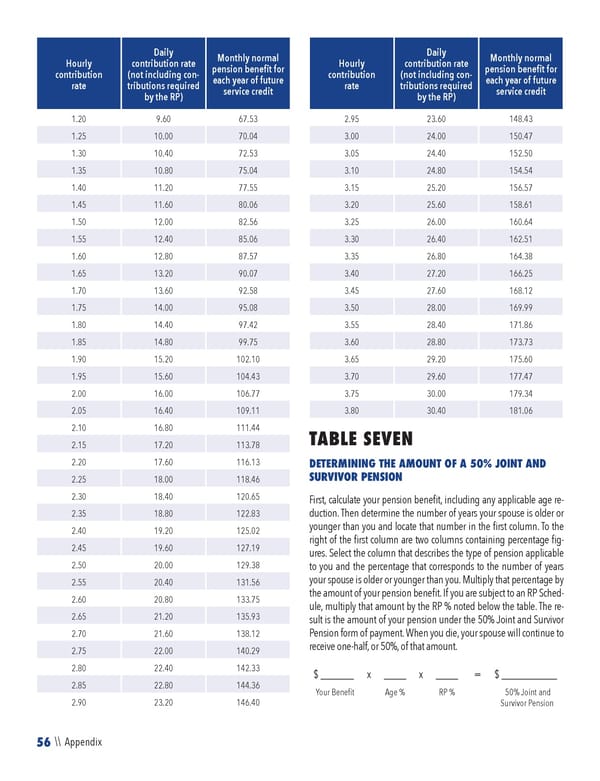

56 \\ Appendix Hourly contribution rate Daily contribution rate (not including con- tributions required by the RP) Monthly normal pension benefit for each year of future service credit 1.20 9.60 67.53 1.25 10.00 70.04 1.30 10.40 72.53 1.35 10.80 75.04 1.40 11.20 77.55 1.45 11.60 80.06 1.50 12.00 82.56 1.55 12.40 85.06 1.60 12.80 87.57 1.65 13.20 90.07 1.70 13.60 92.58 1.75 14.00 95.08 1.80 14.40 97.42 1.85 14.80 99.75 1.90 15.20 102.10 1.95 15.60 104.43 2.00 16.00 106.77 2.05 16.40 109.11 2.10 16.80 111.44 2.15 17.20 113.78 2.20 17.60 116.13 2.25 18.00 118.46 2.30 18.40 120.65 2.35 18.80 122.83 2.40 19.20 125.02 2.45 19.60 127.19 2.50 20.00 129.38 2.55 20.40 131.56 2.60 20.80 133.75 2.65 21.20 135.93 2.70 21.60 138.12 2.75 22.00 140.29 2.80 22.40 142.33 2.85 22.80 144.36 2.90 23.20 146.40 Hourly contribution rate Daily contribution rate (not including con- tributions required by the RP) Monthly normal pension benefit for each year of future service credit 2.95 23.60 148.43 3.00 24.00 150.47 3.05 24.40 152.50 3.10 24.80 154.54 3.15 25.20 156.57 3.20 25.60 158.61 3.25 26.00 160.64 3.30 26.40 162.51 3.35 26.80 164.38 3.40 27.20 166.25 3.45 27.60 168.12 3.50 28.00 169.99 3.55 28.40 171.86 3.60 28.80 173.73 3.65 29.20 175.60 3.70 29.60 177.47 3.75 30.00 179.34 3.80 30.40 181.06 TABLE SEVEN DETERMINING THE AMOUNT OF A 50% JOINT AND SURVIVOR PENSION First, calculate your pension benefit, including any applicable age re- duction. Then determine the number of years your spouse is older or younger than you and locate that number in the first column. To the right of the first column are two columns containing percentage fig- ures. Select the column that describes the type of pension applicable to you and the percentage that corresponds to the number of years your spouse is older or younger than you. Multiply that percentage by the amount of your pension benefit. If you are subject to an RP Sched- ule, multiply that amount by the RP % noted below the table. The re- sult is the amount of your pension under the 50% Joint and Survivor Pension form of payment. When you die, your spouse will continue to receive one-half, or 50%, of that amount. $ __ ____ x ____ x ____ = $ __________ Your Benefit Age % RP % 50% Joint and Survivor Pension

2023 NPF Summary Plan Description Page 57 Page 59

2023 NPF Summary Plan Description Page 57 Page 59