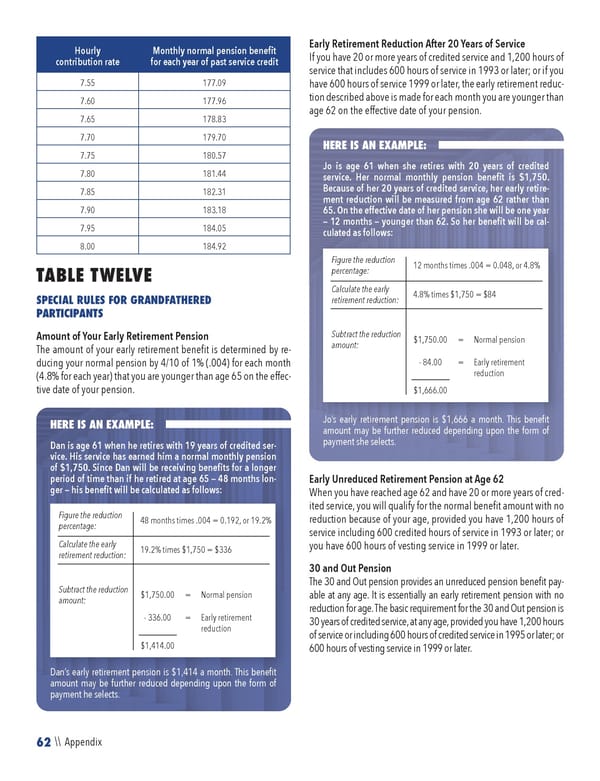

62 \\ Appendix Hourly contribution rate Monthly normal pension benefit for each year of past service credit 7.55 177.09 7.60 177.96 7.65 178.83 7.70 179.70 7.75 180.57 7.80 181.44 7.85 182.31 7.90 183.18 7.95 184.05 8.00 184.92 TABLE TWELVE SPECIAL RULES FOR GRANDFATHERED PARTICIPANTS Amount of Your Early Retirement Pension The amount of your early retirement benefit is determined by re- ducing your normal pension by 4/10 of 1% (.004) for each month (4.8% for each year) that you are younger than age 65 on the effec- tive date of your pension. Early Retirement Reduction After 20 Years of Service If you have 20 or more years of credited service and 1,200 hours of service that includes 600 hours of service in 1993 or later; or if you have 600 hours of service 1999 or later, the early retirement reduc- tion described above is made for each month you are younger than age 62 on the effective date of your pension. Early Unreduced Retirement Pension at Age 62 When you have reached age 62 and have 20 or more years of cred- ited service, you will qualify for the normal benefit amount with no reduction because of your age, provided you have 1,200 hours of service including 600 credited hours of service in 1993 or later; or you have 600 hours of vesting service in 1999 or later. 30 and Out Pension The 30 and Out pension provides an unreduced pension benefit pay- able at any age. It is essentially an early retirement pension with no reduction for age. The basic requirement for the 30 and Out pension is 30 years of credited service, at any age, provided you have 1,200 hours of service or including 600 hours of credited service in 1995 or later; or 600 hours of vesting service in 1999 or later. HERE IS AN EXAMPLE: Dan is age 61 when he retires with 19 years of credited ser- vice. His service has earned him a normal monthly pension of $1,750. Since Dan will be receiving benefits for a longer period of time than if he retired at age 65 — 48 months lon- ger — his benefit will be calculated as follows: Dan’s early retirement pension is $1,414 a month. This benefit amount may be further reduced depending upon the form of payment he selects. Figure the reduction percentage: 48 months times .004 = 0.192, or 19.2% Calculate the early retirement reduction: 19.2% times $1,750 = $336 Subtract the reduction amount: $1,750.00 = Normal pension - 336.00 = Early retirement reduction $1,414.00 HERE IS AN EXAMPLE: Jo is age 61 when she retires with 20 years of credited service. Her normal monthly pension benefit is $1,750. Because of her 20 years of credited service, her early retire- ment reduction will be measured from age 62 rather than 65. On the effective date of her pension she will be one year — 12 months — younger than 62. So her benefit will be cal- culated as follows: Jo’s early retirement pension is $1,666 a month. This benefit amount may be further reduced depending upon the form of payment she selects. Figure the reduction percentage: 12 months times .004 = 0.048, or 4.8% Calculate the early retirement reduction: 4.8% times $1,750 = $84 Subtract the reduction amount: $1,750.00 = Normal pension - 84.00 = Early retirement reduction $1,666.00

2023 NPF Summary Plan Description Page 63 Page 65

2023 NPF Summary Plan Description Page 63 Page 65