STEVE GALLOWAY RICKEY WALLACE Employer THOMAS MITCHELL Co-Chairman AMY KEHOE MARIE UNDERWOOD IAM National Benefit Funds Office Executive Leadership Team Executive Director, RYK TIERNEY General Counsel, RAYMOND GOAD Chief of Staff, WENDY FRYE Director, National IAM Benefit Trust Fund, KAREN BROWN Director, Operations, ANGELA CURSEEN Director, 401(k) and Communications, ADINA DORCH Director, Information Technology, RON NOVAK Director, Accounting & Finance, JONATHAN YOUNG Writing, Editing, & Creative Design Director, 401(k) and Communications, ADINA DORCH Senior Graphic Designer, ERICKA MILLS Contributor, JAMES MARTIN Printing Doyle Printing & Communications Special Thanks To our former trustees and their contribution to the IAM National Benefit Funds. JOURNEY TO RETIREMENT OCTOBER 2022 02 Magazine Disclaimer The contents of this publication are for general information only and are believed to be accurate and reliable as of the publication date but may be subject to change. The IAM National Benefit Funds Office does not provide investment, tax, or legal advice. Please consult your own independent advisor as to any investment, tax, or legal statements made here. You are strongly encouraged to consult with your independent tax or legal adviser if you have any questions related to your specific circumstances.

03 Ryen, a high school graduate who recently completed his apprenticeship with a lead - ing engineering company, is now a full-time machinist eligible to receive retirement benefits that his union, the International Asso - ciation of Machinists and Aerospace Workers, and employer have negotiated especially for machinists like him under a collective bar - gaining agreement (“CBA”). The CBA includes benefits options available under the IAM National Pension Fund and the IAM National 401(k) Fund. With Ryen just starting on his retirement journey, understanding the ben - efit options available under each of the Funds allows him to set his retirement savings goals early and watch them grow over the course of his career. Both the Pension Fund and the 401(k) Fund allow for money to be set aside for retire - ment on a tax-advantaged basis, meaning that contributions and earnings to these Funds are allowed to grow tax-free until they are withdrawn, as governed by federal regulations. The Pension Fund is a multiem - ployer defined benefit plan funded entirely by employer contributions negotiated under a CBA, plus investment income. Ryen is not allowed to make any contributions to the Pen - sion Fund and is not responsible for making any decisions about how those employer con - tributions are invested. As a participant in the Pension Fund, once Ryen meets the require - ments for a pension, when he retires, he will be eligible to receive a retirement benefit, typi - cally paid monthly. By contrast, the 401(k) Fund is a multiemployer defined contribution plan funded by both employer and employee contributions. Ryen may elect to have con - tributions deducted from his paycheck on a pre-tax and after-tax basis, as well as choose where those contributions are invested from among several investment options the 401(k) Fund makes available. Along with Social Security and personal savings — such as through the 401(k) Fund — the Pension Fund offers Ryen a valuable retirement income source for years to come. AN EARLY STA RT: RYEN’S STORY

Like many “Gen Xers”, Debra, a 45-year-old aviation journeyman, has been steadily striving to achieve financial security. While Debra has remained gainfully employed over the years, the burst of the dot.com bubble and the Great Recession in the early 2000s resulted in periods of lagging salary increases and limited opportunities for promotion. A participant in the IAM National Pension Fund, Debra is looking forward to col - lecting a retirement benefit after 25 years of service but knows that her monthly benefit will not be enough for her to maintain her current standard of living in retirement. With mount - ing student loans and credit card debt, plus saving for a daughter off to college in a year, Debra is searching for a way to continue to meet her current living expenses without sacrificing her retirement savings goals. With 20 years or more to go, now is the perfect time for Debra to make slight adjustments to her retirement sav- ings plan to ensure her personal savings goals keep pace throughout her retirement journey. The IAM National 401(k) Fund is a valuable per - sonal savings tool that can be used as a primary retirement savings vehicle or as a supplement to a retirement benefit under the Pension Fund. Debra may elect to have a percentage of her compensation automatically deducted from her paycheck and contributed to the 401(k) Fund before federal income taxes are with- held. We think of these automatic deductions as paying your future self, first! Making pre-tax contributions to the 401(k) Fund could lower Debra’s taxable income and allow her to take advantage of compounding interest. Generally, “compound interest” allows your retirement savings to grow faster because, for each year that your contributions are invested in the 401(k) Fund, you can earn additional interest on any interest earned in the previous year. As a result, the interest continues to compound each year. If Debra elects to have a percentage of her pay automatically deducted and deferred into the 401(k) Fund today and continues to make small percentage increases annually, her investment elections * plus compounding inter- est, subject to earnings and losses, over the next 20 years could allow Debra to comfortably save tens of thousands of dollars more toward her retirement savings goals without significantly impacting her current quality of life. *Past performance is no guarantee of future results. SETTING SAIL SHIFTING DIRECTION: DEBRA’S STORY JOURNEY TO RETIREMENT OCTOBER 2022 04 “I WANT TO SAVE MORE FOR A COMFORTABLE RETIREMENT.”

