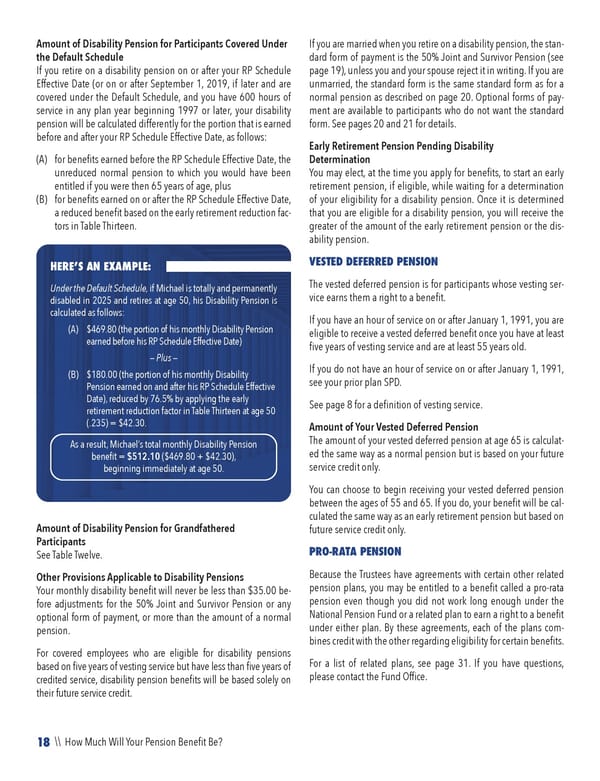

18 \\ How Much Will Your Pension Benefit Be? Amount of Disability Pension for Participants Covered Under the Default Schedule If you retire on a disability pension on or after your RP Schedule Effective Date (or on or after September 1, 2019, if later and are covered under the Default Schedule, and you have 600 hours of service in any plan year beginning 1997 or later, your disability pension will be calculated differently for the portion that is earned before and after your RP Schedule Effective Date, as follows: (A) for benefits earned before the RP Schedule Effective Date, the unreduced normal pension to which you would have been entitled if you were then 65 years of age, plus (B) for benefits earned on or after the RP Schedule Effective Date, a reduced benefit based on the early retirement reduction fac- tors in Table Thirteen. Amount of Disability Pension for Grandfathered Participants See Table Twelve. Other Provisions Applicable to Disability Pensions Your monthly disability benefit will never be less than $35.00 be- fore adjustments for the 50% Joint and Survivor Pension or any optional form of payment, or more than the amount of a normal pension. For covered employees who are eligible for disability pensions based on five years of vesting service but have less than five years of credited service, disability pension benefits will be based solely on their future service credit. If you are married when you retire on a disability pension, the stan- dard form of payment is the 50% Joint and Survivor Pension (see page 19), unless you and your spouse reject it in writing. If you are unmarried, the standard form is the same standard form as for a normal pension as described on page 20. Optional forms of pay- ment are available to participants who do not want the standard form. See pages 20 and 21 for details. Early Retirement Pension Pending Disability Determination You may elect, at the time you apply for benefits, to start an early retirement pension, if eligible, while waiting for a determination of your eligibility for a disability pension. Once it is determined that you are eligible for a disability pension, you will receive the greater of the amount of the early retirement pension or the dis- ability pension. VESTED DEFERRED PENSION The vested deferred pension is for participants whose vesting ser- vice earns them a right to a benefit. If you have an hour of service on or after January 1, 1991, you are eligible to receive a vested deferred benefit once you have at least five years of vesting service and are at least 55 years old. If you do not have an hour of service on or after January 1, 1991, see your prior plan SPD. See page 8 for a definition of vesting service. Amount of Your Vested Deferred Pension The amount of your vested deferred pension at age 65 is calculat- ed the same way as a normal pension but is based on your future service credit only. You can choose to begin receiving your vested deferred pension between the ages of 55 and 65. If you do, your benefit will be cal- culated the same way as an early retirement pension but based on future service credit only. PRO-RATA PENSION Because the Trustees have agreements with certain other related pension plans, you may be entitled to a benefit called a pro-rata pension even though you did not work long enough under the National Pension Fund or a related plan to earn a right to a benefit under either plan. By these agreements, each of the plans com- bines credit with the other regarding eligibility for certain benefits. For a list of related plans, see page 31. If you have questions, please contact the Fund Office. HERE’S AN EXAMPLE: Under the Default Schedule, if Michael is totally and permanently disabled in 2025 and retires at age 50, his Disability Pension is calculated as follows: (A) $469.80 (the portion of his monthly Disability Pension earned before his RP Schedule Effective Date) — Plus — (B) $180.00 (the portion of his monthly Disability Pension earned on and after his RP Schedule Effective Date), reduced by 76.5% by applying the early retirement reduction factor in Table Thirteen at age 50 (.235) = $42.30. As a result, Michael’s total monthly Disability Pension benefit = $512.10 ($469.80 + $42.30), beginning immediately at age 50.

2023 NPF Summary Plan Description Page 19 Page 21

2023 NPF Summary Plan Description Page 19 Page 21