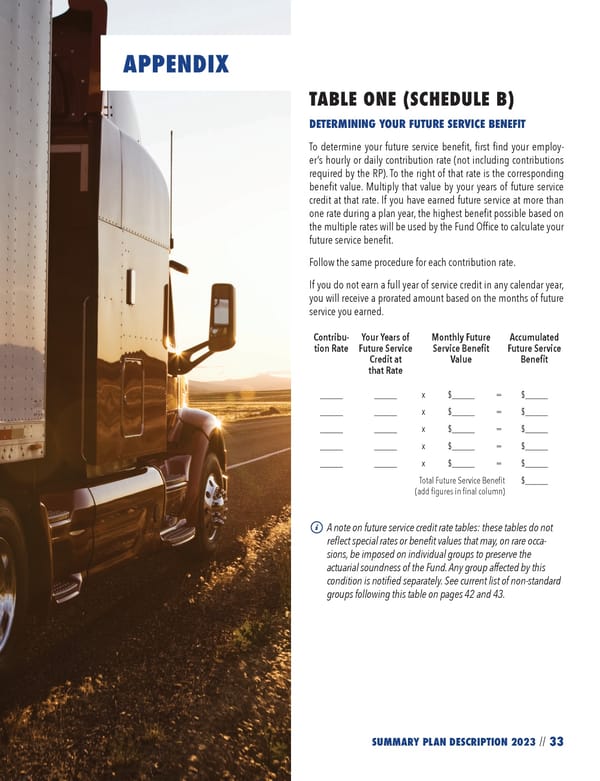

33 SUMMARY PLAN DESCRIPTION 2023 // TABLE ONE (SCHEDULE B) DETERMINING YOUR FUTURE SERVICE BENEFIT To determine your future service benefit, first find your employ- er’s hourly or daily contribution rate (not including contributions required by the RP). To the right of that rate is the corresponding benefit value. Multiply that value by your years of future service credit at that rate. If you have earned future service at more than one rate during a plan year, the highest benefit possible based on the multiple rates will be used by the Fund Office to calculate your future service benefit. Follow the same procedure for each contribution rate. If you do not earn a full year of service credit in any calendar year, you will receive a prorated amount based on the months of future service you earned. Contribu- tion Rate Your Years of Future Service Credit at that Rate Monthly Future Service Benefit Value Accumulated Future Service Benefit _____ _____ x $_____ = $_____ _____ _____ x $_____ = $_____ _____ _____ x $_____ = $_____ _____ _____ x $_____ = $_____ _____ _____ x $_____ = $_____ Total Future Service Benefit (add figures in final column) $_____ A note on future service credit rate tables: these tables do not reflect special rates or benefit values that may, on rare occa- sions, be imposed on individual groups to preserve the actuarial soundness of the Fund. Any group affected by this condition is notified separately. See current list of non-standard groups following this table on pages 42 and 43. APPENDIX

2023 NPF Summary Plan Description Page 34 Page 36

2023 NPF Summary Plan Description Page 34 Page 36