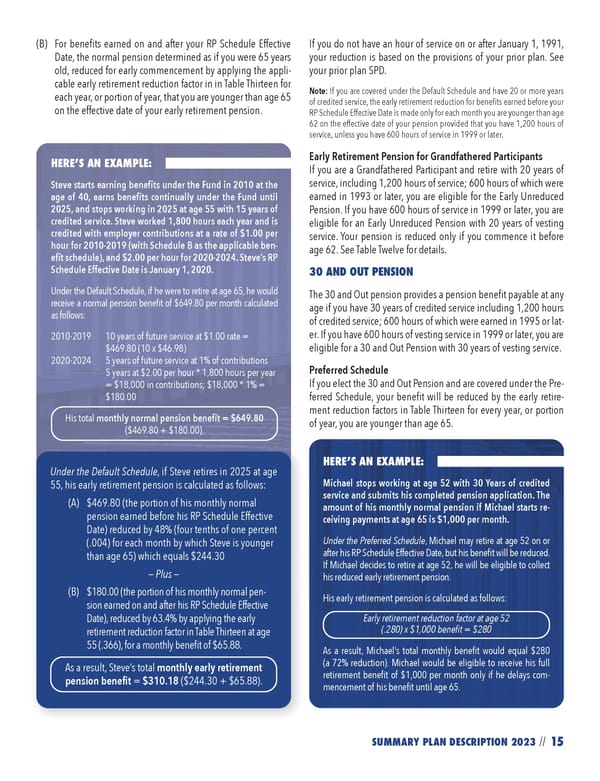

15 SUMMARY PLAN DESCRIPTION 2023 // (B) For benefits earned on and after your RP Schedule Effective Date, the normal pension determined as if you were 65 years old, reduced for early commencement by applying the appli- cable early retirement reduction factor in in Table Thirteen for each year, or portion of year, that you are younger than age 65 on the effective date of your early retirement pension. If you do not have an hour of service on or after January 1, 1991, your reduction is based on the provisions of your prior plan. See your prior plan SPD. Note: If you are covered under the Default Schedule and have 20 or more years of credited service, the early retirement reduction for benefits earned before your RP Schedule Effective Date is made only for each month you are younger than age 62 on the effective date of your pension provided that you have 1,200 hours of service, unless you have 600 hours of service in 1999 or later. Early Retirement Pension for Grandfathered Participants If you are a Grandfathered Participant and retire with 20 years of service, including 1,200 hours of service; 600 hours of which were earned in 1993 or later, you are eligible for the Early Unreduced Pension. If you have 600 hours of service in 1999 or later, you are eligible for an Early Unreduced Pension with 20 years of vesting service. Your pension is reduced only if you commence it before age 62. See Table Twelve for details. 30 AND OUT PENSION The 30 and Out pension provides a pension benefit payable at any age if you have 30 years of credited service including 1,200 hours of credited service; 600 hours of which were earned in 1995 or lat- er. If you have 600 hours of vesting service in 1999 or later, you are eligible for a 30 and Out Pension with 30 years of vesting service. Preferred Schedule If you elect the 30 and Out Pension and are covered under the Pre- ferred Schedule, your benefit will be reduced by the early retire- ment reduction factors in Table Thirteen for every year, or portion of year, you are younger than age 65. HERE’S AN EXAMPLE: Steve starts earning benefits under the Fund in 2010 at the age of 40, earns benefits continually under the Fund until 2025, and stops working in 2025 at age 55 with 15 years of credited service. Steve worked 1,800 hours each year and is credited with employer contributions at a rate of $1.00 per hour for 2010-2019 (with Schedule B as the applicable ben- efit schedule), and $2.00 per hour for 2020-2024. Steve’s RP Schedule Effective Date is January 1, 2020. Under the Default Schedule, if he were to retire at age 65, he would receive a normal pension benefit of $649.80 per month calculated as follows: 2010-2019 10 years of future service at $1.00 rate = $469.80 (10 x $46.98) 2020-2024 5 years of future service at 1% of contributions 5 years at $2.00 per hour * 1,800 hours per year = $18,000 in contributions; $18,000 * 1% = $180.00 His total monthly normal pension benefit = $649.80 ($469.80 + $180.00). Under the Default Schedule, if Steve retires in 2025 at age 55, his early retirement pension is calculated as follows: (A) $469.80 (the portion of his monthly normal pension earned before his RP Schedule Effective Date) reduced by 48% (four tenths of one percent (.004) for each month by which Steve is younger than age 65) which equals $244.30 — Plus — (B) $180.00 (the portion of his monthly normal pen- sion earned on and after his RP Schedule Effective Date), reduced by 63.4% by applying the early retirement reduction factor in Table Thirteen at age 55 (.366), for a monthly benefit of $65.88. As a result, Steve’s total monthly early retirement pension benefit = $310.18 ($244.30 + $65.88). HERE’S AN EXAMPLE: Michael stops working at age 52 with 30 Years of credited service and submits his completed pension application. The amount of his monthly normal pension if Michael starts re- ceiving payments at age 65 is $1,000 per month. Under the Preferred Schedule, Michael may retire at age 52 on or after his RP Schedule Effective Date, but his benefit will be reduced. If Michael decides to retire at age 52, he will be eligible to collect his reduced early retirement pension. His early retirement pension is calculated as follows: Early retirement reduction factor at age 52 (.280) x $1,000 benefit = $280 As a result, Michael’s total monthly benefit would equal $280 (a 72% reduction). Michael would be eligible to receive his full retirement benefit of $1,000 per month only if he delays com- mencement of his benefit until age 65.

2023 NPF Summary Plan Description Page 16 Page 18

2023 NPF Summary Plan Description Page 16 Page 18