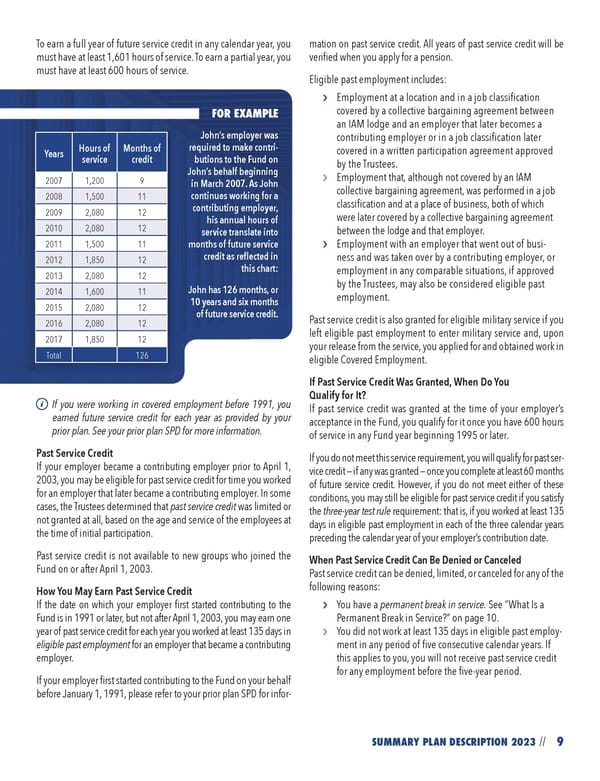

9 SUMMARY PLAN DESCRIPTION 2023 // To earn a full year of future service credit in any calendar year, you must have at least 1,601 hours of service. To earn a partial year, you must have at least 600 hours of service. If you were working in covered employment before 1991, you earned future service credit for each year as provided by your prior plan. See your prior plan SPD for more information. Past Service Credit If your employer became a contributing employer prior to April 1, 2003, you may be eligible for past service credit for time you worked for an employer that later became a contributing employer. In some cases, the Trustees determined that past service credit was limited or not granted at all, based on the age and service of the employees at the time of initial participation. Past service credit is not available to new groups who joined the Fund on or after April 1, 2003. How You May Earn Past Service Credit If the date on which your employer first started contributing to the Fund is in 1991 or later, but not after April 1, 2003, you may earn one year of past service credit for each year you worked at least 135 days in eligible past employment for an employer that became a contributing employer. If your employer first started contributing to the Fund on your behalf before January 1, 1991, please refer to your prior plan SPD for infor- mation on past service credit. All years of past service credit will be verified when you apply for a pension. Eligible past employment includes: › Employment at a location and in a job classification covered by a collective bargaining agreement between an IAM lodge and an employer that later becomes a contributing employer or in a job classification later covered in a written participation agreement approved by the Trustees. › Employment that, although not covered by an IAM collective bargaining agreement, was performed in a job classification and at a place of business, both of which were later covered by a collective bargaining agreement between the lodge and that employer. › Employment with an employer that went out of busi- ness and was taken over by a contributing employer, or employment in any comparable situations, if approved by the Trustees, may also be considered eligible past employment. Past service credit is also granted for eligible military service if you left eligible past employment to enter military service and, upon your release from the service, you applied for and obtained work in eligible Covered Employment. If Past Service Credit Was Granted, When Do You Qualify for It? If past service credit was granted at the time of your employer’s acceptance in the Fund, you qualify for it once you have 600 hours of service in any Fund year beginning 1995 or later. If you do not meet this service requirement, you will qualify for past ser- vice credit — if any was granted — once you complete at least 60 months of future service credit. However, if you do not meet either of these conditions, you may still be eligible for past service credit if you satisfy the three-year test rule requirement: that is, if you worked at least 135 days in eligible past employment in each of the three calendar years preceding the calendar year of your employer’s contribution date. When Past Service Credit Can Be Denied or Canceled Past service credit can be denied, limited, or canceled for any of the following reasons: › You have a permanent break in service. See “What Is a Permanent Break in Service?” on page 10. › You did not work at least 135 days in eligible past employ- ment in any period of five consecutive calendar years. If this applies to you, you will not receive past service credit for any employment before the five-year period. FOR EXAMPLE John’s employer was required to make contri- butions to the Fund on John’s behalf beginning in March 2007. As John continues working for a contributing employer, his annual hours of service translate into months of future service credit as reflected in this chart: John has 126 months, or 10 years and six months of future service credit. Years Hours of service Months of credit 2007 1,200 9 2008 1,500 11 2009 2,080 12 2010 2,080 12 2011 1,500 11 2012 1,850 12 2013 2,080 12 2014 1,600 11 2015 2,080 12 2016 2,080 12 2017 1,850 12 Total 126

2023 NPF Summary Plan Description Page 10 Page 12

2023 NPF Summary Plan Description Page 10 Page 12