WEALTH IN HEALTH: AMAR’S STORY After 28 years as a bus driver for a national transportation company, last year Amar was diagnosed with a rare debilitating illness. His extensive treat - ment program requires him to take daily prescription medications most of which are covered by the National IAM Benefit Trust Fund’s prescription drug program with CVS Caremark. However, Amar also requires certain specialty treatments that cost him over $800 per month out-of-pocket for his physi - cian to administer. Looking forward to retirement in just a few short years, Amar is concerned that the cost to maintain his special - ized treatments will deplete his savings and he will be forced to delay his retirement. The addi - tion of the PrudentRx specialty medication copay program to the Benefit Trust Fund offerings could help Amar reduce his out- of-pocket costs for specialty medications drastically and allow him to continue full speed ahead on his retirement journey. PrudentRx is integrated with CVS specialty pharmacies and is designed to simplify the often-complex process of accessing and uti- lizing specialty medication while reducing or eliminating the out-of-pocket costs for these medications. Because Amar’s specialty treat- ments are included on PrudentRx’s approved drug list, he was automatically enrolled in the program. A PrudentRx representative worked with Amar and his drug manufacturers to provide copay assistance and reduce Amar’s out-of-pocket cost for specialty treatments from over $800 a month to $0. In its first few months of availability, the PrudentRx program saved Benefit Trust Fund participants over $24,000 in out-of-pocket costs. With the cost of his specialty treatments now fully covered under the Benefit Trust Fund’s PrudentRx pro - gram, Amar no longer worries about his health issues throwing his retirement journey off track. 05 “THE COST OF MY SPECIALTY MEDICATIONS IS DEPLETING MY SAVINGS AND THREATENING MY RETIREMENT.”

This is a modal window.

07 A ccording to a 2019 survey conducted by the Employee Benefit Research Institute, health problems forced 4 out of 10 people to retire earlier than planned. Focusing on your physical as well as financial health along your journey to retirement is an integrated approach to wellness. Understanding the importance of preventive care within this integrated approach to well- ness can reduce the risk of disease, disability, and premature death. Each year, millions of people in the United States do not receive recommended preventive care for themselves and their families because of the cost of care and a lack of awareness, among other reasons. The goal of preventive care is to help you stay healthy and reduce the likelihood of an unexpected health emergency through regular screenings, check-ups, and vaccinations. The U.S. Department of Health and Human Services focuses its “Healthy People 2030” campaign on increasing the availability and use of preventive care for people of all ages. The National IAM Benefit Trust Fund makes pre- ventive care services like annual physicals, dental cleanings, flu shots, and screenings for high blood pressure or high cholesterol available to participants at a low to no cost . Visit https://health.gov/healthypeople for more information on the Healthy People 2030 campaign. PREVENTIVE CARE: KEEPING YOUR HEALTH AFLOAT

