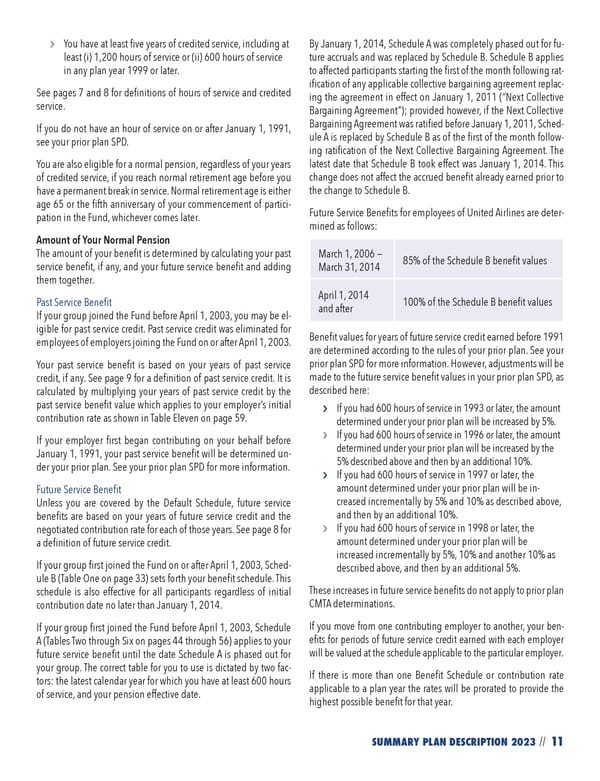

11 SUMMARY PLAN DESCRIPTION 2023 // › You have at least five years of credited service, including at least (i) 1,200 hours of service or (ii) 600 hours of service in any plan year 1999 or later. See pages 7 and 8 for definitions of hours of service and credited service. If you do not have an hour of service on or after January 1, 1991, see your prior plan SPD. You are also eligible for a normal pension, regardless of your years of credited service, if you reach normal retirement age before you have a permanent break in service. Normal retirement age is either age 65 or the fifth anniversary of your commencement of partici- pation in the Fund, whichever comes later. Amount of Your Normal Pension The amount of your benefit is determined by calculating your past service benefit, if any, and your future service benefit and adding them together. Past Service Benefit If your group joined the Fund before April 1, 2003, you may be el- igible for past service credit. Past service credit was eliminated for employees of employers joining the Fund on or after April 1, 2003. Your past service benefit is based on your years of past service credit, if any. See page 9 for a definition of past service credit. It is calculated by multiplying your years of past service credit by the past service benefit value which applies to your employer’s initial contribution rate as shown in Table Eleven on page 59. If your employer first began contributing on your behalf before January 1, 1991, your past service benefit will be determined un- der your prior plan. See your prior plan SPD for more information. Future Service Benefit Unless you are covered by the Default Schedule, future service benefits are based on your years of future service credit and the negotiated contribution rate for each of those years. See page 8 for a definition of future service credit. If your group first joined the Fund on or after April 1, 2003, Sched- ule B (Table One on page 33) sets forth your benefit schedule. This schedule is also effective for all participants regardless of initial contribution date no later than January 1, 2014. If your group first joined the Fund before April 1, 2003, Schedule A (Tables Two through Six on pages 44 through 56) applies to your future service benefit until the date Schedule A is phased out for your group. The correct table for you to use is dictated by two fac- tors: the latest calendar year for which you have at least 600 hours of service, and your pension effective date. By January 1, 2014, Schedule A was completely phased out for fu- ture accruals and was replaced by Schedule B. Schedule B applies to affected participants starting the first of the month following rat- ification of any applicable collective bargaining agreement replac- ing the agreement in effect on January 1, 2011 (“Next Collective Bargaining Agreement”); provided however, if the Next Collective Bargaining Agreement was ratified before January 1, 2011, Sched- ule A is replaced by Schedule B as of the first of the month follow- ing ratification of the Next Collective Bargaining Agreement. The latest date that Schedule B took effect was January 1, 2014. This change does not affect the accrued benefit already earned prior to the change to Schedule B. Future Service Benefits for employees of United Airlines are deter- mined as follows: March 1, 2006 — March 31, 2014 85% of the Schedule B benefit values April 1, 2014 and after 100% of the Schedule B benefit values Benefit values for years of future service credit earned before 1991 are determined according to the rules of your prior plan. See your prior plan SPD for more information. However, adjustments will be made to the future service benefit values in your prior plan SPD, as described here: › If you had 600 hours of service in 1993 or later, the amount determined under your prior plan will be increased by 5%. › If you had 600 hours of service in 1996 or later, the amount determined under your prior plan will be increased by the 5% described above and then by an additional 10%. › If you had 600 hours of service in 1997 or later, the amount determined under your prior plan will be in- creased incrementally by 5% and 10% as described above, and then by an additional 10%. › If you had 600 hours of service in 1998 or later, the amount determined under your prior plan will be increased incrementally by 5%, 10% and another 10% as described above, and then by an additional 5%. These increases in future service benefits do not apply to prior plan CMTA determinations. If you move from one contributing employer to another, your ben- efits for periods of future service credit earned with each employer will be valued at the schedule applicable to the particular employer. If there is more than one Benefit Schedule or contribution rate applicable to a plan year the rates will be prorated to provide the highest possible benefit for that year.

2023 NPF Summary Plan Description Page 12 Page 14

2023 NPF Summary Plan Description Page 12 Page 14