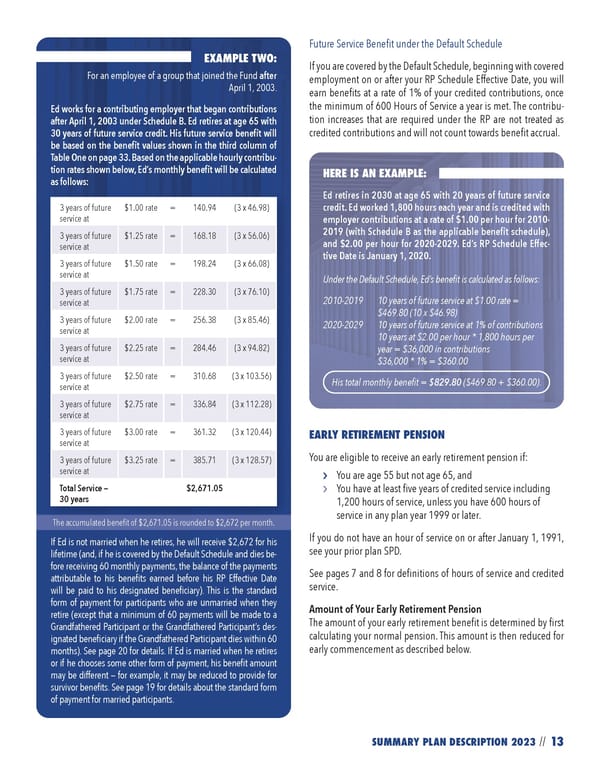

13 SUMMARY PLAN DESCRIPTION 2023 // Future Service Benefit under the Default Schedule If you are covered by the Default Schedule, beginning with covered employment on or after your RP Schedule Effective Date, you will earn benefits at a rate of 1% of your credited contributions, once the minimum of 600 Hours of Service a year is met. The contribu- tion increases that are required under the RP are not treated as credited contributions and will not count towards benefit accrual. EARLY RETIREMENT PENSION You are eligible to receive an early retirement pension if: › You are age 55 but not age 65, and › You have at least five years of credited service including 1,200 hours of service, unless you have 600 hours of service in any plan year 1999 or later. If you do not have an hour of service on or after January 1, 1991, see your prior plan SPD. See pages 7 and 8 for definitions of hours of service and credited service. Amount of Your Early Retirement Pension The amount of your early retirement benefit is determined by first calculating your normal pension. This amount is then reduced for early commencement as described below. EXAMPLE TWO: For an employee of a group that joined the Fund after April 1, 2003. Ed works for a contributing employer that began contributions after April 1, 2003 under Schedule B. Ed retires at age 65 with 30 years of future service credit. His future service benefit will be based on the benefit values shown in the third column of Table One on page 33. Based on the applicable hourly contribu- tion rates shown below, Ed’s monthly benefit will be calculated as follows: If Ed is not married when he retires, he will receive $2,672 for his lifetime (and, if he is covered by the Default Schedule and dies be- fore receiving 60 monthly payments, the balance of the payments attributable to his benefits earned before his RP Effective Date will be paid to his designated beneficiary). This is the standard form of payment for participants who are unmarried when they retire (except that a minimum of 60 payments will be made to a Grandfathered Participant or the Grandfathered Participant’s des- ignated beneficiary if the Grandfathered Participant dies within 60 months). See page 20 for details. If Ed is married when he retires or if he chooses some other form of payment, his benefit amount may be different — for example, it may be reduced to provide for survivor benefits. See page 19 for details about the standard form of payment for married participants. 3 years of future service at $1.00 rate = 140.94 (3 x 46.98) 3 years of future service at $1.25 rate = 168.18 (3 x 56.06) 3 years of future service at $1.50 rate = 198.24 (3 x 66.08) 3 years of future service at $1.75 rate = 228.30 (3 x 76.10) 3 years of future service at $2.00 rate = 256.38 (3 x 85.46) 3 years of future service at $2.25 rate = 284.46 (3 x 94.82) 3 years of future service at $2.50 rate = 310.68 (3 x 103.56) 3 years of future service at $2.75 rate = 336.84 (3 x 112.28) 3 years of future service at $3.00 rate = 361.32 (3 x 120.44) 3 years of future service at $3.25 rate = 385.71 (3 x 128.57) Total Service — 30 years $2,671.05 The accumulated benefit of $2,671.05 is rounded to $2,672 per month. HERE IS AN EXAMPLE: Ed retires in 2030 at age 65 with 20 years of future service credit. Ed worked 1,800 hours each year and is credited with employer contributions at a rate of $1.00 per hour for 2010- 2019 (with Schedule B as the applicable benefit schedule), and $2.00 per hour for 2020-2029. Ed’s RP Schedule Effec- tive Date is January 1, 2020. Under the Default Schedule, Ed’s benefit is calculated as follows: 2010-2019 10 years of future service at $1.00 rate = $469.80 (10 x $46.98) 2020-2029 10 years of future service at 1% of contributions 10 years at $2.00 per hour * 1,800 hours per year = $36,000 in contributions $36,000 * 1% = $360.00 His total monthly benefit = $829.80 ($469.80 + $360.00).

2023 NPF Summary Plan Description Page 14 Page 16

2023 NPF Summary Plan Description Page 14 Page 16