JOURNEY TO RETIREMENT OCTOBER 2022 08 Protecting and preserving your hard-earned retirement savings for when you need them requires an ongoing commitment to regular maintenance and care. Once you have charted your unique path to financial freedom in retire- ment, selecting waypoints along the journey, like checking your financial statements often and keeping your survivor and beneficiary informa - tion up to date, can help you stay the course, or adjust, to ensure your journey to retirement is as smooth as possible. You need a retirement readiness routine maintenance plan! CHECK-IN FOR CHECK-UPS The IAM National Benefit Funds Office, and the service providers that we work with, make available valuable tools, resources, and infor - mation to support your retirement savings goals. Checking your account statements and transaction details at least annually can not only help you identify unusual activity on your account but also ensures that you are regularly reviewing and updating important account information on file with the Benefit Funds Office (or a service provider that we work with). Making plans for how your retirement savings will be managed should something happen to you is a difficult but critical part of your retire - ment readiness maintenance routine. Retire- ment readiness includes identifying how you would like your retirement savings managed should you become temporarily or permanently incapacitated, as well as after you pass away. Providing the Benefit Funds Office with a copy of your fully executed power of attorney (or other legal document authorizing another per - son to make specific legal and financial deci - sions on your behalf) helps us to know who has permission to act for you if you become unable to make decisions for yourself while you are alive. While naming your beneficiary or ben - eficiaries is a straightforward process that tells us and your loved ones how you would like your retirement savings distributed once you are no longer living. Notifying the Bene - fit Funds Office immediately of any changes to your address, marital status, or other life events will help us distribute any benefits you or your survivors and beneficiaries are entitled to quickly and accurately. Please keep in mind that your account and beneficiary information is maintained separately, and must be updated separately, for each of the Funds. PICK A TIME & REMIND Most employees use their annual benefit open enrollment season to make updates to bene - fit elections and report life-changing events like marriage (or divorce) and childbirth (or adoption) with their employers. This is also a perfect time to verify important account information the Benefit Funds Office uses, STAYING THE CHARTED COURSE: A RETIREMENT READINESS ROUTINE MAINTENANCE PLAN NAVIGATING THE WAY "SETTING A REMINDER COULD HELP YOU ESTABLISH AND MAINTAIN A RETIREMENT READINESS ROUTINE MAINTENANCE PLAN."

This is a modal window.

09 Between 2016 and 2020, Americans age 65 and older spent an average of $4,066 per month on household expenses. With increasing cost of liv- ing expenses, many retirees and their families experience an income gap after transitioning out of the workforce and into retirement. For decades, Americans have referred to the “three- legged stool” — Social Security, employer-spon - sored pension plans, and personal savings — as the model for financial security in retirement. With fewer employers offering pension plans and uncertainty around the long-term avail- ability of Social Security, today, there is a greater emphasis on personal savings to sustain retirees through their retirement years. Articles on the tax advantages of using a defined contribution plan, like the IAM National 401(k) Fund, to save more the closer you get to retirement are avail- able from reliable industry sources, including the Internal Revenue Service. To encourage sav - ing more for retirement, especially as you get closer to retirement age, the IRS allows partici - pants age 50 or over to defer thousands of dol- lars more than the annual IRS elective deferral limits in place for that year. These types of con - tributions are commonly referred to as “Age 50 Catch-Up” contributions. BRIDGING THE GAP TO RETIREMENT INCOME SECURITY such as your mailing address, phone number, and email address, to keep you informed of changes to the benefits or services we make available. If you do not participate in an annual open enrollment period, setting a reminder to check your retirement health and readiness at the same time you schedule your annual well- ness exams, or every quarter when you receive other financial statements, could help you establish and maintain a retirement readiness routine maintenance plan. Pull out your calen - dar, pick a date, and set a reminder to complete retirement readiness checkups on a recurring schedule that fits your needs. Your retirement readiness routine mainte - nance plan, like your retirement journey, is unique to you! Document how you want your retirement savings managed when you are no longer able to make decisions for yourself; save copies of your elections in a safe place for future reference and keep your account infor - mation up to date, especially with the Benefit Funds Office, so that you worry less and enjoy retirement more!

Discussing the financial security of your loved ones after you pass away can be difficult and complicated. The IAM National Pension Fund has both standard and optional benefit payment op - tions to choose from when you are ready to retire which provide continued financial support for your loved ones after you pass away. The benefit payment options available to you, your survivors, and beneficiaries vary based on factors such as your marital status, whether you were retired and receiving a benefit from the Pension Fund at the time of your death, as well as other factors. For example, married participants typically receive a 50% Joint and Survivor annuity which pays a re - duced monthly benefit to you so that when you pass away, your spouse continues to receive 50% of that reduced benefit. Or you can elect a higher benefit payment for your surviving spouse, such as a 75% or 100% Joint and Survivor Annuity which work the same as a 50% Joint and Survivor annui - ty, but your benefit payment is reduced by a great - er amount to provide a higher survivor benefit to your spouse. If you pass away after April 16, 2019, and prior to starting to receive your benefit, your qualified spouse will receive the 100% Joint and Survivor Annuity. For participants who are not married, depending on the option you elect and when you retire, there may be a benefit payable to your beneficiary after you pass away. Regardless of your marital status, you should immediately notify the Benefit Funds Office of any life events, such as a change of address, marriage, or divorce. You may not be allowed to change your bene - fit payment elections after retirement, so con- sidering the options available to you with your survivors, beneficiaries, and financial or legal advisor in advance can help you make informed decisions when you retire. Keeping your infor - mation up to date with the Benefit Funds Of - fice, and your financial documents organized, and readily available to those who will act on your behalf after your passing can ease your transition into retirement and beyond. BEYOND RETIREMENT: BENEFITS FOR YOUR SURVIVORS JOURNEY TO RETIREMENT OCTOBER 2022 10

