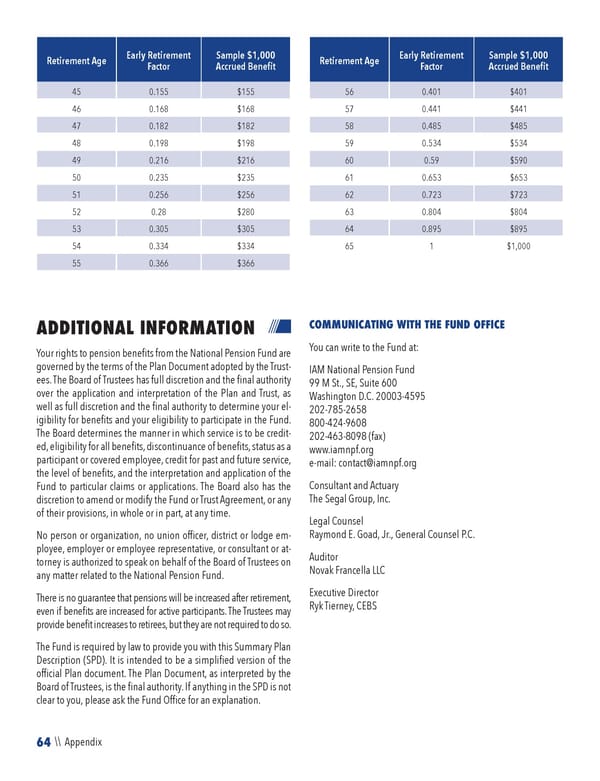

64 \\ Appendix Retirement Age Early Retirement Factor Sample $1,000 Accrued Benefit 45 0.155 $155 46 0.168 $168 47 0.182 $182 48 0.198 $198 49 0.216 $216 50 0.235 $235 51 0.256 $256 52 0.28 $280 53 0.305 $305 54 0.334 $334 55 0.366 $366 Retirement Age Early Retirement Factor Sample $1,000 Accrued Benefit 56 0.401 $401 57 0.441 $441 58 0.485 $485 59 0.534 $534 60 0.59 $590 61 0.653 $653 62 0.723 $723 63 0.804 $804 64 0.895 $895 65 1 $1,000 ADDITIONAL INFORMATION Your rights to pension benefits from the National Pension Fund are governed by the terms of the Plan Document adopted by the Trust- ees. The Board of Trustees has full discretion and the final authority over the application and interpretation of the Plan and Trust, as well as full discretion and the final authority to determine your el- igibility for benefits and your eligibility to participate in the Fund. The Board determines the manner in which service is to be credit- ed, eligibility for all benefits, discontinuance of benefits, status as a participant or covered employee, credit for past and future service, the level of benefits, and the interpretation and application of the Fund to particular claims or applications. The Board also has the discretion to amend or modify the Fund or Trust Agreement, or any of their provisions, in whole or in part, at any time. No person or organization, no union officer, district or lodge em- ployee, employer or employee representative, or consultant or at- torney is authorized to speak on behalf of the Board of Trustees on any matter related to the National Pension Fund. There is no guarantee that pensions will be increased after retirement, even if benefits are increased for active participants. The Trustees may provide benefit increases to retirees, but they are not required to do so. The Fund is required by law to provide you with this Summary Plan Description (SPD). It is intended to be a simplified version of the official Plan document. The Plan Document, as interpreted by the Board of Trustees, is the final authority. If anything in the SPD is not clear to you, please ask the Fund Office for an explanation. COMMUNICATING WITH THE FUND OFFICE You can write to the Fund at: IAM National Pension Fund 99 M St., SE, Suite 600 Washington D.C. 20003-4595 202-785-2658 800-424-9608 202-463-8098 (fax) www.iamnpf.org e-mail: [email protected] Consultant and Actuary The Segal Group, Inc. Legal Counsel Raymond E. Goad, Jr., General Counsel P.C. Auditor Novak Francella LLC Executive Director Ryk Tierney, CEBS

2023 NPF Summary Plan Description Page 65 Page 67

2023 NPF Summary Plan Description Page 65 Page 67