11 1 FBI: Elder Fraud Report https://www.ic3.gov/Media/PDF/ AnnualReport/2021_IC3ElderFraudReport.pdf . SAFEGUARDING YOUR PERSONAL ASSETS: CYBERSECURITY & YOU In 2021, seniors age 60 and over lost $1.7 billion as victims of cybercrime, a 74% increase in losses from the year before. 1 Recognizing that many se- niors own mobile devices, surf the internet, and engage on social media platforms but may not be “tech-savvy,” cybercriminals have intensified in - ternet crime and fraud toward seniors by 400% over the past five years. With so many new smart technologies, applications, and software designed to make our lives easier, understanding how your personal information is being used and where it's being stored can be confusing. Precautionary measures like becoming familiar with common scams used by cybercriminals and choosing unique passwords combined with multifactor au - thentication, are the first steps to safeguarding your private information from cyber predators. YES, IT COULD BE YOU Anyone can become a victim of cybercrime at any time! Most people, including seniors, under- estimate how vulnerable they are to a cyberat - tack, or the extent of the damage scammers can inflict on our personal lives and finances once they have access to our private information. Cy - bercriminals use targeted tactics like social en - gineering and phishing to gain and then exploit the trust of their victims. It is important to un - derstand that these types of scams exist, and how they can be used to steal your personal informa - tion and commit identity theft. “Social engineering” involves telling lies or inten - tionally misrepresenting information to persuade someone to share confidential or private infor - mation with a cyber thief. Through social media sites and dating apps, cybercriminals can conduct elaborate “romance scams” designed to capitalize on the desire some seniors have for companion- ship. Another common tactic called “phishing” uses an email or text, from a source that appears to be a trusted contact to give a victim a false sense of security. The email or text typically includes a link or attachment that, once clicked or opened, gives the cybercriminal the ability to infect your device with malicious software and steal your personal information. “IN 2021, SENIORS AGE 60 AND OVER LOST $1.7 BILLION AS VICTIMS OF CYBERCRIME.”

WHAT CAN YOU DO? Take your time and pro - ceed with caution when meeting new people on - line. If you feel pressure to share personal or fi- nancial information with someone you have just met, do not be afraid to take a step back and speak with a trusted family member, friend, or advisor about your concerns. Review the source of emails and texts closely before opening them to make sure that you are receiving a message from a contact that you recognize or can independently verify. Avoid opening links or attachments from suspicious or unknown sources; rather consider deleting the email or text and blocking the send - er from contacting you further. MORE THAN JUST A PASSWORD We’ve all been warned of the importance of password safety, and we’ve learned to use lengthy passwords containing letters, numbers, and symbols, and to use a unique password for each account to avoid giving a cyber thief con - trol over not just one but possibly all of our ac - counts. These are just the first steps to optimiz - ing your password protection. Most financial institutions now require you to enable multifac - tor authentication, which as the name suggests, uses more than one method or device to verify your identity. For example, when you attempt to log into your bank’s website with your username and password, your bank may call, text, or email a code to the phone number or email address they have on file for you to confirm that it is you who is accessing your account. According to Microsoft’s October 2021 Digital Defense Report, 98% of hacking attempts can be prevented using basic security measures, including multifactor authentication. 2 Where available, consider enabling multifactor authen- tication when accessing any of your financial in - formation, especially your retirement accounts, and keep your mobile phone number and email address used to verify your identity up to date with each of your financial institutions, includ - ing the IAM National Benefit Funds Office. TOP FIVE RISKS ROCKING THE BOAT TO RETIREMENT READINESS Retirees face numerous challenges when pre - paring for retirement. A brief recently released by the Center for Retirement Research at Bos- ton College 3 outlined the financial risks retirees face in retirement and how retirees view these risks when planning for retirement. The IAM National Benefit Funds offer benefit options to help address these risks, such as sup - plementing a retirement benefit under the IAM Na tional Pension Plan by starting or increasing contributions to the IAM National 401(k) Plan or exploring $0 cost preventive care services through the National IAM Benefit Trust Fund. SEARCHING FOR A LIGHTHOUSE JOURNEY TO RETIREMENT OCTOBER 2022 12 2 Microsoft Corporation. (2021). Microsoft Digital Defense Report (October 2021) from https://query.prod.cms.rt.microsoft.com/cms/ api/am/binary/RWMFIi#page=121. 3 Wenliang Hou. (2022, July). How Well Do Retirees Assess the Risks They Face in Retirement? (Issue Brief No. 22-10). Center for Retirement Research at Boston College.

This is a modal window.

TOP 10 BEST PLACES IN THE U.S. TO RETIRE JOURNEY TO RETIREMENT OCTOBER 2022 14 DISCOVERING NEW LAND FREEDOM & FUN: CURRENT TRENDS FOR AGE 50-PLUS

POPULAR RETIREMENT ACTIVITIES 15 TOP 10 BEST PLACES IN THE WORLD TO RETIRE “ON AVERAGE, SENIORS AGE 75 AND OVER SPEND OVER 7 HOURS A DAY ENGAGED IN LEISURE AND SPORTS.” WWW.BLS.GOV

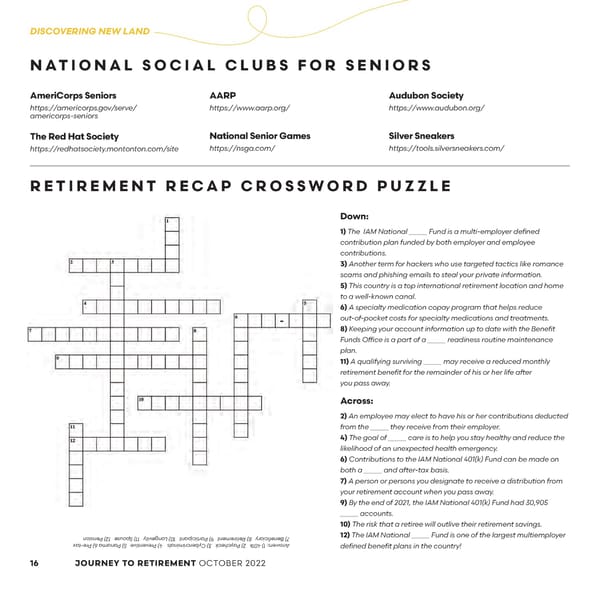

JOURNEY TO RETIREMENT OCTOBER 2022 16 RETIREMENT RECAP CROSSWORD PUZZLE DISCOVERING NEW LAND Down: 1) The IAM National _____ Fund is a multi-employer defined contribution plan funded by both employer and employee contributions. 3) Another term for hackers who use targeted tactics like romance scams and phishing emails to steal your private information. 5) This country is a top international retirement location and home to a well-known canal. 6) A specialty medication copay program that helps reduce out-of-pocket costs for specialty medications and treatments. 8) Keeping your account information up to date with the Benefit Funds Office is a part of a _____ readiness routine maintenance plan. 11) A qualifying surviving _____ may receive a reduced monthly retirement benefit for the remainder of his or her life after you pass away. Across: 2) An employee may elect to have his or her contributions deducted from the _____ they receive from their employer. 4) The goal of _____ care is to help you stay healthy and reduce the likelihood of an unexpected health emergency. 6) Contributions to the IAM National 401(k) Fund can be made on both a _____ and after-tax basis. 7) A person or persons you designate to receive a distribution from your retirement account when you pass away. 9) By the end of 2021, the IAM National 401(k) Fund had 30,905 _____ accounts. 10) The risk that a retiree will outlive their retirement savings. 12) The IAM National _____ Fund is one of the largest multiemployer defined benefit plans in the country! AmeriCorps Seniors https://americorps.gov/serve/ americorps-seniors The Red Hat Society https://redhatsociety.montonton.com/site AARP https://www.aarp.org/ National Senior Games https://nsga.com/ Audubon Society https://www.audubon.org/ Silver Sneakers https://tools.silversneakers.com/ NATIONAL SOCIAL CLUBS FOR SENIORS Answers: 1) 401k 2) Paycheck 3) Cybercriminals 4) Preventive 5) Panama 6) Pre-tax 7) Beneficiary 8) Retirement 9) Participant 10) Longevity 11) Spouse 12) Pension -